Company Update / IJ / Click here for full PDF version

Author: Timothy Handerson

- One of the major HE financing players has stopped its disbursement since Mar amid rising restructuring requests, mainly from construction.

- It expects to resume financing disbursement only in Jul, though recovery will remain slow, indicating a 60-65% yoy drop in FY20F financing.

- Taking this as proxy, we expect UT's FY20F HE sales at 1-1.2k units (previous target: 2.8k) translating a 10% EPS downside. Maintain Buy

Halt in financing amid steep increase in restructuring requests

Our discussion with one of the major heavy equipment (HE) financing player (non-related party) revealed that it has stopped new HE financing disbursement since Mar amid a steep increase in restructuring requests (c.35% of total portfolio currently) - majority of the restructuring requests are coming from the construction sector, though it has also seen some requests from the mining sector (smaller coal miners). We believe this shall exacerbate volume as majority of HE purchases (>75%) are made through credit.

Weakening demand, indicative assessment suggests a 60% downside

It expects financing disbursement to only be resumed starting July with a stricter approach vs. normal (i.e. lower LTV of 60-65% vs. 80% for new units under normal condition, along with stricter approval criteria), though recovery in demand is expected to remain very slow. As such, it indicates for a c.60-65% yoy drop in its new financing volume in FY20F, assuming a base case of an easing quarantine measures in June.

Extrapolating the number to , we see a low since 2003 and 10% downside to FY20F EPS

Using the 60-65% drop as a proxy (note that Komatsu commands one of the largest share of its new financing), it implies Komatsu HE sales volume of 1000-1200 units (1Q20: 617 units) will be the lowest since 2003. Concurrently, we think that the current weakness from the mining sector will also result in much lower realization of big machine sales, which is priced 6- 7x higher than the mid-smaller units (sales volume of 570 units in 2019) as well as lower parts and services revenues - Fig 3. All-in-all, we expect a 10% EPS downside to our forecast from the lower HE sales volume alone.

FY20 outlook remains challenging offset by attractive valuation

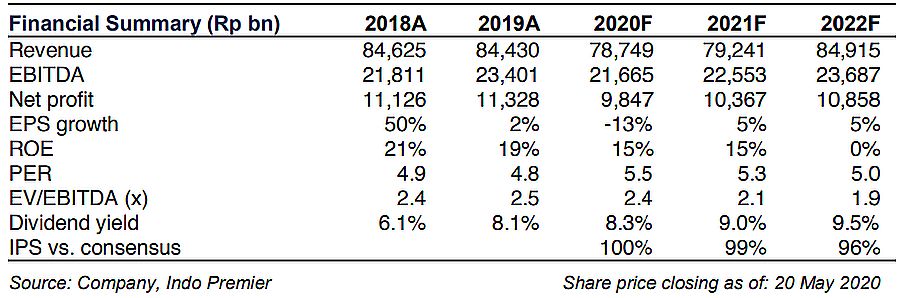

We believe that FY20F outlook remains challenging especially amid the drop in coal prices (Newcastle at U$50-55/tonne) and slowing demand - note that management is planning to publish its revised FY20F guidance next week. Main downside risk is worsening coal prices and a prolonged outbreak. For now we maintain our Buy rating amidst attractive valuation.

Sumber : IPS