Company Update / Banks / IJ / Click here for full PDF version

Author(s): Jovent Muliadi ;Axel Azriel

- 9M25 net profit of Rp40.8tr (-10% yoy)broadly in-lineamidweak PPOP (-1% yoy)from slower recovery. Provisions eased -6% qoq(CoC 3.2%).

- NIM was stable at 7.7% vs. 7.8% in 1H25 from flat asset yield and CoF. Deposits rose +8% yoy from impressive CA growth of +24% yoy.

- Loan grew +6% yoy from corporate (+16% yoy); LAR improved to 10.7% vs. 10.8% in 2Q25. Maintain Buy on better loan growth/CoC outlook.

9M25 results: below from miss in recovery despite improving provision

posted 9M25 net profit of Rp40.8tr (-10% yoy/+15% qoq in 3Q25), broadly in-line at 72% of ours/consensus FY25F. PPOP slipped -1% yoy from weaker non-II (-2% yoy - due to weak recovery at -14.4% yoy) while NII was modest (+3% yoy). Opex grew at +5% yoy, translating to steady CIR of 43% (vs. 42%/41% in 2Q25/3Q24). Provisions rose +14% yoy but eased -6% qoq, bringing CoC lower to 3.2% (vs. 3.4% in 2Q25/3Q24), trending back towards management's 3.0-3.2% guidance.

Relatively stable NIM while improved from robust CA

Consolidated NIM stood at 7.7% in 9M25 (7.8%/7.7% in 1H25/9M24), in-line with guidance of 7.3-7.7% as asset yield was steady at 10.8% (flat qoq/yoy) along with stable CoF at 3.6% (flat qoq/-10bp yoy). LDR rose to 87% (vs. 85%/89% in 2Q25/3Q24). Deposit grew +8% yoy (flat qoq), driven by at +14% yoy from robust CA at +24% yoy vs. SA at +7% yoy, while TD contracted -2% yoy; this led to higher ratio of 68% vs. 66% in 2Q25.

Tepid loan growth as micro continue to remain weak

Loan grew +6% yoy (+2% qoq) in 3Q25, slightly below the 7-9% guidance. This was supported by corporate (+16% yoy) and consumer (+10% yoy), while micro remained weak (+1% yoy), dragged down by Kupedes (-10% yoy) and KUR (-0.3% yoy) as it still prioritizing asset quality over expansion.

Slight uptick on NPL but LAR/SML improved

NPL rose to 3.1% in 3Q25 (vs. 3.0%/2.9% in 2Q25/3Q24) from downgrade in micro & consumer. However, LAR improved to 10.7% (vs. 10.8%/11.7% in 2Q25/3Q24) while SML declined to 5.0% (vs. 5.2%/5.6% in 2Q25/3Q24) with steady LAR coverage of 52.6% vs. 53.2% in 2Q25.As of 3Q25, the remaining 2023 Kupedes accounted for Rp44tr/3.1% of total loans with NPL of c.13%, which is expected to be resolved by 1H26. Net micro downgrade (both NPL and SML) also continued to improve sequentially.

Maintain Buy on better growth and asset quality outlook

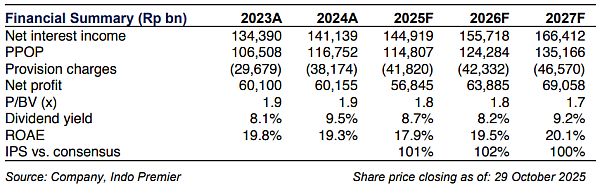

We maintain our Buy rating on the back of better growth (especially micro) and asset quality outlook (improving CoC and lower net downgrade). trades at 1.8x FY25F P/B and 10.4x P/E (vs. 10Y avg. of 2.4x P/B and 14.7x P/E). Risk is NIM compression.

Sumber : IPS