Sector Update / Banks / Click here for full PDF version

Author(s): Jovent Muliadi ; Anthony

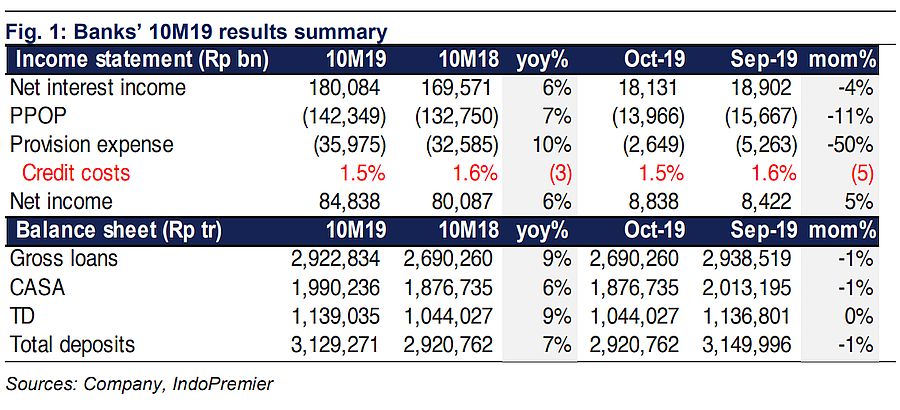

- Overall 10M19 bank-only net profit grew 6% yoy (+5% mom); andn posted the strongest profit growth, while was the weakest.

- Overall Oct19 mom profit growth was largely driven by lower provision (-n 50% mom) as PPOP came slower (-11% mom).

- Maintain Overweight with , , and as top picks amidn improving outlook next year and no more M&A overhang.

Moderate net profit growth - was the clear outperformer

Aggregate big 4 + bank-only 10M19 net profit of Rp84.8tr (+6% yoy/+5% mom in Oct) was broadly in-line at 79%/78% of our/consensus FY19 estimates, except for (net profit growth of 5% in 10M19 vs. our/cons expectation of 8% yoy) and , though the latter was expected. (+14% yoy) and (+9% yoy) saw the strongest EPS growth.

Decent growth in NII, NIM was flat except for

II grew 6% yoy (-4% mom) in 10M19 as overall loan growth was partly offset by lower NIM (5.7% in 10M19 vs. 5.9%/5.8% in 10M18/9M19) - most banks posted flattish NIM, except for which saw NIM contraction (-20bp mom). Among our coverage, (+14% yoy/+5% mom) and (+9% yoy/-1% mom) saw the strongest pick-up in NII growth

Significant mom improvement in provisioning

Provisions rose 10% yoy but saw a significant improvement mom (-50% mom), as most banks prefer to book bulk of its provisioning in Jan20 using its balance sheet ( IFRS 9 implementation will be in Jan20 and shall impact aggregate CAR of banks under our coverage by 150bp, though it will also raise aggregate NPL coverage to 216% from 143%). CoC improved slightly to 1.5% in 10M19 from 1.6% in 10M18 (1.6% in 9M19)

Liquidity remains relatively tight

Loans grew 9% yoy (-1% mom) in Oct19, with (+13% yoy/-1% mom) growing the fastest while was the slowest (+5% yoy/-1% mom). Loan still outpaced deposit growth (+7% yoy/-1 %mom), TD still grew 9% yoy (flat mom), outpacing CASA growth (+6% yoy/-1% mom). LDR stood at 93% in 10M19 vs. 92% in 10M18 (flat mom).

Maintain Overweight

Maintain Overweight as we see improving outlook going into next year with , and as our top picks. The sector is trading at 1.8x 2020 P/BV (ex-), below 10-year avg of 2x P/BV. Catalyst is improving CoF in subsequent months and better asset quality (from IFRS 9 clean-up). Risk will be government intervention, though we think its less likely.

Sumber : IPS