Company Update / Banks / IJ / Click here for full PDF version

Author(s): Anthony ; Jovent Muliadi

- 9M23 net profit of Rp2.3tr came below cons' at 71% but ahead of ours at 80%.

- Pick-up in loan growth (+10% yoy/+3% qoq) supported by corporate (+36% yoy/+8% qoq) and sharia mortgage (+19% yoy/+6% qoq).

- Overall asset quality slightly improved qoq but LAR remains elevated which may lead to elevated CoC. Maintain Hold.

9M23 results was below consensus but ahead of ours

net profit of Rp2.3tr in 9M23 (+2% yoy/+25% qoq) came below consensus estimates at 71% but ahead of ours at 80%. PPOP grew marginally by +6% yoy (flat qoq) supported by significant increase in non-interest income (+67% yoy/-24% qoq) - mainly from treasury and recovery, along with drop in opex (-11% yoy/+5% qoq); this was despite weak NII at -12% yoy (+9% qoq). Provision rose by +12% yoy but declined -16% qoq, which brought the 9M23 CoC to 1.3% vs. 1.2/1.3% in 9M22/1H23, in-line with its new target of 1.2-1.4% (previously at 1.1-1.2%).

Sequential qoq improvement in NIM

Overall NIM stood at 3.8% in 9M23 (vs. 4.5/3.6% in 9M23/1H23) with qoq improvement was driven by better asset yield. LDR remained at 98% in 3Q23 vs. 93/98% in 3Q22/2Q23. Concurrently, deposit growth was slower at +4% yoy (+3% qoq) as strong growth (+12% yoy/-6% qoq - mostly driven by current account as savings growth dropped by -8% yoy) was offset by drop in TD (-3% yoy/+14% qoq). This resulted in ratio of 50% in 3Q23 vs. 46/54% in 3Q22/2Q23.

Pick-up loan growth from strong sharia mortgage

Overall loan grew by +10% yoy (+3% qoq) in 3Q23, which was in-line with its guidance of 10-11%. This was driven by corporate loans (+36% yoy/+8% qoq) while mortgage grew by +8% yoy/+3% qoq, supported by sharia mortgage (+19% yoy/+6% qoq).

Improving asset quality

NPL/SML slightly improved qoq to 3.5/9.4% in 3Q23 from 3.7/9.5% in 2Q23 respectively. Further NPL improvement will be coming from bulk asset sale in 4Q23 amounting to Rp861bn which expected to reduce NPL by c.0.25%. Overall LAR (incl. Covid) also improved to 23% in 3Q23 vs. 26/23% in 3Q22/2Q23 with LAR coverage of 22% in 3Q23 vs. 20/22% in 3Q22/2Q23.

Maintain Hold

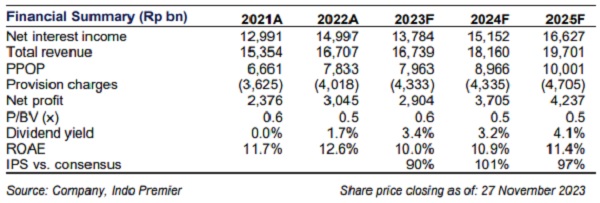

Maintain Hold despite is currently trading at undemanding valuation of 0.5x FY24F P/B (below -1s.d. of 0.6x) as we see lack of imminent catalyst. Upside risk is lower CoF from peaking interest rate.

Sumber : IPS

powered by: IPOTNEWS.COM