MacroInsight / Click here for full PDF version

Author(s): Luthfi Ridho, Desty Fauziah

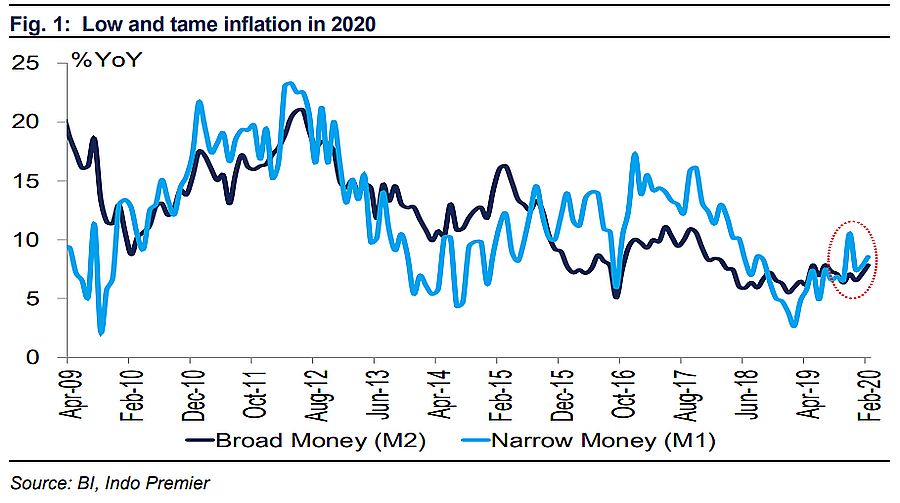

- Money supply (M2) inched-up to 7.8% yoy (vs 7.1% in Jan), due to higher net foreign asset (NFA) and net domestic asset (NDA) at 9.9% and 7.2%.

- Higher NFA was due to low base effect (-5.1% in 2019), while higher NDA was due to increased government operation (+2.8% yoy)

- We are on the view that recent situation is not reflected in the promising Feb M2 data. Macroeconomic stability is key to survive the storm

Recent government stimulus is enough to avoid recession

Relatively promising indicator in Feb M2 was not yet reflecting the recent sharp reversal in macroeconomic indicator in March. Both the increase in NFA and NDA will turn around in March, judging by the amount of capital reversal (-Rp167tr, Rp153.4tr in bonds and Rp13.4tr in equity) and the sharp depreciation in Rupiah (-13% to Rp16.2k) since late Jun. Recent government measure to widen the fiscal deficit to around 5.1% may to some extent help alleviate the impact of coronavirus outbreak.

Recovery bond may result in higher money supply but Rupiah impact shall be manageable

The financing of the wider fiscal deficit, of which around Rp200-500tr will be in the form of recovery bond and to be entirely subscribed by BI we believe. This will ultimately affect to an additional of 3% to 8% increase in the M2 and will likely affect the Rupiah exchange rate and inflation. However, as all other countries are also doing similar policy, we see the impact of the recovery bond issuance to be limited to Rupiah exchange rate. We currently project exchange rate to be Rp16k/US$ for 2020 average. Concurrently, we also see the impact to inflation will remain low as well amid weaker economic activity. Possibility of lower fuel price due to weak global oil price shall also be a boon for inflation.

Macroeconomic stability is imperative

We believe macroeconomic stability is the key in order to gain investor's trust and maintain the credit rating position. Ensuring the continuity of economic activity growth, while at the same time containing and overcome the current outbreak will require drastic measures as reflected in the recently issued PERPPU. We believe recent economic package stimulus from the government may be enough to maintain economic growth at positive level. Our preliminary figure suggests economic growth may be around 2% in 2020, lower than 4-4.5% our initial estimate.

Sumber : IPS