Sector Update / Banks / Click here for full PDF version

Author: Jovent Muliadi ;Axel Azriel

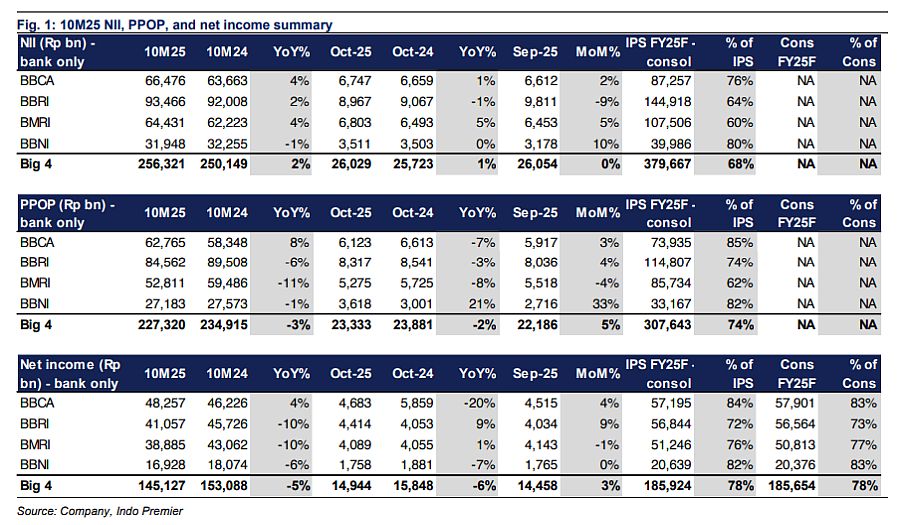

- Aggregate big 4 bank-only profit of Rp145.1tr in 10M25 (-5% yoy) came in-line. On a mom basis, big 4 earnings improved +3% mom in Oct25.

- Bank-only NIM weakened to 5.2% in 10M25 (-33bp yoy/flat mom) on lower asset yield (-31bp yoy), though CoF was stable (+1bp yoy).

- We maintained OW for the sector given the gradual improvement in CoF and bottoming valuation. is our top pick right now.

10M25 bank-only results: in-line with decent mom improvement

Aggregate big 4 bank-only earnings fell -5% yoy to Rp145.1tr in 10M25, in-line with our/consensus FY25F consol growth estimates of -3% yoy. On mom basis, big 4 bank earnings posted decent improvement of +3% mom in Oct25, led notably by (+9% mom) and (+4% mom) while /BBNI were flat.NIM contracted -33bp yoy to 5.2% from lower asset yield (-31bp yoy) while CoF was relatively stable (+1bp yoy). Loan grew +8% yoy while deposits rose +12% yoy; this translates to lower LDR of 87% (-297bp yoy).

: remained in-line with relatively stable margin

bank-only profit of Rp48.3tr in 10M25 (+4% yoy/+4% mom) was in-line on consol basis at 84%/83% of IPS/consensus. PPOP grew +8% yoy from non-II at +9% yoy while NII grew at +4% yoy; opex was mild at +4% yoy. Provision rose +110% yoy (+97% mom), bringing CoC to 0.4% (+20bp yoy) and in-line with guidance of 30-50bp. NIM was stable at 5.9% in 10M25 from stable CoF and asset yield. Loan grew +8% yoy while deposits rose +7% yoy, supported by growth of +10% yoy while TD dropped at -5% yoy.

: notable improvement in credit cost and CoF

posted bank-only net profit of Rp41.1tr in 10M25 (-10% yoy/+9% mom); on consol basis, it was relatively in-line at 80%/81% of IPS/consensus. PPOP declined -6% yoy on weak non-II (-10% yoy). Provision rose +6% yoy (+10% mom), bringing CoC to 3.2%, in-line with guidance of 3.0-3.2%. NIM softened to 6.5% (-29bp yoy) on lower asset yield (-46bp yoy) though CoF improved (-20bp yoy). Loan grew +5% yoy while deposit rose +8% yoy from robust (+16% yoy). LDR stood at 88% (-231bp yoy).

: weak while CoC was still far behind guidance and spike in TD

bank-only net profit of Rp38.9tr in 10M25 (-10% yoy/-1% mom) was in-line on consol basis at 82%/83% of IPS/consensus. PPOP fell -11% yoy amid opex drag (+41% yoy). Provision down -25% yoy (-56% mom) which translates to CoC of 0.5% (-25bp yoy), far below guidance of 0.8-1.0%. NIM slipped to 4.3% (-42bp yoy) from lower asset yield (-24bp yoy) and higher CoF (+18bp yoy). Loan grew +11% yoy while deposit rose +15% yoy, sourced from TD (+51% yoy) amid tepid (+5% yoy) which bring LDR to 92% (-340bp yoy).

: in-line; higher provision/CoC suggests precautionary stance

recorded bank-only net profit of Rp16.9tr in 10M25 (-6% yoy/flat mom); on consol basis, it was in-line at 82%/83% of IPS/consensus. PPOP slipped -1% yoy from weak NII (-1% yoy) and non-II (+3% yoy). Provision rose +18% yoy (+154% mom) which bring CoC higher to 1.1% (+8bp yoy), slightly above its guidance of c.1%. NIM fell to 3.6% (-42bp yoy) on lower asset yield (-40bp yoy) while CoF was relatively stable. Loan grew +10% yoy while deposit expanded +21% yoy which translated to lower LDR of 87% (-889bp yoy).

Sumber : IPS