- : Brighter outlook! Earnings to DOUBLE - UPGRADE TO BUY TP2750 (+33% Upside)

- LPS lowers lending rate by 25bp - lower CoF indicator

.

: Brighter outlook! UPGRADE TO BUY TP2750 (+33% Upside)

Download complete report

Worth to highlight:

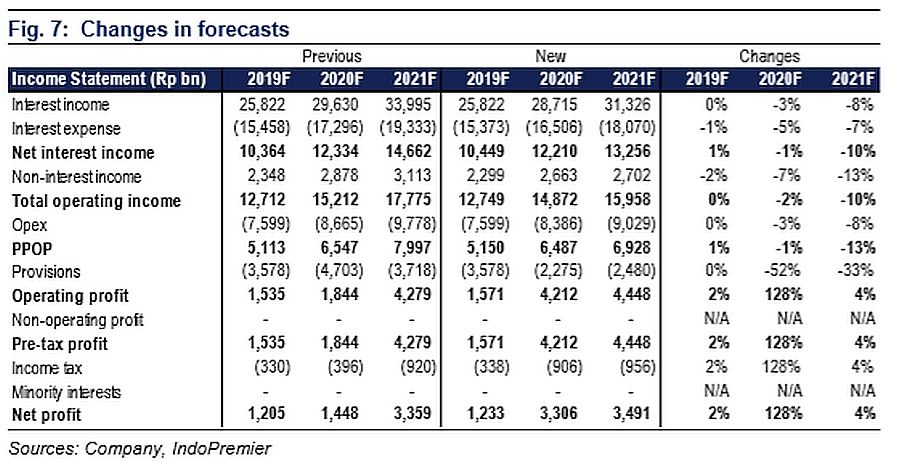

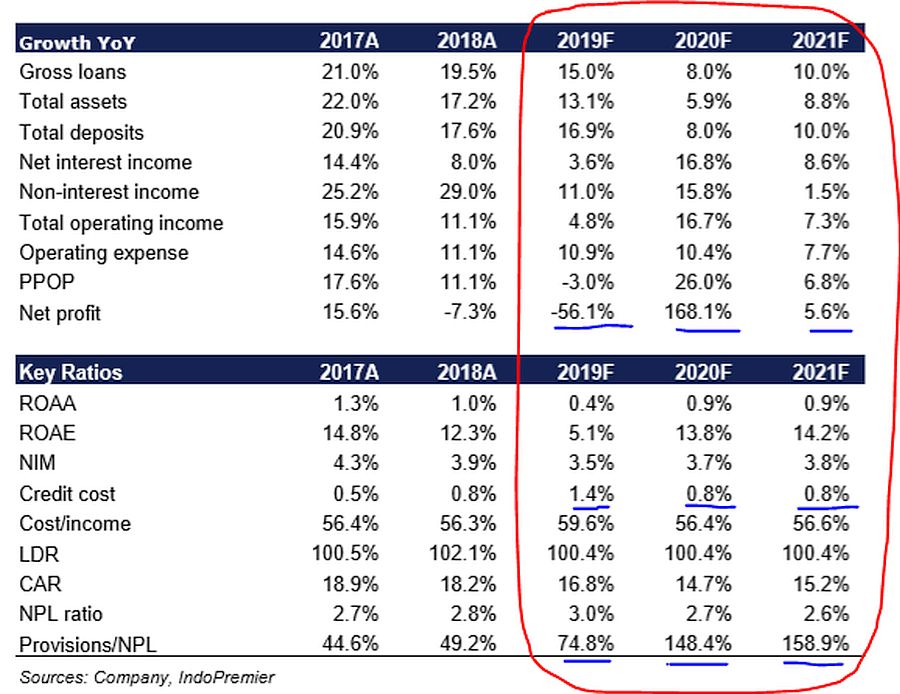

- By year-end, may require additional c.Rp4.5tr of provisioning to be taken from its retained earnings to comply with IFRS 9 (it is a one-off). This shall lower CAR by 250bp but increase ROE by 150bp. Yet we expect earnings to bounce back strong in 2020 (+147% yoy) despite our conservative est.

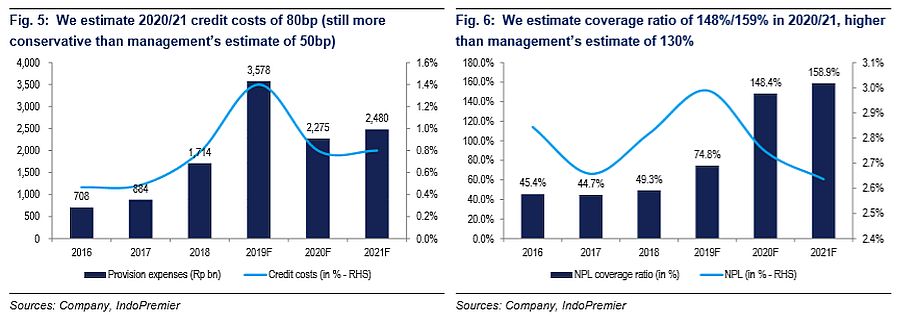

- Our provision estimate for FY20/21 is still more conservative than management's (80bp CoC for FY20/21 vs. management's 50bp - in-line with its historical average) which result in higher coverage (150% in FY20/21 vs. management est of 130%). It also has taken all the necessary steps to improve its loan quality (i.e. especially after formation of regional processing centre/RPC).

Appointment of the new CEO 27th Nov and improvement on its fundamentals shall spark the re-rating, in our view. We fine-tune our forecasts (especially FY20) as we already taken into account the impact of IFRS 9. Risk is deterioration in asset quality .

- Management has set its priority straight, managing CoF is imperative

- Loan growth target (now only at 5-7% for 2020, from high teens in previous years)

- they are to cut expensive funding (start from wholesale funding at 8.8% cost in 9M19, then TD at 8.3% cost in 9M19 - due to high institutional holding of 80%) and moving to improve its (even by offering higher rate).

.

in a nutshell

.

Snippets

OJK wants new investor to take over Jiwasraya

Currently, one of the formulated solutions for Jiwasraya is to establish a new subsidiary (Jiwasraya Putra) and have it focus on tapping into the SOEs ecosystem - this initiative is expected to provide c.Rp5tr of additional liquidity for Jiwasraya. For example, it will partner with SOEs such as , KAI, Pegadaian and Telkom, to act as distribution channels for Jiwasraya's products. In exchange, the 4 SOEs will get a total of 35% stake on Jiwasraya Putra. Nonetheless, OJK also encouraged Jiwasraya to look for new investors. Last week, the Vice Minister of SOEs cited that there are 8 investors interested in acquiring Jiwasraya. Based on Kontan's sources, these 8 parties include Sinar Mas, FWD , Allianz and Fosun, among others. (Kontan)

BPJS will use fresh funds to make payments to hospitals

By end of this week, BPJS is expected to receive Rp9tr of fresh funds from the Ministry of Finance - these funds are coming from the higher contribution for recipient of the social assistance. The second phase of this payment is expected to be done next week, which shall bring the total proceeds for BPJS to Rp13-14tr (implying another Rp4-5tr next week). The proceeds will be largely used to pay down its payables to the hospitals. As of Oct19, BPJS ' total payables to hospitals have reached Rp21.1tr. (Kontan)

Electricity prices to be adjusted in 2020

Government will implement the electricity tariff adjustment starting Jan2020 - by then, the tariff will be affected by 4 variables: crude oil price (ICP), exchange rate, inflation, and coal price. Furthermore, some of the households in the 900VA class (Rumah Tangga Mampu) will no longer get a subsidy starting Jan 2020, and prices will follow the new adjustment scheme. The government guides that any increases will not be major. (Kontan)

Government will continue to implement DMO for coal producers in 2020

Initial talks suggest that the DMO policy will be maintained going into 2020, with producers having to sell 25% of its production volume to domestic parties. Currently, the DMO price is capped at US$70/tonne, though the price for the 2020 DMO has yet to be finalized, if any. (Bisnis Indonesia)

LPS lowers lending rate by 25bp

LPS has lowered the deposit guarantee rates by 25bp. The deposit guarantee rates for rupiah/FX deposits are now at 6.25%/1.75%, respectively (8.75% for rural bank deposits). The new rates will be effective up to Jan 2020. (Investor Daily)

.

This is one of indicators that might lead to Bank's lower Cost of Fund ("CoF"). - and might benefit from this.

.

OJK revises down loan growth target

OJK has revised down its loan growth target for 2019 to 8-10% from 9-11% previously. As of Sep19, OJK reported that industry loan grew 8% yoy - investment loans (+13% yoy) were the key drivers, while working capital (+6% yoy) and consumption loans (+7% yoy) were weaker. (Investor Daily)

obtains Rp2.3tr of new syndication facility

has just obtained a new syndication facility amounting to Rp2.3tr from , , and . The loans are due on Oct 2034. The facility will be used for construction of Cinere-Serpong toll road, whose progress has reached 72% to date. (Bisnis Indonesia)

Sumber : IPS

powered by: IPOTNEWS.COM