Company Update / IJ / Click here for full PDF version

Author: Timothy Handerson

- Corona virus impact has been worse than expected - sizeable demand revision is imminent, though chance of 1998 repeat is slim, in our view.

- China's Feb 4W volume fell 85% mom (-80% yoy). Based on this, we see a possibility of 25% drop in Indonesia's 2020F auto volume.

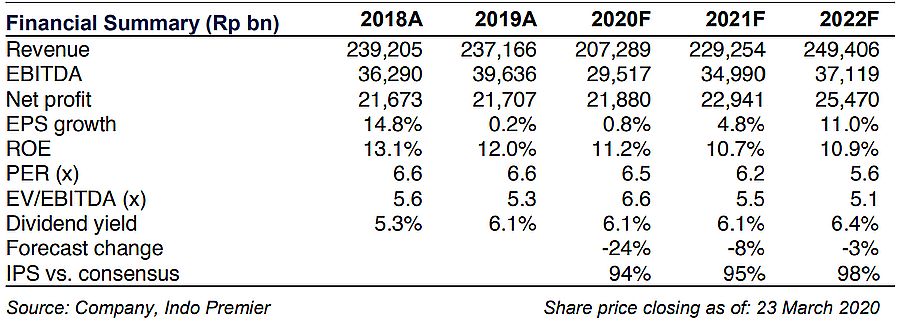

- We downgrade our FY20F EPS by 24% on the back of lower 4W/2W volume, but maintain Buy with a new SOTP -based TP of Rp5,000.

Corona virus has showed no signs of slowdown

The corona virus pandemic has proven to be worse than expected - our strategist previously highlighted that a slowdown is imminent (our economist expects FY20F GDP to be at 4-4.5% and possibly lower if the outbreak worsens). Our checks with major 4W brands also revealed that they have started to see a significant drop in new sales bookings starting mid-March.

Expect another major volume correction, though 1998 repeat is unlikely

Over the last 25 years, there were only 6 years that auto volume experienced a sharp contraction: 2019, 2015, 2006, 1998, 1996 - the worst being in 1998 (-85% yoy) and 2006 (-40% yoy). Note that 2 of these 6 years were crisis related (1998, 2009). While we are entering uncharted territory now especially with possibility of hard landing in growth (post 1998, lowest GDP growth was at 4.6% in 2009), we believe that the chances of 1998 case to recur is quite slim while a repeat of 2006 seems more probable - although this time is without a fuel price shock (fuel price went up by 2.5x in 2005).

How low can we go?

Taking cues from China's recent data point, we expect car sales to drop by 25% yoy in FY20F China has seen 4W sales drop 85% mom (-80% yoy) in Feb20 amid the peak of corona virus outbreak (2k mtd vs. 67k in Feb20). Using this as a benchmark and assuming that corona virus cases peak in Apr20 in Indonesia (i.e. extremely weak Apr/May sales as May also coincides with Lebaran, though we assume that the drop is not as severe as China's as we have not had production halt) and a subsequent mild/gradual recovery in 2H (similar to 2006), our base case pencils in a 25% drop in 4W volume (Fig 4) - assuming maintain its market share. Note that we also expect Jakarta/Java (Fig 5) to see a steeper drop, while the drop in ex-Java islands should be relatively milder as most of the cases have been concentrated in Jakarta so far.

Downgrade EPS, but maintain Buy

Downgrade FY20F EPS by 24% on the back of lower 4W/2W volumes (i.e. - 25% yoy in FY20F), but maintain Buy with a lower SOTP -based TP of Rp5,000. EPS downside has been largely priced-in ( down 49% YTD), in our view. Short term risks are: surge in infection cases and weaker Rupiah.

Sumber : IPS