UP EARNINGS & TP Post FY19 Results;

- : FY19 in line, improvement asset quality will secure FY20 outlook

- : 4Q19, why are we so confident towards its 2020 earnings growth"

- : FY19 result was in-line despite higher provision in 4Q19 + Expect DOUBLE digit Earnings growth in FY20

.

: FY19 results: in-line, improvement in asset quality will secure FY20 outlook

Download complete report

UPGRADE TP from 8000 to 9000 (+12.5% INCREASE)

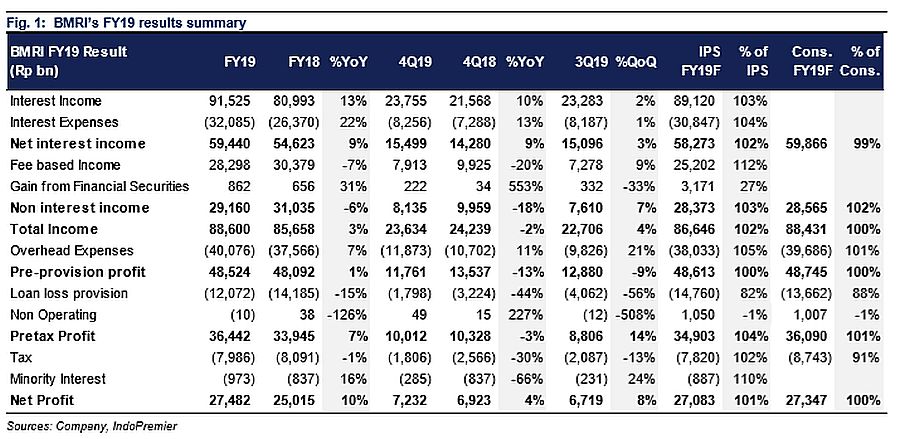

Stellar PPOP growth excluding one-offs

FY19 net profit of Rp27.5tr (+10% yoy/+8% qoq) was in-line at 101%/100% of our/consensus estimates. Headline PPOP was mild (1% yoy/-9% qoq) due to one-off gain/tax income in FY18 (Rp2.5tr) and one-off tax provision in 4Q19 (Rp625bn). Excluding all the one-offs, PPOP grew 8% yoy (-4% qoq). Concurrently, provision also improved (-15% yoy/-56% qoq) which result in lower credit costs (CoC) at 1.4% in FY19 vs. 1.8% in FY18 (0.8% in 4Q19 vs. 2% in 3Q19). It guides for lower CoC of 1.2-1.4% in FY20 (ours: 1.3%).

Robust NIM in FY19, though FY20 guidance remains conservative

NIM stood at 5.6% in FY19 relatively stable on a qoq basis (5.7% in FY18) this was largely due to higher LDR (97% in 4Q19 vs. 94%/97% in 3Q19/4Q18). Deposits grew at 11% yoy (+5% qoq) driven by (+13% yoy/+7% qoq), while TD was weaker (+7% yoy/flat) - this also helps CoF. It guides for NIM of 5.4-5.6% in 2020 (our estimate: 5.5%).

Loan growth driven by micro and corporate

Loan grew 11% yoy (+8% qoq) driven by micro (20% yoy/+6% qoq) and corporate (+11% yoy/+11% qoq). Commercial (+6% yoy/+10% qoq) and small (+3% yoy/+2% qoq) were weakest. It guides for 8-10% growth in 2020.

.

..

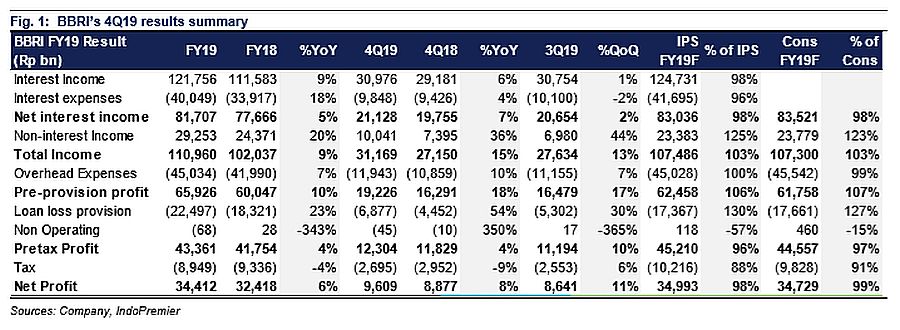

: FY19 results: in-line, strong PPOP was due to robust growth in fee income -UPGRADE TP from 4600 to 5200 (+13% INCREASE)

Jovent Muliadi, our bank analyst, fined tune our FY20-21F EPS amid new guidance. Nonetheless we think its FY20 earnings can reach c.20% yoy under best case scenario (cost to income of 41% instead of our current assumption 42% and CoC of 1.8% instead of 2% - this level of credit costs still way higher than its peers of c.1.3%) this underpin our TP upgrade to Rp5,200 based on 2.6x P/BV. Amidst recent rally, it now trades at 2.7x 2020F P/BV (post IFRS 9 book value) vs. 10-year average of 2.3x P/BV. Key risks are worsening asset quality and higher CoF.

.

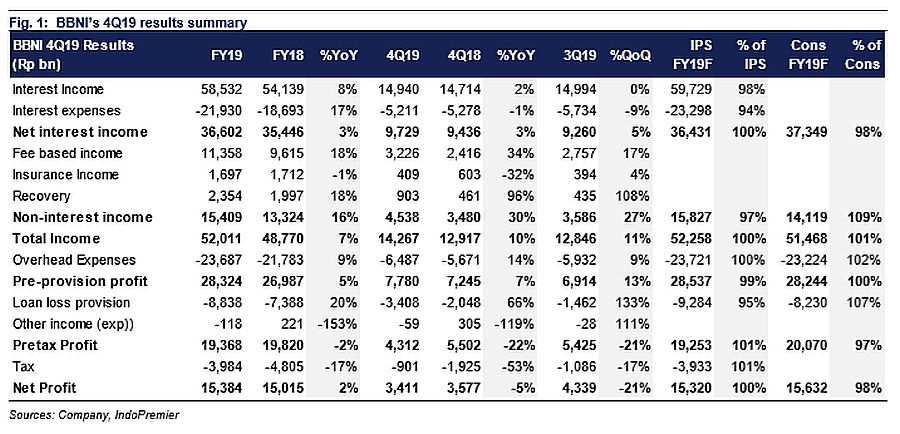

: FY19 result was in-line despite higher provision in 4Q19 + Expect DOUBLE digit Earnings growth in FY20

.

Snippets

LPS cut deposit insurance rate by 25bps

LPS cut the rupiah deposit insurance rate by 25bps to 6%, while the deposit insurance rates for FX deposits were unchanged at 1.75%. Rural bank (BPR) insurance deposit rates were also reduced by 25bp drop to 8.50%. The new rates will be effective starting 25th Jan to 29th May 2020.. (Kontan)

aims for 9% revenue growth

In 2020, is aiming for c.9% revenue growth and 3-5% net profit growth, to be driven largely by the retail segment. It also plans to introduce its HydroCoCo product to Dubai this year, expanding its export market. (Kontan)

BPJT will raise Jakarta inner city toll road tariffs

The Toll Road Regulatory Agency ( BPJT ) guides that it will raise tariffs for inner city Jakarta toll roads soon - currently, it is still in the phase of socializing the planned tariff increase. Note that the tariff for the inner city toll roads was previously raised by 5.9% in Dec 2017. (Kontan)

Commentary: this is in-line with market expectation. All in all, this shall be positive for

Lion Air to be the biggest IPO in 2020

Lion Air will be doing a pre-deal roadshow starting end of Jan to 7 Feb ahead of their IPO plan. It targets a total proceed of US$1bn, which shall make it the largest IPO in 2020. The proceeds will be largely used to acquire fleets, which are currently under operating leases. (Investor Daily )

to hold AGM on 18 February 2020

's AGM will be held on 18 February 2020 at 2pm. One of the agendas included will be changes to the management team. (Bisnis Indonesia)

Sales commentary is not a product of research

Sumber : IPS

powered by: IPOTNEWS.COM