Initiating Coverage / KLBF IJ / Click here for full PDF version

Author(s): Kevie Aditya, Elbert Setiadharma

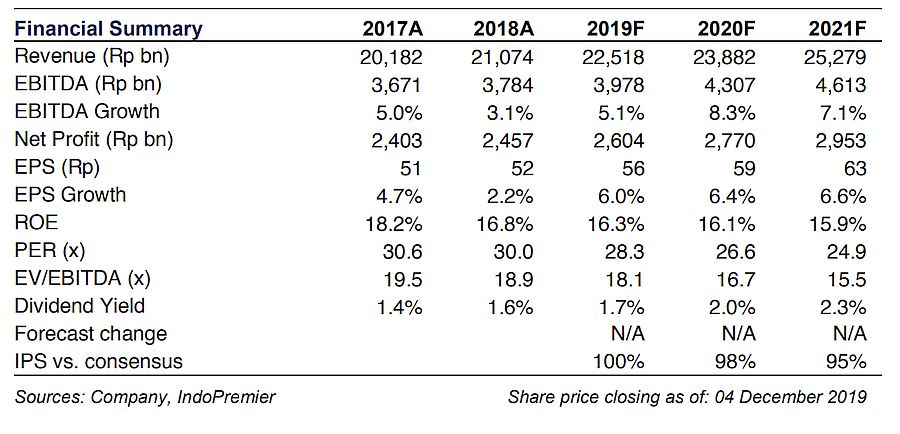

- We expect core earnings to improve by 6.5% CAGR 2019-21F vs. 5.2% CAGR 2014-18 on the back of improving sales and stabilizing margins.

- Better receivable days also may improve FCF and along with normalizing capex, this may translate to better dividend payout.

- Improving earnings outlook underpin our Buy rating. Risk will be regulation uncertainties from the new health minister.

A pick-up in revenue

We expect overall prescription pharma's revenue yoy growth to stabilize to 5-7% in 2019-21F from 4.0% CAGR in FY14-18 following expectation of improving growth outlook from both licensed products and branded generics to 5.0% and 2.0% in 2019-20F from 3.2% and 1.8% CAGR in FY14-18, respectively. We also expect some volume recovery in Kalbe's key brands (i.e. Extra Joss) while others (i.e. Zee) should be able to maintain its market share. ASP however may remain tepid amid lacklustre purchasing power.

Minimal drop in margin shall allow better earnings stability

While sales shift to unbranded generics stabilize, we see prescription pharmaceuticals GPM's to still decline, albeit at much slower rate with an average of 20 bps p.a. in 2019-21F (vs. an average decline of 170bp p.a. in 2014-18). Stable rupiah against US$ also should help preserve GPM, although we still see some downside particularly from nutritionals amid Kalbe's limitation to increase prices despite the rising skimmed milk prices.

Rising BPJS premium should gradually improve receivables turnover

As government increases BPJS premium in 2020F and targets Rp17tr surplus, we expect faster payment to Kalbe resulting in lower receivable days from 58 days at end-2Q19 and possibly back to around 50 days in the next couple of years. We estimate FCF of Rp1.8tr and Rp2.1tr in FY20/21F. With capex possibly normalizing in 2020F onwards, we see upside to Kalbe's dividend payout (c.50% in FY19).

Higher earnings growth may spark re-rating; initiate with a Buy call

We expect Kalbe to book core earnings recovery of 6.5% CAGR 2019-21F (vs. 5.2% CAGR in 2014-18) which underpin our Buy rating with TP of Rp1,800 (pegged to its 5Y mean). With market sell-offs triggering 1.9% share price de-rating in the past 1M, Kalbe is trading at an attractive 25.9x P/E (around 1 s.d. below its 5-year mean). Risk is regulation uncertainty.

Sumber : IPS

powered by: IPOTNEWS.COM