- Bank: Acceleration in 2020 Earnings is a NEWS and still undermined IMO TOP PICK BUY BMRI

- AGM on 20th Feb - Management Change?

- : Taco Bell is HERE in Indonesia

.

Bank: Better NPL/LAR coverage and earnings pick-up are the key catalysts for 2020

Download complete report

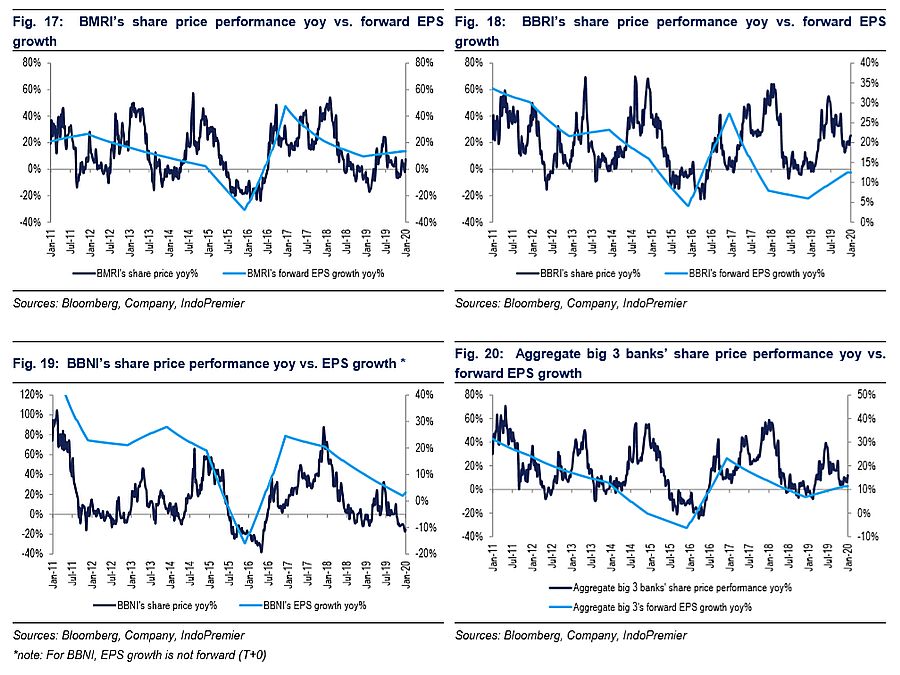

BIG 3 SOE BANKS have posted FY19 Results - all posted in-line results. Simultaneously, all these BIG 3 SOE BANKS guided for robust FY2020 earnings.

- was the only bank that booked double-digit earnings growth (+10% yoy), followed by (+6% yoy) and (+2% yoy).

- NIM was weaker across the board ( -50bp yoy, followed by and at -40bp yoy and and -10bp yoy, respectively) amid tight liquidity.

- On the credit costs (CoC), however, only posted better than expected CoC (1.4% in FY19 vs. 1.8 in FY18), while both and saw higher CoC (1.7%/2.6% in FY19 vs. 1.5%/2.3% in FY18).

Robust earnings growth (14% in FY20-21 vs. 7% in FY19) stems from lower CoC (post IFRS 9) and bottoming NIM

All banks are currently guiding for lower CoC (by at least 2030bp) especially post IFRS 9 implementation, which shall boost aggregate NPL/LAR coverage to 235%/60% from 147%/37% in FY19. Jovent Muliadi, our banking analyst, likes this strategy as it will alleviate investors' concerns on loan quality and under provisioning - excess provisioning is always better than excess capital, in our view.

.

: FY19 results: in-line, improvement in asset quality will secure FY20 outlook

: FY19 results: in-line, strong PPOP was due to robust growth in fee income

: FY19 result was in-line despite higher provision in 4Q19 + Expect DOUBLE digit Earnings growth in FY20

.

Snippets

Creditors have reached agreement on restructuring

The 10 creditors to has finally reached an agreement on the restructuring scheme for amounting to US$2bn. The loan will be split into three tranches, namely Tranche A (US$220mn due 2027), Tranche B (US$735mn with 3 year tenor), and tranche C1/C2 (US$789mn/262mn with 9 year tenor, respectively). On a separate note, cited that by end of Jan20, it will adjust ' collectability to SML and no longer in NPL. also expects to start making payment on the loan starting end of 1Q20 ('s portion: US$618mn). (Bisnis Indonesia/Investor Daily)

Hospital holding will be completed in 1H20

The SOE minister guided that it plans to accelerate and finalize the formation of hospital holding before Jun20, in-line with its vision to re-align SOEs' focus on core businesses. It also opens up the possibility of partnership with Japan, which has a lot of need for nurses. Post its formation, the hospital holding is expected to have a total capacity of 6,500 beds, which will be the largest in Indonesia. (Bisnis Indonesia)

House of Representatives will do a hearing session on Bank Muamalat next week

Comission XI from the House of Representatives claimed that it has received reports from OJK, saying that the Al Falah Investment Consortium has met all requirements from OJK to be the investor for Bank Muamalat. The hearing session between Bank Muamalat and the House of Representatives will be conducted next week. Based on Investor Daily's reports, Al Falah will enter to Muamalat through a Rp2tr rights issue and Rp6tr subordinated bonds issuance (in stages). (Investor Daily)

will hold AGM on 20 Feb 2020

's AGM will hold on February 20th, 2020 at 2pm. The list of agendas will include changes to the management team. (Investor Daily)

has completed its buyback program

has completed its buyback of 87.52mn shares at Rp4,235/sh, amounting to a total of Rp371bn (lower than the allocation of Rp573bn for Rp87.54mn shares). Management guides that it will no longer continue its buyback program..(Kompas)

to add new KFC chain and open first Taco Bell

will continue to expand their KFC chains this year and will bring in the first Taco Bell to Indonesia this April 2020. also allocated Rp500mn capex for 2020and will use it to add another 25 to 30 new KFC stores in Jabodetabek. It aims for revenues of Rp7.8-8tr in 2020. It also plans to do a 1:2 stock split to be finalized in 1H20. (Kontan).

Sales commentary is not a product of research

Sumber : IPS