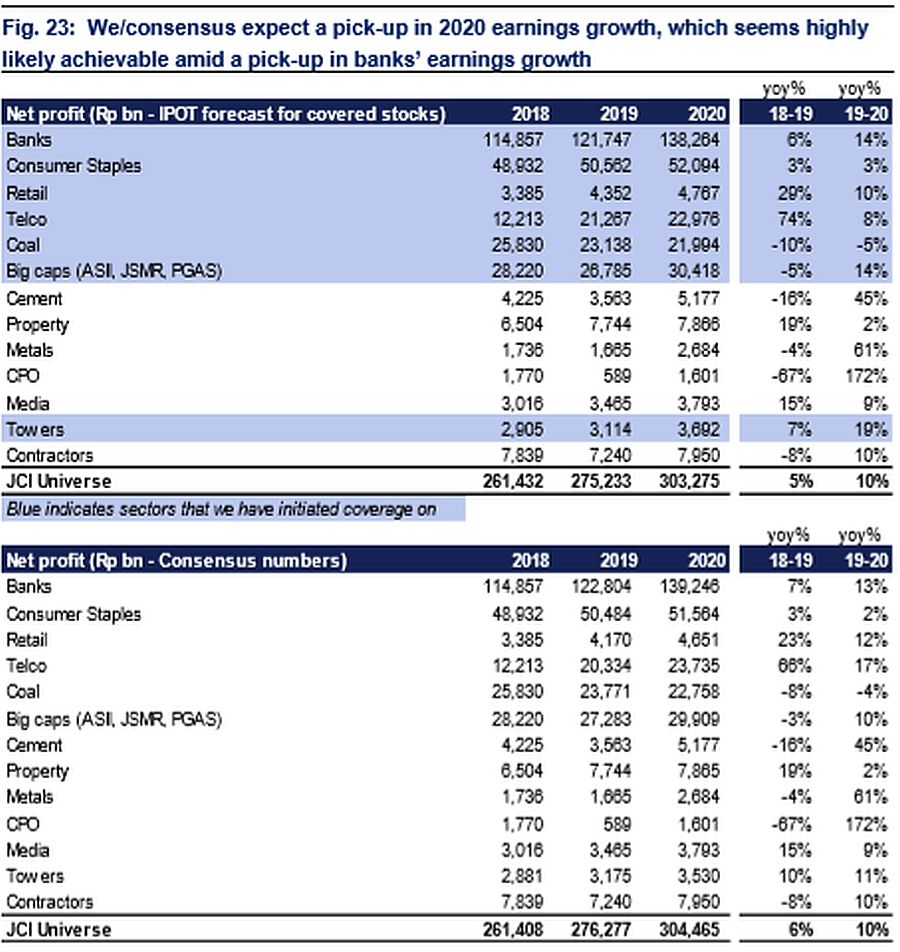

Last Friday we published a strategy update on what has caused the sell-off and what we think may change next year. We concluded that there were 3 factors that caused the sell-off: 1) extremely weak nominal GDP (all-time low since 1999), 2) tepid earnings growth (JCI always posted negative return during period of single digit earnings growth) and 3) weak sentiment from both domestic and external. We think most of the concerns shall gradually improve next year, especially earnings (+10% in 2020 vs. 5-6% in 2019) and domestic sentiment.

We maintain our JCI target of 6,900 next year, largely driven by pick-up in earnings (based on 2.1x PB vs. 10Y avg of 2.3x). We prefer interest sensitive names (esp banks like Mandiri/BNI/BTN and ) and selective staples (/INDF).

.

Link to our note: IP Strategy update 9 Dec 2019

.

Few details:

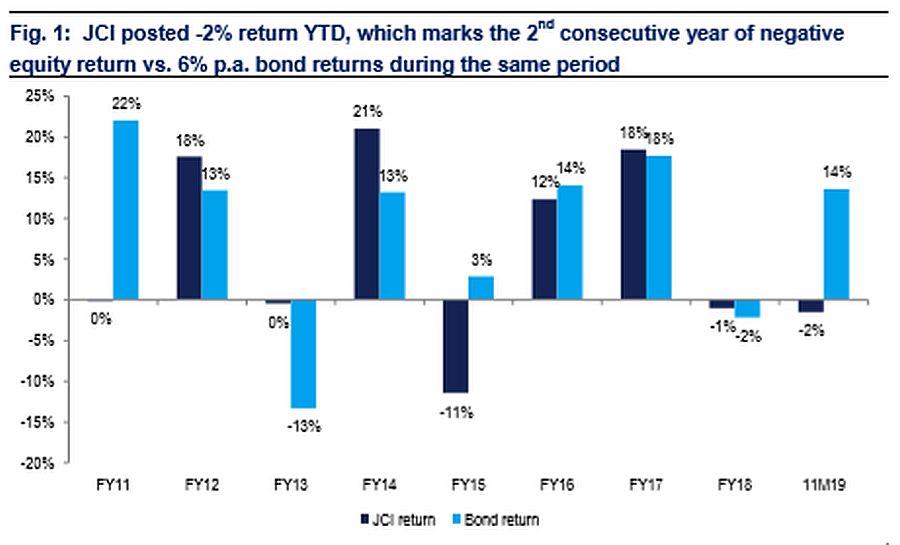

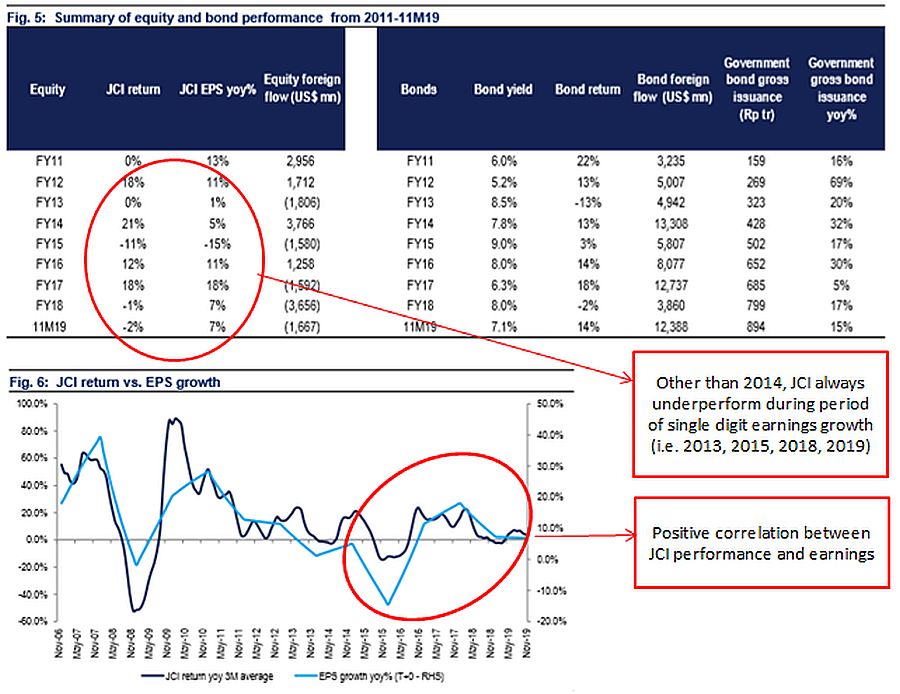

JCI dropped by another 4% in Nov, which brought overall YTD return to -2%, this marks 2nd consecutive year of negative equity return vs. +6% p.a. bond returns during the same period. Based on our analysis and discussion with several investors (both local and foreign), we believe these are the main causes for JCI underperformance: 1) weak economic growth (especially on nominal GDP side), 2) tepid earnings outlook and 3) sentiment (domestic factors like political and/or intervention noises along with external noises).

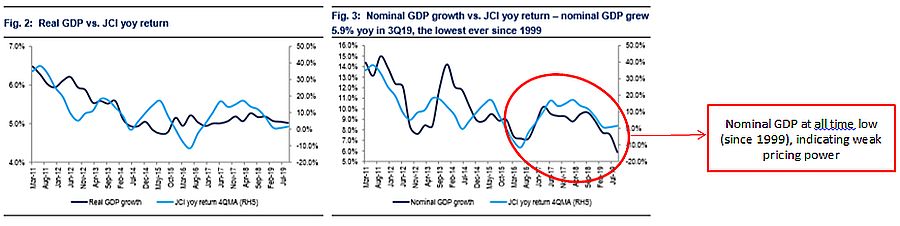

Despite decent real GDP (5% in 3Q19), to our surprise nominal GDP was only at 5.9% in 3Q19, the lowest ever since 1999 (all-time low of 5%). This suggests a very weak ASP on the producer side which may due to slowing demand. This also resulted in lacklustre earnings growth (FY19F of 5%).

Historically JCI always posted negative return during period of single digit earnings growth except for 2014 (rally was caused by the election euphoria). 9M19 earnings growth of 8% and FY19 expectation of 5% clearly wasn't attractive enough to compensate risk-adjusted return of holding equity as opposed to holding bonds.

- Domestic noises such as political (uncertainty during presidential election and cabinet reshuffle) and intervention (lowering gas price/lending rate) has been major pushback for most of the investors. This was exacerbated by external noises such as trade war and riot in Hong Kong.

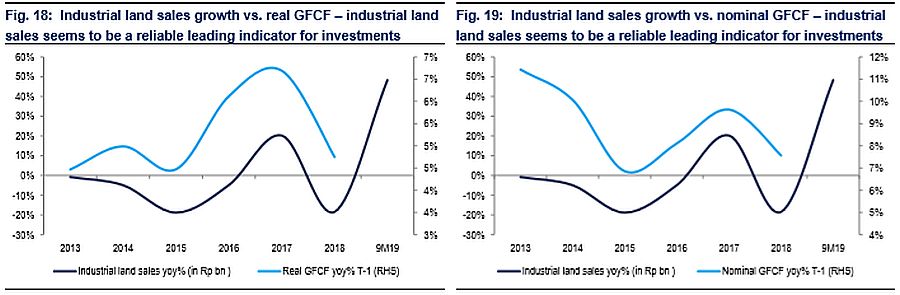

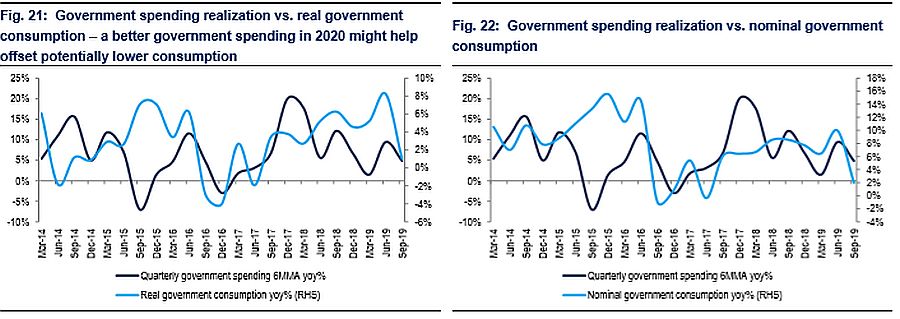

We think generally next year will be a better year as: 1) domestic sentiment will not get any worse (subduing political/intervention overhang), 2) pick-up in economic growth, especially with empirical evidence in pick-up in investment from higher industrial estate sales and hopefully better government spending to offset lower consumption (from lower purchasing power) and 3) better earnings growth as we/consensus expect 10% earnings growth in FY20 (vs. 5% in FY19) which has high probability to achieve amid pick-up in banks earnings growth (post IFRS 9 implementation).

Sumber : IPS

powered by: IPOTNEWS.COM