Company Update / Towers / TBIG IJ / Click here for full PDF version

Author(s): Giovanni Dustin ;Michelle Nugroho

- 9M23 net profit was Rp1.1tr (-9% yoy), which met our/cons estimates.

- EBITDA came in flat yoy at Rp4.3tr and was broadly in-line.

- Revenue was also in-line at Rp5.0tr (flat yoy), as soft revenue from IOH and Tsel were already expected; Reaffirm Buy.

9M23 net profit and EBITDA met our/cons expectations

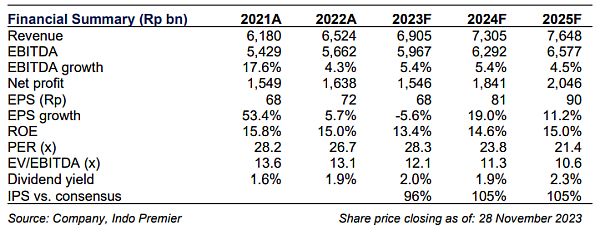

Net profit reached Rp1.1tr (-9% yoy) in 9M23, and was broadly in-line with our/cons FY23F estimates at 72/75% run-rate. Meanwhile, 9M23 EBITDA came at Rp4.3tr (flat yoy) - largely in-line with our/cons forecasts (72/74%); this implies a slightly lower EBITDA margin of 86.5% (-46bps yoy). The company booked 9M23 revenue of Rp5.0tr (flat yoy), which also met our/cons expectations (72/74% of our/cons).

Revenue from IOH declined further sequentially; soft Tsel revenue

3Q23 net profit came in at Rp430bn (+8% yoy/+20% qoq). In 3Q23, EBITDA reached Rp1.4tr (+3% yoy/flat qoq), which translates to EBITDA margin of 86.2% (+3bps yoy/-96bps qoq). Of note, cash opex grew by +3% yoy/+8% qoq. 3Q23 revenue came-in at Rp1.7tr (+3% yoy/+1% qoq) where revenue from IOH continued to decline sequentially (-13% yoy/-4% qoq) given some non-renewals of expiring leases. Meanwhile, revenue from EXCL grew by +12% yoy/+6% qoq and revenue from Tsel remained soft (-2% yoy/-1% qoq).

Slower tenancy net add sequentially; tenancy ratio declined marginally

TBIG saw 149 net tower addition qoq in 3Q23 (only slightly higher than 146 net add qoq in 2Q23), and added 137 new tenants qoq (lower than 419 net add qoq in the previous quarter. As a result, tenancy ratio decreased slightly on sequential basis to 1.87x in 3Q23 (3Q22: 1.88x/2Q23: 1.88x). Blended lease rates were flat qoq at Rp13.5mn/month (3Q22: Rp13.4mn/2Q23: Rp13.5mn). As of 9M23, TBIG had 22,175 tower sites and 41,455 tenants.

Reaffirm BUY, with an unchanged TP of Rp2,550

Soft revenue from IOH and Tsel were already expected, and thus, overall 9M23 results were broadly in-line with our expectations. In the near-term, VTO could help to provide share price support, while looking ahead to FY24F, a peak (or reversal) in interest rates and faster-than-expected site relocations by IOH are potential catalysts. Its growing fiber business (though still sub-scale at this juncture) could also help to support the company's growth during the 5G cycle. Reiterate BUY with an unchanged blended valuation-based (DCF and EV/EBITDA multiple) TP of Rp2,550. Downside risks: 1) low tenancy growth; and 2) pressure on lease rates.

Sumber : IPS

powered by: IPOTNEWS.COM