Company Update / Commodities / IJ / Click here for full PDF version

Author(s): Timothy Handerson

- guides FY20F HE sales volume of 1.4k units (-50% yoy), this was in-line with ours. We see better HE sales volume beyond FY20F.

- [=PAMA=] volume set to drop 18% yoy in FY20 with US$120-140mn discount (vs. our estimate of -14%/US$150mn); the latter is a positive.

- Gold production will miss target, though we see a volume recovery and higher ASP in FY21F. Maintain Buy.

HE demand remains lacklustre; recovery is slated in FY21-22

guides for FY20F HE sales of 1,350-1,400 units, down 50% vs. FY19 achievement/previous FY20F target of 2,800-2,900 units largely due to weak demand. The guidance however, was in-line with our FY20F estimates of 1,450 units (all-time low since 2003). We think that this year's weak volumes has been priced-in, and expect HE volumes to recover to 2,300-3,200 units in FY21-22F in-line with improving economy and potential capex windfall (as most miners/contractors defer their capex to FY21).

Steep drop in [=PAMA=] volume, though discount is manageable

It guides for a 18% drop in [=PAMA=]'s FY20F volume (our estimate of -14%) as most coal producers have lowered production target by 15-20%. It also expects US$120-140mn of discount to be given by [=PAMA=] in FY20F (vs. its previous guidance/our estimate of US$150mn). Despite a bleak volume outlook this year, we believe that its latest discount guidance is a positive surprise. We pencil-in 13-19% revenue growth for [=PAMA=] in FY21-22F on the back of 1) volume recovery (7-8% p.a.) driven by higher coal prices (Newcastle price of US$55/65/70 in FY20/21/22), and 2) minimal discountof US$20-30mn in FY21-22F.

Plenty of upside to Martabe despite short term challenges

Amid suboptimal production activities in Martabe, guides for a base case of c.300k oz gold production (vs. initial target of 360k oz) in FY20F before recovering to 350k oz in FY21F though we have pencilled this in our forecast. Going forward, it will be less conservative on its hedging strategy (i.e. use put options instead of fixed forward contracts, lower proportion of volume hedged) in FY21F which shall be positive for ASP. Despite the recent correction to gold price, we still see ample upside to its valuation amid its steep discount vs. peers ( link to our previous report ).

Maintain Buy

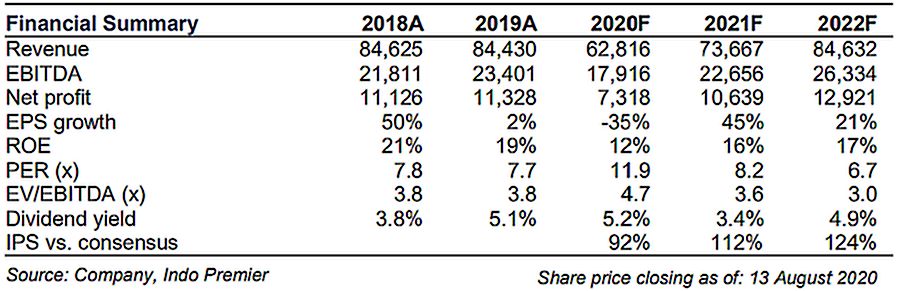

Maintain Buy as we believe that the weak FY20F has been largely priced in, while expecting a strong EPS recovery in FY21-22F (+21-45% yoy). It now trades at 8x 2021F P/E. below 10-year average of 13x P/E. Main risk is worsening gold/coal prices.

Sumber : IPS

powered by: IPOTNEWS.COM