Company Update / IJ / Click here for full PDF version

Author(s): Jovent Muliadi, Timothy Handerson

- We recently met with management (CEO, CFO and its corporate banking director) to discuss its FY20 outlook.

- We were pleasantly surprised to find out that NIM has started to improve while provision to remain prudent, contrary to what market believes.

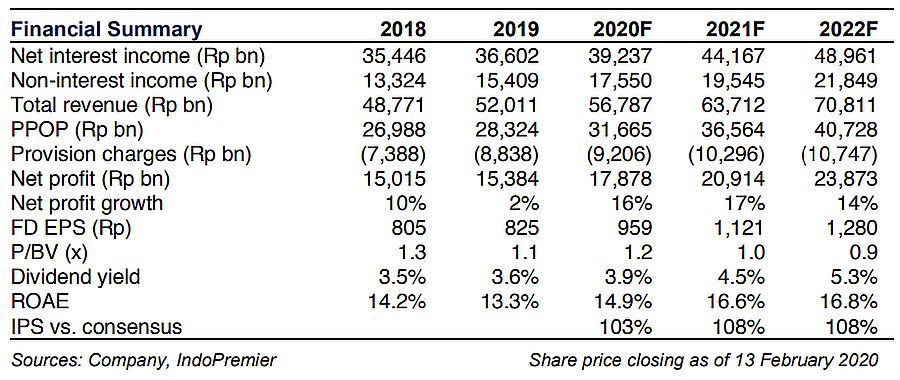

- It remains one of our top pick. At 1.2x P/BV we think its offers the most attractive risk-reward preposition. Risk is management change, if any.

FY20 outlook remains bright despite upcoming AGM

We recently had a discussion with 's CEO, CFO and corporate banking director with regards to its FY20 outlook amidst investors' concern on upcoming AGM (potential management change hence higher risk of kitchen sinking). Pak Baiquni as its CEO admitted that AGM remains the biggest overhang and hence already anticipated such issue by starting building its provision in FY19 (instead of booking bigger profits) along with higher IFRS 9 provision adjustment.

Prudent provisioning approach

Contrary to investors' concern on underprovisioning, we found that has been quite prudent with its provisioning approach. Post IFRS 9 both and Duniatex (two biggest issues last year) coverage will be at 90% and 100%, respectively (higher than 's c.45%/60% and 60-70%/100% for /Duniatex). Overall NPL/LAR coverage will be at 260%/59% vs. 's 256%/61% and 's 229%/60% which doesn't justify the valuation discount.

Improvement in NIM was encouraging amidst lower CoF

Our discussion with management also suggested that its NIM has come back to c.5% in Jan20 vs. 4.9% in FY19. The improvement in NIM was largely supported by lower CoF amid surge in CASA in Nov/Dec (CASA up 5% mom both in Nov and Dec). Jan20 CASA also went up by c.11% yoy vs. TD -3% yoy which showed an encouraging trend.

remains one of our top pick

remained a laggard vs. (-10%) and (-8%) YTD due to AGM overhang. Our discussion suggests that whoever replaces current management shall not be worried by asset quality post build-up in provision in FY19 and IFRS 9 adjustment. It now trades at 1.2x 2020 P/BV (post asset reval and IFRS 9 adjustment), lower than its 10Y avg of 1.4x, it also offers 36%/57% discount against /BBRI vs. its 10Y avg of 29%/44%. Risk is major change in management, though we think its unlikely.

Sumber : IPS