MacroInsight / Click here for full PDF version

Author(s): Luthfi Ridho, Desty Fauziah

- Headline inflation came as a surprise at 0.18% mom (+1.96% yoy) in Jun, above our and consensus expectations at -0.02% and 0.05% mom.

- Pick-up in inflation mainly due to fresh food (+0.47% mom), sports & recreation (+0.13% mom) and restaurant (+0.28% mom).

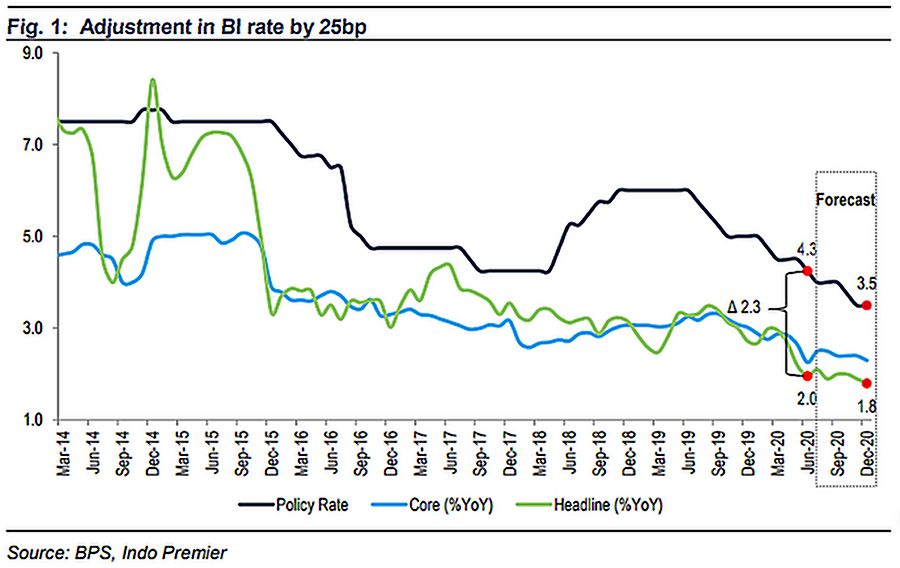

- We foresee inflation in 2020 will remain benign and manageable at 1.8% yoy mostly due to lower food, transport and energy prices.

Recovery in consumption, albeit not too strong

Headline inflation accelerated to 0.18% mom (+1.96% yoy) in Jun, from +0.07% mom (2.19% yoy) in May, this was higher than our and consensus estimates at -0.02% mom (+1.76% yoy) and +0.05% mom (+1.84% yoy). Higher monthly inflation in June was due to fresh food prices at +0.47% mom (vs -0.32% mom in May), recreational & sports prices at 0.13% mom (vs +0.06% mom in May) and restaurant prices at 0.28% mom (vs 0.08% mom in May). The increase in these types of goods category were consistent with the gradual relaxation of the large-scale social restriction ( PSBB ).

Inflation will remain low, even if there is a pick-up in money supply

We are on the view that full year inflation in 2020 will remain benign and manageable at 1.8% yoy mostly due to lower food, transport and energy prices. Moreover, despite the concern that money supply may likely increase going forward (+10.4% yoy in May), we see its impact to inflation number to be limited. This is due to the weak economic growth and lower energy price that will mitigate the inflationary effect of the increased money supply. The money supply may potentially grew more than +25% yoy if in accordance with the recent government financing needs of around Rp1,039tr, including the expected incoming foreign flows of around Rp500tr (Rp200tr on portfolio and Rp300tr on others).

25bp adjustment to the policy rate this month

We see BI rate this month to be lowered by 25bp to 4.0%, as we believe the accommodative stance from BI will continue. In addition, we also foresee a potential cut by another 50bp in BI rate to 3.5% most likely in 4Q, this is imperative to kick-start the economic growth.

Sumber : IPS

powered by: IPOTNEWS.COM