- Banks: has limited impact towards KUR program

- : +ve progress on its Asset Quality

- BUY : Solid Fundamental yet Shares Oversold

- Auto: 4W Sales Volume Data

Banks - potential adverse changes in KUR scheme, though impact is manageable

Download complete report

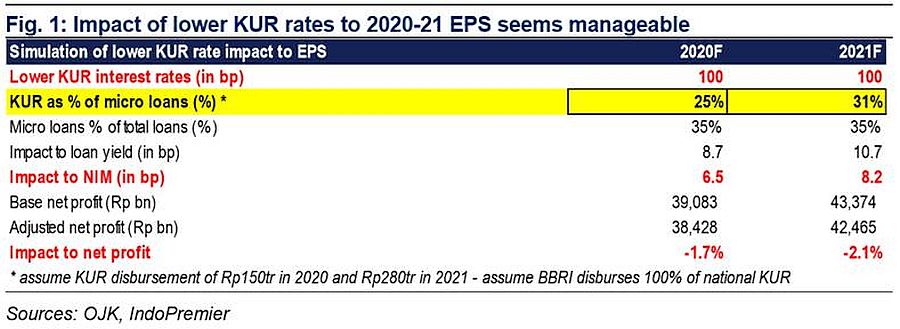

We would like to reiterate that Impact on is still manageable. We are running a scenario where to take up majority portion of KUR program. Impact of KUR is only about 2-3% to 's earnings given the run-off is quite significant.

- Government's Subsidy for this year remains the same (on the surface, it does not sound so good to banks who participate in KUR program. Yet, it comes back to operational excellence of the banks to be able to benefit this program).

- KUR rate to decline from 7% to 6%

- Target disbursement increase from Rp140tr to Rp190tr (FYE20)

KUR Rate to be reduced from 7% to 6%

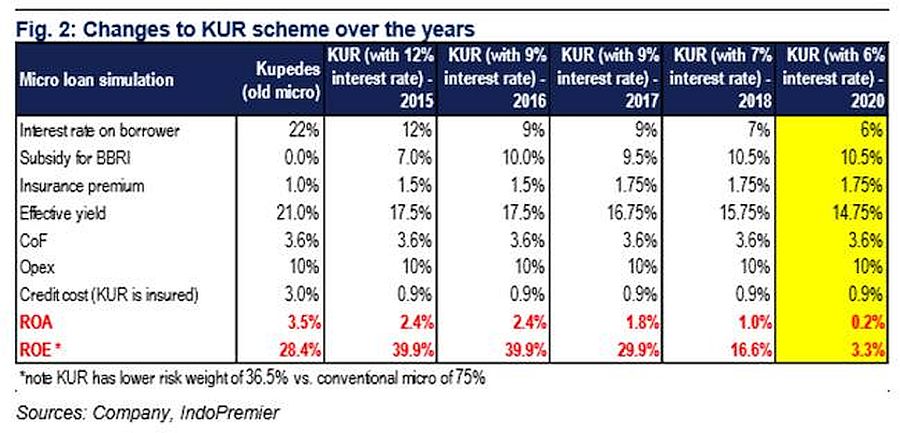

The media recently reported that government plans to reduce KUR (the subsidized micro loan program) to 6% from 7% currently, though there no details yet on subsidy rate. At the same time, the maximum ticket size for the micro KUR will be potentially increased to Rp50mn from Rp25mn currently.

Manageable risk - limited impact to earnings

This is not the first time that government cut KUR rate, previously KUR rate has been reduced from 12% in 2015 to 9% in 2016-17 and 7% in 2018. Despite 500bp cut in the KUR rate, the subsidy for micro KUR only increased by 350bp. Assuming flat subsidy this time around, we estimate KUR's ROA/ROE will drop to 0.2%/3% from 1.0%/16% (Kupedes ROA/ROE at 3.5%/28%) but only presents 2% downside to 2020 earnings (all else equal)

ROA & ROE Impact

Another risk beside lower loan rate - cannibalization (KUR vs KUPEDES)

The impact based on our estimates was way more benign than what people expect. This is based on lower rate, Rp280tr KUR's budget in 2021 (vs. Rp150tr in 2020) and thus an implied KUR growth of 40% vs. Kupedes's 4% (already taking into account cannibalization), the overall impact to BRI's 2021 NIM and EPS is only 8bp and 2%, respectively - this was largely due KUR's short tenor and thus higher run-off rate (80-90% p.a.).

Stick to fundamental despite adverse news flow - maintain Neutral on

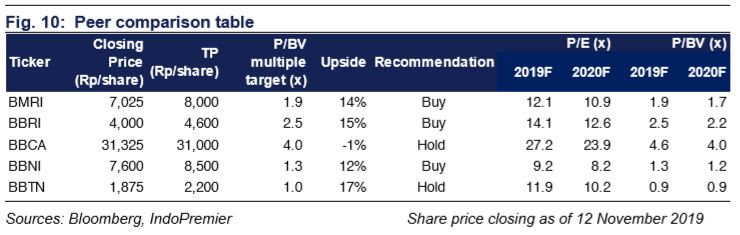

and remains our top picks.

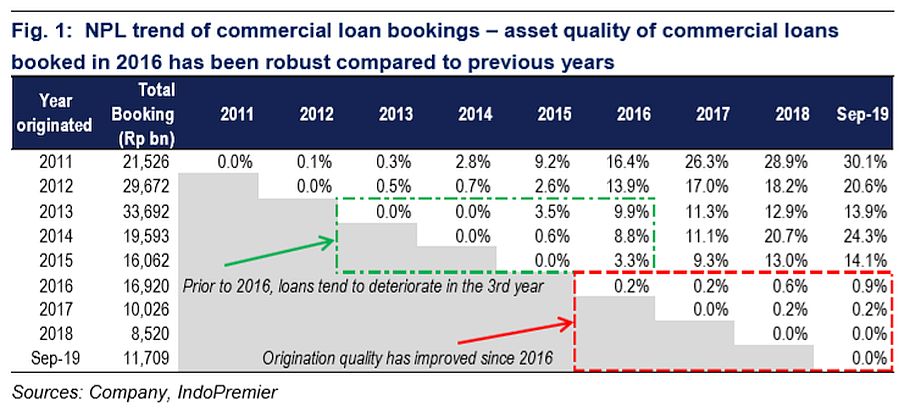

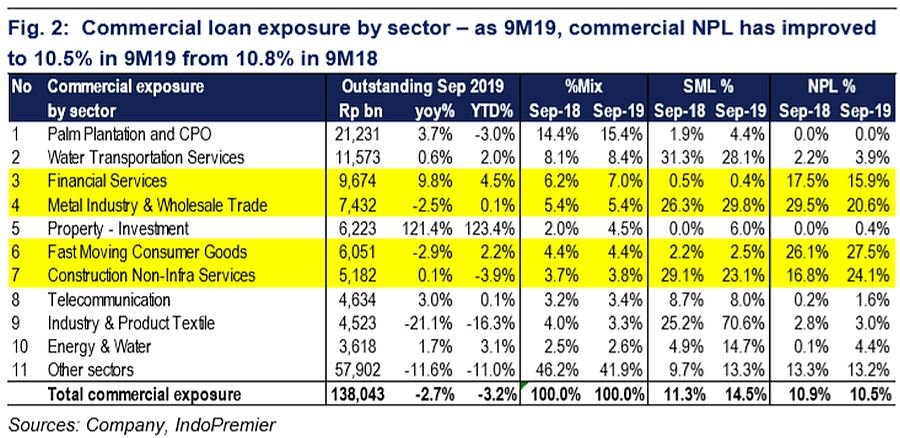

: Positive progress on its asset quality

Download complete report

- We recently attended 's event in regards to its wholesale asset quality management progress.

- We were surprised on how the bank has improved and managed its asset quality. Credit initiation process becomes the key.

- Post- IFRS 9, we think there will be no further surprise. It guided for a 280bp CAR as a result of the IFRS 9 ( PSAK 71) implementation, the highest among SOE banks (vs. 100bp/100bp/250bp for /BBRI/BBTN). Its capital remain sufficient post IFRS 9 (to 22% from 19% for its CAR).

- 's is one of our top pick for the sector especially after the sell-off.

BUY - Solid Fundamental / everything is in-tact

We reckon there is no significant news that might jeopardize 's financial performance 2019/2020

Auto - 4W Sales Volume Data

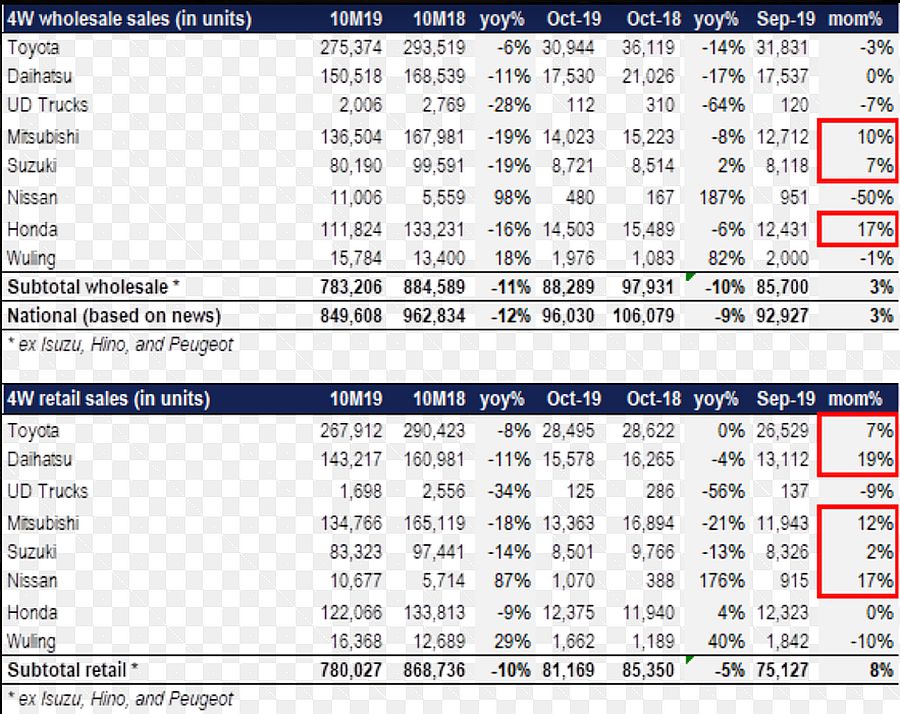

We have a quick summary on Oct19's 4W sales volume data ( note that Isuzu/Hino/Peugeot have yet to report their numbers ).

We are continuing to see a mom pick-up in retail 4W volume in Oct19, especially for in the LMPV segment. We believe that this indicative of a more upbeat demand going into 4Q19/2020, although the recent policy to raise transfer of title tax rate for new car purchase (BBN-KB) to 12.5% from 10% previously (for DKI Jakarta, effective Dec19) might be short-term negative for demand (link to news here).

A few interesting takeaways from the Oct19 numbers:

Stark difference in mom wholesale 4W volume trend between and non- brands

- Wholesale 4W volume (excluding brands that have not published their Oct19 numbers) were down 10% yoy but up 3% mom.

- Mitsubishi (-8% yoy/+10% mom), Suzuki (+2% yoy/+7% mom) and Honda (-6% yoy/+17% mom) all saw a mom pick-up in wholesale volume, while Toyota (-14% yoy/-3% mom) and Daihatsu (-17% yoy/flat mom) saw weak wholesale volume.

- We believe the difference is due to the fact that pre-emptively ramped-up its wholesale volume in Sep19 in anticipation of improving retail demand in 4Q19 (+3% yoy/+10% mom vs. -5% yoy/-5% mom for non- brands in Sep19).

Another mom pick-up in retail sales in Oct19

- Overall retail 4W volume was down 5% yoy but picked-up by 8% mom.

- Most major brands saw a strong mom pick-up in retail 4W sales, though brands such as Toyota (flat yoy/+7% mom) and Daihatsu (-4% yoy/+19% mom) seem to be better off than non- brands (especially on a yoy basis) such as Mitsubishi (-21% yoy/+12% mom), Suzuki (-13% yoy/+2% mom), and Honda (+4% yoy/flat mom - despite a strong mom pick-up in wholesale volume). Nissan (+176% yoy/+17% mom) was the only non- brand to see robust yoy and mom growth.

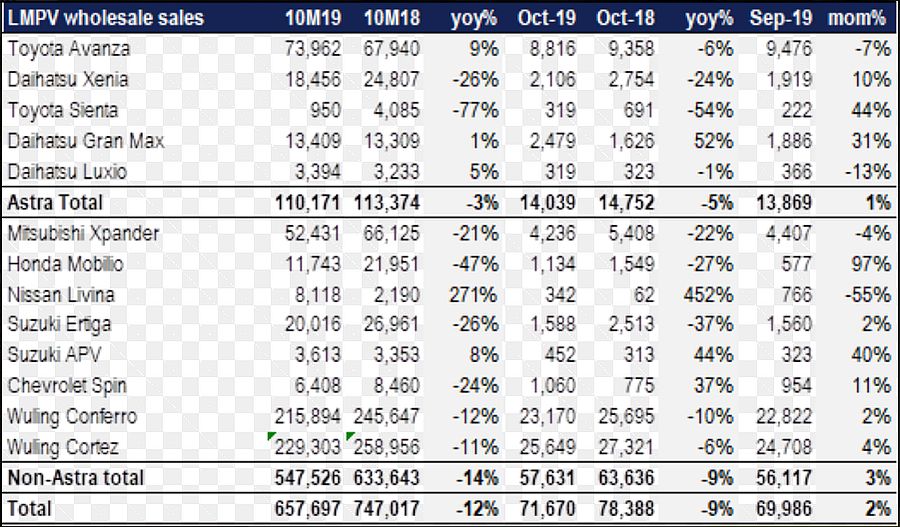

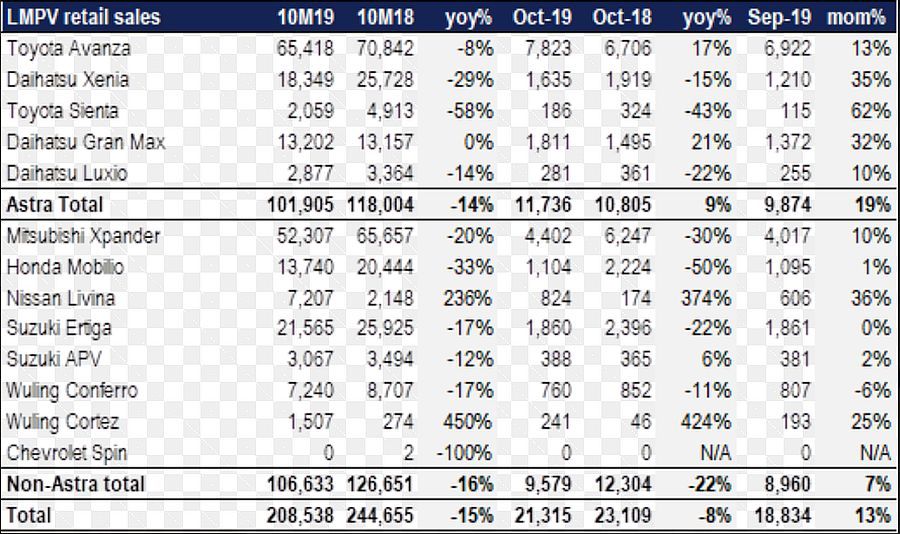

Robust LMPV sales volume for in Oct19

- National LMPV wholesale volume was down 9% yoy (+2% mom) - LMPV wholesale volume was down 5% yoy (+1% mom), while non- LMPV volume was down 9% yoy (+3% mom)

- Retail LMPV sales were down 8% yoy (+13% mom). However, retail LMPV sales saw positive growth of 9% yoy (+19% mom), outpacing non- brands (-22% yoy/+7% mom).

- Among the models, Avanza (+17% yoy/+13% mom) and Gran Max (+21% yoy/+32% mom) were the only ones to see higher yoy retail volume in Oct19, though all of 's LMPV models saw mom pick-up.

- Among the non- models, only Livina (+374% yoy/+36% mom), and Cortez (+424% yoy/+25% mom) saw noticeable yoy retail volume pick-up, although most models were able to saw higher retail volumes mom as well.

Please find the details below.

Summary of 4W wholesale and retail volume as of Oct19

Summary of LMPV wholesale and retail volume as of Oct19

Xpander launched Xpander Cross yesterday

- Mitsubishi has officially launched the Xpander Cross model yesterday, with price point of Rp267-287mn.

- Mitsubishi targets for sales volume of 2-2.5k units per month, based on our checks.

Xpander Ultimate (top) vs. Xpander Cross (bottom)

Snippets

Government lowers KUR interest rate to 6%

Government will lower KUR interest rate to 6% in 2020 from 7% currently to expand the scope of the program's coverage. The national disbursement target is also being raised by 36% to Rp190tr in 2020 from Rp140tr in 2019. Government is planning to gradually increase the target to become c.Rp325tr in 2024. (Bisnis Indonesia)

Oct19 wholesale 4W volume at 96k units

Gaikindo reported that national 4W wholesale volume reached 96k units in Oct19 (-9% yoy/+3% mom). This brought the cumulative 10M19 wholesale 4W volume to 850k units (-12% yoy). (Investor Daily)

Transfer of title tax rate for car purchase in Jakarta raised to 12.5%

The government finalized the new regulation to increase the transfer of title tax rate (BBN-KB) for car purchases in Indonesia - for DKI Jakarta, the rate is being increased from 10% previously to 12.5%, effective Dec19. Car producers are opposed to this change as this could exacerbate the weak demand. Toyota guided that it will increase its car prices in Jakarta to pass on the increase in tax. (Bisnis Indonesia/Investor Daily)

Nickel ore export ban effective 1 Jan 2020, maximum price set at US$30/tonne

The association of nickel businesses and the government has agreed to implement the nickel ore export bank starting 1 Jan 2020. The parties also agreed to maintain selling price at a maximum of US$30/tonne and the minimum price at US$27/tonne. (Kontan)

BPJT aims for ODOL full implementation by 2020-21

Indonesia Toll Road Authority guides ( BPJT ) that it will fully implement ODOL policy in all toll roads in 2020, and move on to implement ODOL in all roads in Indonesia by 2021. According to BPJT , violation of the ODOL policy is causing an annual damage of c.Rp1tr. (Bisnis Indonesia)

Sumber : IPS