Company Update / INDF IJ / Click here for full PDF version

Author(s): Kevie Aditya, Elbert Setiadharma

- 's FY19 earnings grew by 42% yoy (4Q19: 24% yoy), which was inline amid solid sales and margin expansion in both CBP and Bogasari.

- Bogasari and agribusiness are expected to still book positive sales and earnings growth in FY20F despite ongoing coronavirus pandemic.

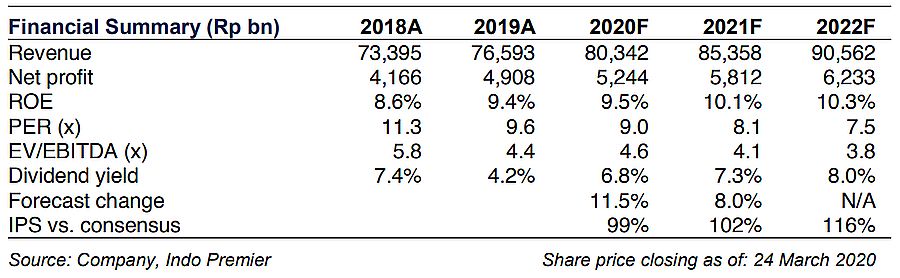

- 's valuation at 9.4x 12M fwd. P/E is attractive given current circumstances. We maintain our Buy call on with TP of Rp8,200.

Solid 41.8% yoy earnings growth in FY19, in line with our/consensus

booked Rp4.8tr of profit in FY19 (+42% yoy/+24% yoy in 4Q19), in-line with our and consensus' estimates (96/102% of our/consensus FY19E). Robust earnings growth was driven by solid sales and margins expansion in both CBP and Bogasari units. Agribusiness also booked significant improvement in 2H19, ended FY19 with Rp495bn operating profit (vs. Rp41bn operating loss in 1H19). On top of that, gross debt declined 15.9% yoy to Rp21tr.

Bogasari: Another possible wheat price rally

Bogasari's revenue growth increased 8% yoy in FY19, driven by increase in ASP (largely in 2H18) while volume was flat. Global wheat price has increased by c.11% in the past 3M and may possibly increase further on the back of increased global demand for staple foods (i.e. pasta and bread), hence we may see another round of ASP increase in 2Q20 onwards to further boost Bogasari's FY20F EBIT margin (vs. 7.1% in FY19 and 6.0% in FY18).

Agribusiness: continuous improvement is well expected for 2020

Agribusiness booked Rp367bn operating profit in 4Q19 (vs. Rp169bn in 3Q19), on the back of c.23% qoq global CPO price increase to an average of MYR2,539 in 4Q19. Indeed, excitement over CPO price rebound to >MYR3,000 in Jan 2020 did not last long as it has crashed by 20% over the past 2M to currently around MYR2,300. Nonetheless, assuming average CPO price at MYR2,400 (average YTD is still at MYR2,700), we estimate agribusiness to still be able to book an operating profit of Rp972bn in FY20F, implying 96.5% yoy increase from FY19.

Valuation remains attractive at 9.4x P/E; maintain Buy

Albeit outperforming JCI, 's share price dropped by c.21% during the market-selloffs in the past 1M (broadly in line with 's c.20% share price drop). With positive growth outlook retained for all of its business units, we estimate that shall still be able to book a solid 10% yoy core earnings growth in FY20F, despite cutting our FY20/21F earnings forecast by 12/8%. Hence, its current valuation at 9.4x 12M forward P/E seems like quite a bargain (vs. 15.6x 5Y average). At 54% valuation discount from (vs. 5- year average of 35% discount), remains our preferred pick. We maintain our Buy call with new SOTP -based TP of Rp8,200, implying 12.4x FY21F P/E.

Sumber : IPS

powered by: IPOTNEWS.COM