Sector Update / Bank / Click here for full PDF version

Author (s) : Jovent Muliadi, Anthony

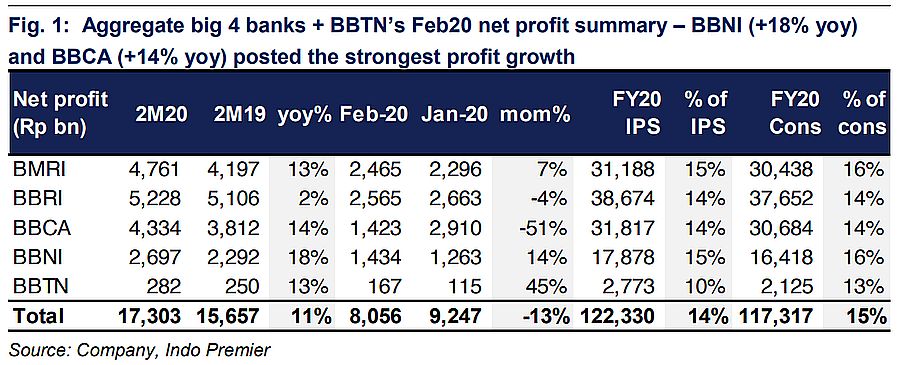

- Big 4 banks and 2M20 results were pretty encouraging with profit still grew by 11% yoy (-13% mom) and PPOP of 19% yoy (-8% mom).

- Provisioning however, started to rose by 43% yoy in 2M20 (+12% mom) with and booked steep increase in its provisioning.

- , and all booked robust PPOP in 2M20; meaningful impact from Covid-19 will probably be only transpired in Apr, we think.

Decent bottom line growth amidst robust PPOP

Banks under our coverage posted 11% yoy profit growth in 2M20, relatively in-line with our initial estimate of 15% yoy profit growth for 2020. This was supported by robust net interest income growth (+11% yoy in 2M20/-3% mom in Feb20) and also PPOP (+19% yoy in 2M20/-8% mom in Feb20). /BBNI posted the highest profit growth in 2M20 (+14%/18% yoy) while /BBNI posted the highest PPOP growth in 2M20 (+18%/25% yoy).

NIM buffer may be enough to weather upcoming restructuring issue

Other than and , all banks posted NIM expansion of 10-50bp yoy ( was the highest). NIM expansion in our view, shall allow banks to have some room to restructure its debtors amidst on-going coronavirus outbreak. Note that in our previous report (link), we assume that there will be c.200bp adjustment towards MSME rate which shall impact banks NIM by 21-42bp (assuming it affects 50-100% of its MSME portfolio).

Loan remained at high single digit, though it might not for long

Loan grew by 9% yoy (+1% mom) for banks under our coverage, but deposit was higher at 10% yoy (+1% mom) - CASA growth was slightly stronger than TD. Only and that were able to post a double digit loan growth in Feb20 (+11% and 12% respectively). and were the slowest at +6% and 7% respectively. Slow loan growth for is positive, in our view, as it will result in less incremental funding needs shall there are a lot of MSME restructuring (principal payment delay resulted in lesser loan run-off).

Rising provisioning is inevitable

Overall provision rose by 43% yoy in 2M20 (+12% mom in Feb20) with (+71% yoy) and BRI (+85% yoy) were leading the way. Only and booked a yoy drop in provisioning in 2M20 (-14 and -6% yoy respectively). Our discussion with the banks also suggested that they are seeing a yoy pick-up in SML thus far. We think provision shall continue to increase going forward though not for the NPL as most shall be restructured to remain in current category (col 1).

Coronavirus impact may only be seen in Apr; expect a decent 1Q number

We think most banks shall report decent 1Q number as coronavirus impact might only be seen in Apr (infection case only started to build up in early Mar). We recommend investors to stick with - defensive nature and the most prudent in terms of managing asset quality, and - major underperformer and offers attractive risk-reward. Overall sector has dropped by 30% YTD (in-line with JCI), now trading at 1.8x P/BV (vs. 10Y avg of 2.3x) - note that bottom valuation in 2008/2013/2016 were at 1.2x/1.9x/1.6x. Risk is massive slowdown in economy which may result in worse than expected asset quality issue.

Sumber : IPS