Company Update / IJ / Click here for full PDF version

Author: Timothy Handerson

- 's HE sales were down 44% yoy in 2M20, forming 16% of its target, though we think it may miss as we anticipate further weakness.

- PAMA's Feb20 volume was down 15% yoy due to lower utilization amid higher rainfall. It maintains its FY20F volume guidance for now.

- Coal sales volume grew 14% yoy, while gold sales were flat yoy in 2M20. Maintain Buy amid resilient outlook and undemanding valuation.

Weak Feb20 HE sales, expect further weakness ahead

's Feb20 HE sales were at 216 units (-42% yoy/-14% mom), which brought the 2M20 sales to 467 units (-44% yoy). Mining (-63% yoy) was the weakest, followed by agri (-47% yoy) and construction (-45% yoy); forestry was the only segment to post growth (+51% yoy). While 2M20 sales was relatively in-line at 16% of its FY20F target of 2.9k units, we anticipate further weakness (especially in construction) in the coming months amid the corona virus impact, which might pose some downside to its target.

Drop in PAMA's volume in Feb, though Mar volume should normalize

PAMA's total volume (coal + OB) was down 12% yoy (-3% mom) in Feb20 - this brought the 2M20 volume to -8% yoy, slightly below its guidance. Strip ratio stood at 7.6x in 2M20 vs. 7.7x in 2M19. Our checks with the management suggest that the drop in Feb20 volume was due to lower utilization amid intense rainfall in Feb20, though volume should recover in Mar20. Nonetheless, its FY20F target is still intact (-5% yoy volume growth with strip ratio of 7.1-7.2x).

Coal volume has recovered, gold volume has been resilient

Coal sales volume grew 28% yoy (+50% mom) in Feb20 - the pick-up was supported by favourable weather (i.e. higher rainfall/water level allowing more coal transport). This brought the 2M20 coal sales volume to 1.9m tonnes (+14% yoy), forming 19% of its FY20F target of 9.8m tonnes - thermal coal volume grew 9% yoy, while coking coal grew 39% yoy. Gold sales was at 65k tonnes (flat yoy), forming 18% of its FY20F target of 360k oz.

Maintain Buy

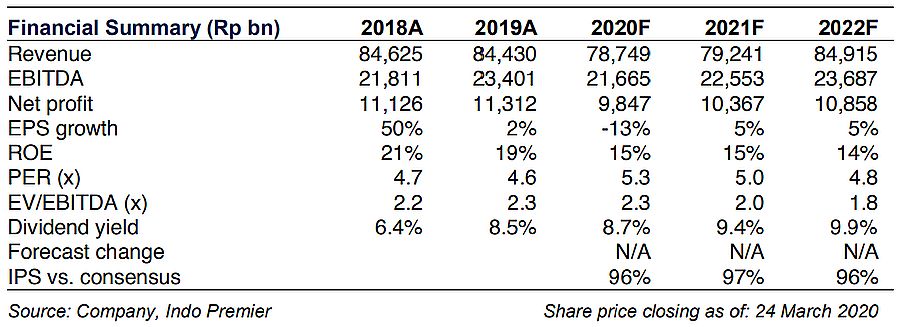

Maintain Buy as we think FY20F earnings outlook remain resilient ( link to our previous report ) - recovery in China, lower oil price and depreciating rupiah are all accretive for 's EPS. Valuation is also undemanding, trading at 5.3x 2020F P/E vs. 10-year average of 13x P/E. Risk is collapse in coal prices.

Sumber : IPS