Company Update / Consumer Discretionary / IJ / Click here for full PDF version

Author(s): Kevie Aditya, Elbert Setiadharma

- SSSG further improved to -8.1% in Jul20 from -10.7% in Jun20. At this rate, we think ' sales may return to pre-Covid-19 level in 4Q20.

- With continued high demand for lifestyle products (i.e. sporting goods and housewares), we think that overall GPM of 47% can be maintained.

- Robust fundamental (especially against its peers) has been reflected in strong YTD share price performance. Maintain Hold.

Improvement remains on-track with gradual recovery in traffic

Jul20 SSSG came in at -8.1%; further improved from -10.7% in Jun20 (worst at -27.7% in Apr20). Traffic has mostly recovered to around 80-90% of normal in ' stores which is significantly better compared to its peers at 40-50%. Sales of lifestyle products (i.e. sporting goods and housewares) remained stellar despite gradual economic re-opening. As such, we believe that both conversion rate and basket size shall remain high, hence ' sales can possibly return to pre-Covid-19 level by 4Q20. We maintain our +0.3% yoy FY20F sales growth estimates (-5.9% yoy decline as of Jul20).

GPM improvement remains intact as lifestyle items remain popular

In 1H20 ' GPM improve significantly by 195bps yoy to 47.2%, which according to the company is mainly driven by the shift in product mix to lifestyle products (i.e. sporting goods and houseware) that in general command higher GPM, and we believe were less price sensitive than basic home-improvement products. As demand from these items remained high, may be able to maintain its higher-than-expected GPM throughout 2H20, better than our current estimate of 45.5% (flat yoy).

Cost efficiency measures to continue in 2H20

plan to open 2-3 additional new stores up to year-end, on top of its 11 newly-opened stores YTD. However, also tried to minimize new hires and partially discontinued contractual workers, resulting in better employee productivity (29.7sqm/employee in 1H20 vs. 28.2 in 2019). also still gets rental discounts in some locations despite having all of its outlets fully reopened.

Robust fundamental has been priced-in; maintain Hold

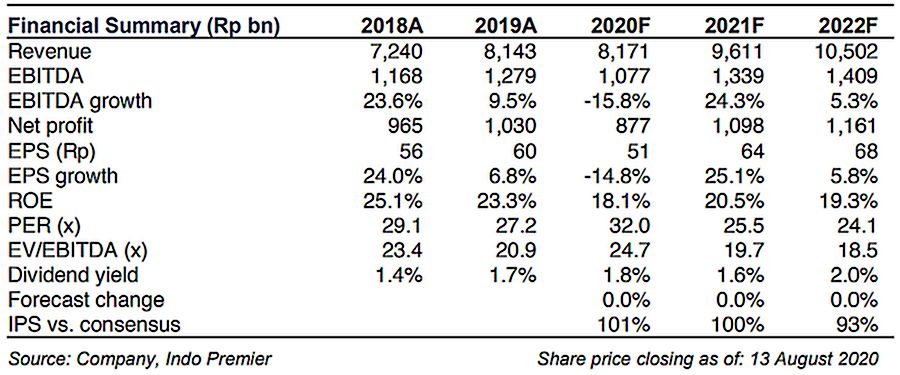

Minimal drop in SSSG and solid GPM made a clear outperformer vs. its peers during this tough situation. We maintain our -14.8% yoy earnings estimates for FY20 (vs. sector's -87.1%). Nonetheless, ' valuation at 28.1x 12M forward P/E (around 1 s.d. above 5-year mean) seems fair, hence our maintained Hold call and Rp1,800/sh TP.

Sumber : IPS

powered by: IPOTNEWS.COM