Sector Update / Bank / Click here for full PDF version

Author(s): Jovent Muliadi , Anthony

- Restructuring has somewhat peaked since Jul with addition in Aug was barely noticeable. Only BBTN posted additional sizable restruct in Aug.

- At the same time, Jakarta PSBB impact should be manageable as most debtors that needed restructuring have been restructured in Apr-Jun.

- Our checks suggested that there will not be any revision to guidance; maintain OW with BBNI and BMRI are our picks.

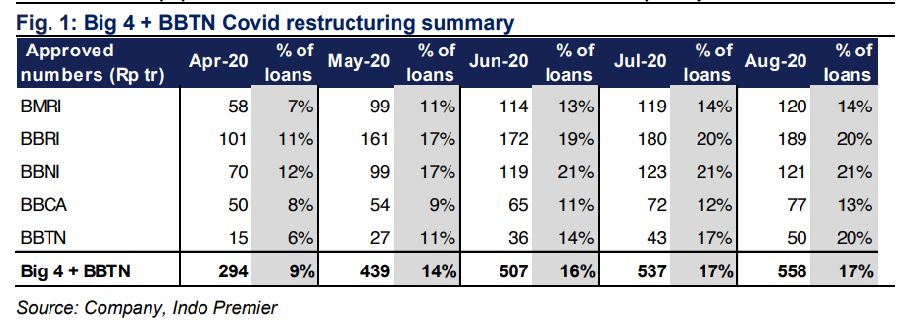

Marginal addition for Covid restructuring in Aug

Banks under our coverage posted additional Rp20tr restructuring (based on approved numbers) in Aug (-31% mom) despite a very low July numbers (Rp30tr/-56% mom). Aug restructuring was contributed mainly by BBRI (+Rp9tr/+13% mom) and BBTN (+Rp7.2tr/+3% mom). However, BBNI and BMRI were able to have flattened its restructuring which indicated that there was not much restructuring requests left. In terms of % of total loan, BBCA and BMRI are in the class above the rest at 13-14% vs. the rest of 20-21%.

Stricter PSBB in Jakarta shall have muted impact to banks

Jakarta's Governor announced stricter PSBB (not full scale PSBB similar to Apr-May) last week with the main differences lies on reduced office capacity (to 25% from 50% previously) and prohibition of dine-in in the restaurant (only allowed for takeaway). The adverse impact shall possibly come from: 1) worsening outlook for hotel and restaurant portfolio; the counter argument is hotel and restaurant only represent 1-2% of banks' loan portfolio and 2) possible deterioration in micro portfolio that located in Jakarta; the counter argument is that micro debtors that has been restructured during PSBB and located in Jakarta was only 3.5% of total Covid micro restructuring even after 2 months of full scale PSBB and 3.5 months of transitional PSBB .

No change in guidance for banks

Our discussion with the banks suggested that there shall be no revision towards overall FY20 guidance; however, as a precautionary measure they are considering to increase credit costs (CoC) guidance for next year - just in case OJK didn't extend the restructuring relaxation, which is unlikely. Our checks with the banks also suggested that most debtors in Jakarta that got affected have been restructured in Apr-Jun, else they would have been downgraded to NPL by now. Indeed the percentage of Jakarta portfolio from overall Covid restructuring is around 7-10% which is relatively small and manageable especially considering the length of PSBB .

Maintain OW with BBNI and BMRI as our picks

The sector is trading at 1.4x FY21F P/BV ex-BCA vs. its 10Y average of 1.9x P/BV. Our top picks are BBNI and BMRI . Risk is asset quality deterioration.

Sumber : IPS

powered by: IPOTNEWS.COM