Sector Update / Banks / Click here for full PDF version

Author: Jovent Muliadi ;Axel Azriel

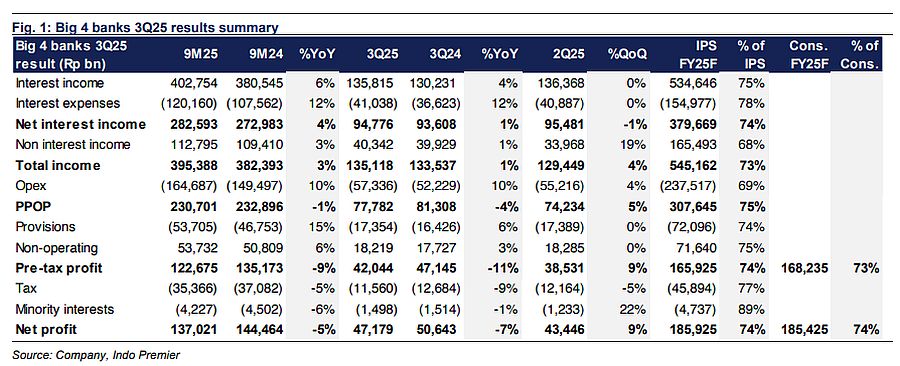

- Big 4 banks net profit of Rp137tr in 9M25 (-5% yoy/+9% qoq in 3Q25) came in-line. On qoq basis, all SOE banks posted significant improvement.

- NIM was broadly stable across all banks amid peaking CoF, while asset quality improved with LAR declined by -10bp to -60bp qoq, led by .

- We maintained our OW stance for the sector from limited downside in valuation and easing funding cost. and are our top picks.

In-line big 4 banks results but qoq numbers have started to improve

Aggregate big 4 banks net profit of Rp137tr in 9M25 (-5% yoy/+9% qoq in 3Q25) was relatively in-line at 74% of ours/cons. However, all SOE banks posted decent qoq improvement at +7% to 18%. PPOP was lacklustre at -1% yoy (+5% qoq) amid tepid NII/non-II at +4%/+3% yoy from persistent margin pressure. Opex grew +10% yoy (+4% qoq) though this was mostly dragged by (+25% yoy) while others remained manageable at +4% to +5% yoy. Provision grew +15% yoy (flat qoq) mainly from (+49% yoy) as it prefers to remain cautious on the asset quality outlook.

Relatively stable NIM with CoF showing early signs of improvement

All banks showed steady NIM in 3Q25 (-20bp qoq for while -10bp qoq for the remaining three). In terms of loan yield, /BBRI/BMRI dropped by c.-20bp qoq while fared better at -10bp qoq. For CoF, a slight improvement was already seen in (-12bp qoq), (-9bp qoq), and (-8bp qoq), though still increased by +12bp qoq. We expect this gradual improvement in CoF to carry towards 4Q25F, as most banks already reported lower MTD CoF in Sep25 which shall ease pressure on NIM.

Robust deposit growth amid MOF liquidity injection

Overall loan grew +9% yoy (+2% qoq) with /BBNI posted the strongest growth of +11% yoy (+4% qoq), followed by at +8% yoy (-2% qoq) and of +6% yoy (+2% qoq). On the funding front, deposit grew quite robust at +12% yoy (+2% qoq), driven by TD (+16% yoy/+9% qoq) from MoF's liquidity injection though remained healthy at +10% yoy (-1% qoq). and led growth at +14% yoy (+3% qoq) and +13% yoy (-5% qoq).

Gradual improvement in asset quality especially LAR

Asset quality was improving across the big 4. In 3Q25, experienced the biggest qoq improvement in LAR at -60bp qoq to 10.4%, followed by which dropped to 6.5% (-44bp qoq), to 5.5% (-20bp qoq), and which down to 10.7% (-10bp qoq). CoC for all banks were still in-line with their guidance except for (0.7% vs. guidance of 0.8-1.0%) which may suggest a pick-up in 4Q, in our view.

Maintain OW from bottoming valuation and easing liquidity condition

We maintained our OW stance on banks, given the valuation downside is limited (link tonote), along with sequential improvement in CoF that shall positively affect margin. The sector currently trades at of 2.0x P/B and 11.1x P/E (vs. 10Y avg of 2.2x and 14.6x). Our top picks are: given the funding turnaround and amid improving CoC and better loan/funding growth outlook. Risk is worsening economic condition which may result in slower loan growth and asset quality deterioration.

Sumber : IPS