Sector Update / Bank / Click here for full PDF version

Author(s): Jovent Muliadi, Anthony

- Just couple of days after PMK70, government issued PMK71 last Friday which shed some clarity on the insurance scheme for new disbursement.

- It shall covers 80% of new working capital loan disbursement for MSME (20% is still being borne by the bank). Premium is paid by government.

- Equity injection for insurers shall expand its guarantee capability. Loss limit program will also limit insurers' downside. All in all it's a positive.

New PMK71 on the insurance for new MSME loan disbursement

Government through Ministry of Finance (MoF) just issued a new regulation (PMK71) on the loan guarantee scheme (insurance) for new working capital disbursement for MSME (micro and SME) segment. According to this regulation MSME is classified as loan with maximum limit of Rp10bn. This was issued couple of days post PMK70 (government fund placement to commercial banks - refer to our previous note ).

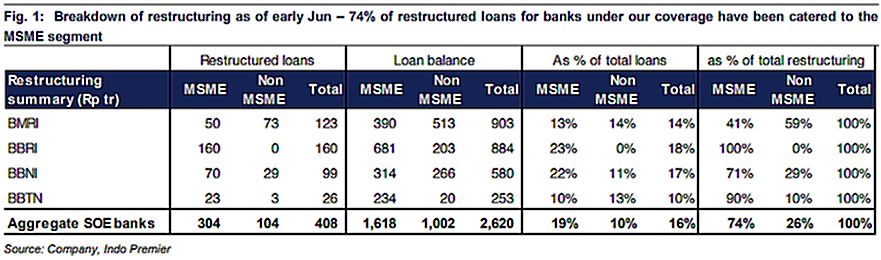

MSME accounts for 45-50% of total system restructuring

As of mid-Jun, total restructuring in the banking system reached Rp656tr with MSME accounts for Rp299tr (46% of total) and non- MSME accounts for Rp357tr (54% of total). For banks under our coverage (the SOEs), 74% of the restructuring are still on the MSME side i.e. 's MSME accounts for 100% of its restructuring, at 90%, at 71%, and at 41%.

Support from the Government to both the banks and the insurers

The insurance shall cover 80% of the credit risk for the new loan that is being disbursed (the bank still borne the remainder of 20% credit risk to mitigate moral hazard). At the same time, the insurance premium shall be fully paid by government. For insurers, government will inject additional Rp6tr to both Askrindo and Jamkrindo (split equally) or 30% to their existing capital.

What will be the capacity of the insurers?

We looked into both Askrindo and Jamkrindo financial statement to analyse their capacity, as of 2018 (the last FS that was being published) Jamkrindo still has Rp113tr credit guarantee capacity (for productive loan) and Rp257tr (for total loan) but no details on Askrindo. For productive loan, insurers are allowed to have 20x gearing ratio (vs. their equity) and up to 40x for overall loan (including productive loan). Hence taking into account the new capital injection, both Askrindo and Jamkrindo can insure up to Rp540tr of loan (20x of Rp27tr); we estimated that currently Askrindo and Jamkrindo have guaranteed c.Rp250-300tr of loan and hence leaving them with Rp240-290tr capacity, which shall be enough in our view assuming the restructuring has peaking (80% of current MSME restructuring of Rp300tr is Rp240tr).

Loss limit program is positive for insurers; this may be a game changer

On top of the capital injection, the government also provide a loss limit program for the insurers i.e. government will bear the additional risk when the claim > premium being paid to insurers (figure 5). Risk on the government side will be insured again through IndonesiaRe (another SOE insurance company). Overall this regulation may be a game changer for MSME and clearly showed government's commitment to support the banks. We maintain our Neutral stance due to risk on earnings downgrade (especially for FY21). The sector now trades at 1.4x P/BV ex- (vs. 10Y avg of 1.9x ex-). Our pecking order is: , , , then .

Sumber : IPS

powered by: IPOTNEWS.COM