Company Update / IJ / Click here for full PDF version

Author: Kevie Aditya

- 's FY19 earnings was below our and consensus' estimates; mainly as margins dropped following inventory clearance and weak SSSG .

- 4Q19 SSSG of -1.5% was very weak, but we think we may yet to see the bottom. Inventory clearance shall continue; further eroding GPM.

- We expect -16.8% yoy earnings decline in FY20F on top of -27.7% yoy earnings decline in FY19; downgrade to SELL despite cheap valuation.

FY19 still disappoint despite investors' low expectation

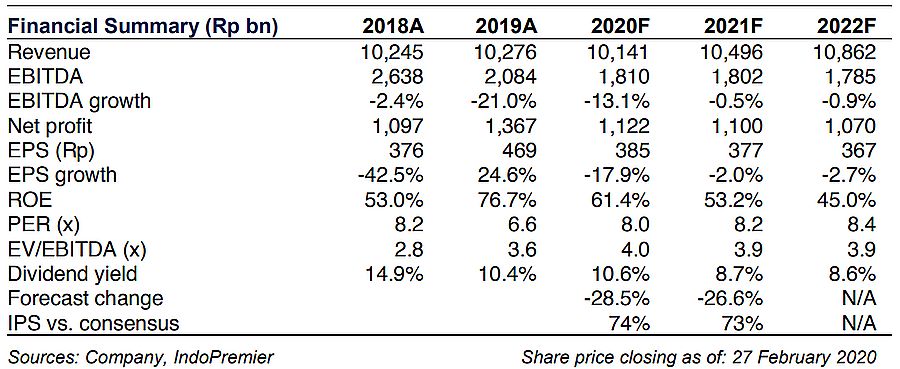

recorded core profit of Rp1,350bn in FY19 (-27.7% yoy), below our and consensus' estimates at 92% and 91% respectively (net profit improved +24.6% yoy if we ignore the one-off impact from Matahari Mall's Rp770bn write-offs in 4Q18). Main culprit is the massive inventory clearance in 3Q4Q19 that caused FY19 GPM to fall by 240bps yoy to 33.9%. In addition, FY19 net sales were flattish at Rp10.3tr, still in line with ours and consensus at 101%/99%, on the back of flat SSSG - causing lack of operating leverage.

Disappointment shall continue

The management indicated that 2020F may remain challenging, mainly as weak purchasing power was made worse by the emergence of coronavirus. While did not directly import their products from China, supply may be disrupted as its suppliers imported their raw materials from China. While 4Q19 SSSG was bad enough at -1.5%, 1Q20 SSSG may came out even worse. We now expect -2% SSSG for FY20F (vs. previously +2%). In addition, will continue to flush out aging inventories, meaning GPM will remain weak in the next few quarters, we believe.

Welcoming new CEO; change in strategy may be costly in the near term

Starting early this year, welcomed new CEO, Terry O'Connor (previously at Courts Asia), whom was speaking for the first time during the FY19 earnings call. Mr O'Connor acknowledges the need of making store products right, hence his decision to continue clearing aging inventory. In addition, he also commits on not opening any more specialty stores; while planning to discontinue "361 Degree" specialty stores (which were first opened only recently in Dec 2018). While these strategies may be necessary for the long run, short-term sentiment may be negative, in our view.

No signs of getting better soon; downgrade to SELL

While valuation at 8.7x 12M forward P/E looks appealing, fundamentals show otherwise. We cut our FY20-21F earnings estimates by 26-29%, thus lowering our DCF-based TP of Rp2,800 (implying 7.4x 2021F P/E) and downgrading our call to SELL (previously: HOLD ). Potential M&A and its solid 10.6%/8.7% dividend yield are its only catalysts.

Sumber : IPS

powered by: IPOTNEWS.COM