Company Update / IJ / Click here for full PDF version

Author(s) : Kevie Aditya, Elbert Setiadharma

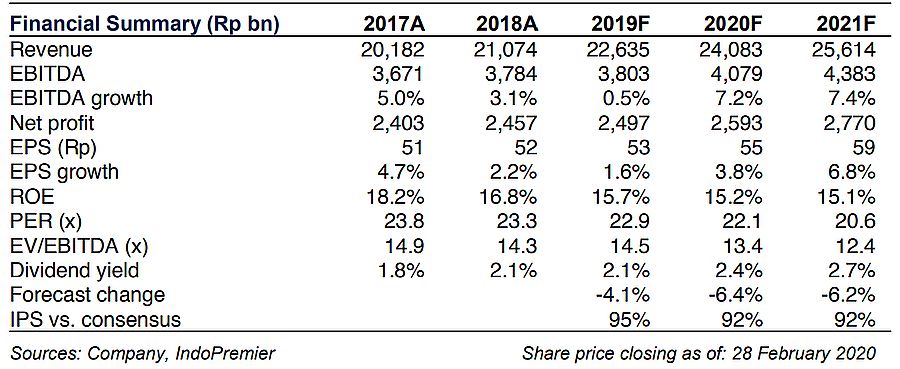

- While 's unaudited FY19 yoy earnings growth of 1.7% is disappointing, FY20 outlook looks better despite lingering corona issue.

- We conservatively pencilled in 6.4%/3.8% yoy sales and earnings growth for FY20 to anticipate worsening purchasing power.

- We, however, feel direct impact from coronavirus can be minimized shall Rupiah appreciates. We maintain our Buy call with lower TP Rp1,500.

Weak FY19 indicative results; below our and consensus' expectations

Yesterday held its analyst meeting and reported an unaudited FY19 net profit of Rp2.5tr (+1.7% yoy vs. 6-7% yoy target), slightly below at 96%/95% of our and consensus' estimates. FY19 sales however, met its target growth of 7.4% yoy although was mainly driven by low-margin distribution & logistics segment (+15.7% yoy) while consumer health segment sales growth declined by -2.8% yoy on the back of regulatory issues. As a result, gross margin declined by c.150bps to 45.2%

Decent FY20F growth guidance despite coronavirus outbreak

For this year, targets 6-8% yoy sales growth and 5-6% yoy net profit growth. This has included a worst-case scenario where the company may not be able to proceed with production due to coronavirus (if continues beyond Jun 2020), hence a loss of Rp100-200bn of sales (less than 1% of total) in 2H19. estimated that affected API's is c.10% of total COGS , while they have enough APIs ready for production until Jun 2020 (our analysis here ).

Cautious stance for FY20F

As weak purchasing power is likely to linger as we enter into 2020F, we pencilled in 6.4% and 3.8% yoy sales and earnings growth, respectively, more conservative than company's guidance. We expect regulatory issues on consumer health products (blue-labelled OTC pharma products, i.e. Komix, Woods, Procold) to slowly resolve but we conservatively expect the segment to post +2% sales growth (lower than company's 4-6% target; but rebound from -2% in FY19). Growth from its RTD beverages (i.e. Hydro Coco) also may see risk if sweetened beverages excise is applied.

Maintain BUY; strengthening rupiah will remain as 's saving grace

We do believe strengthening rupiah may still be 's saving grace as we use lower exchange rate of Rp13,700/US$ (from previously Rp14,200/US$). While we cut our FY20-21F EPS by 6-7%, our Buy call is maintained although TP is lowered to Rp1,500, now pegged to 25.5x 2021F P/E (1 s.d below 5-year mean) from previously 30.0x 2020F P/E (5-year mean of 29.5x). Current valuation at 2 s.d. below its 5-year mean is an attractive entry point.

Sumber : IPS

powered by: IPOTNEWS.COM