Company Update / IJ / Click here for full PDF version

Author(s):Kevie Aditya,Elbert Setiadharma

- We estimate weak 4Q19 SSSG to drag ' FY19 SSSG to 0%. Margin shall remain resilient; as such we expect c.8% FY19 core EPS growth.

- Increase in CPO price, along with delay in electricity price hike and faster social assistance disbursement shall allow better FY20 SSSG of 2%.

- With positive catalysts emerging, we are more upbeat than we were two months ago. Maintain Buy with a higher TP of Rp1,400.

We expect a very weak 4Q19 with a negative sales growth

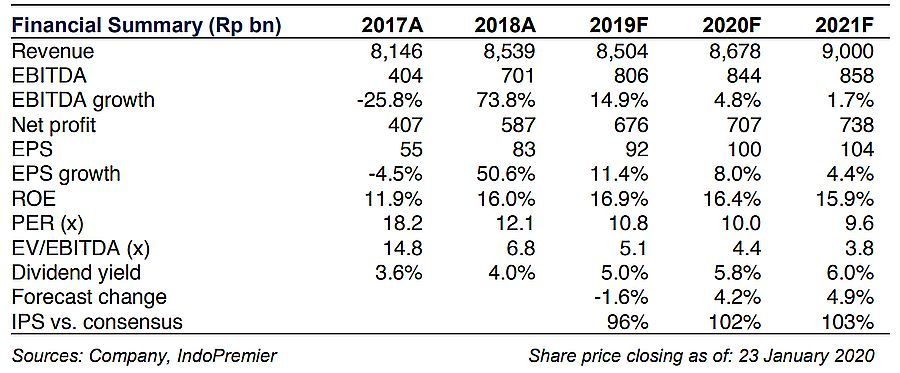

We expect to book a negative SSSG and sales growth in 4Q19, taking FY19 SSSG closer to flat. Nonetheless, we believe should be able to maintain its GPM at 29.7% (9M19: 29.7%); still a 30bps yoy improvement on the back of higher consignment's GPM, while sales contribution from supermarket (with lower GPM vs. department stores) also shrinks. With opex relatively flat yoy, higher interest income, and lower tax rate (back to c.20%), we estimate FY19 core net profit to still grow by 11.4% yoy to Rp655bn.

2020 may not be as gloomy as we initially thought

While we cut our FY19 earnings forecast by 1.6%, we increase our FY20/21 earnings forecast by 4.2/4.9% as we regain confidence on better SSSG for FY20F on the back of improving CPO price (which is highly correlated with outer Java's SSSG ; which contributes c.36% to ' total sales), better Eid holiday spending on the back of front-loaded social assistance disbursement and delay in electricity price hike. We therefore revised up our FY20 SSSG forecast from 0.8% to 2.0%. Worth noting that the weak SSSG was also stemmed mainly by the major decline in ' supermarket sales

New store openings to be expected in 1H20

With all the store openings scheduled in 2H19 delayed, we expect to ramp-up 3-4 new store openings in March and April 2020 to fully benefit on the upcoming Eid holiday. We expect a total of 5-6 new store openings in FY20F; still largely in the Greater Jakarta area

Maintain Buy with a higher TP Rp1,400

As we see emerging catalyst that may help to support ' SSSG , while also maintaining its profitability margins, we expect the company to re-rate from its current bottom valuation (currently at 11.8x 12M forward P/E). We maintain our Buy call, but now peg our valuation to 13.7x 2021F P/E at 0.5 s.d. below its 5-year mean (rolled over from previously 12.1x 2020F P/E; 1 s.d. below its 5-year mean) and arrive at our TP of Rp1,400 (from previously Rp1,200).

Sumber : IPS