MacroInsight / Click here for full PDF version

Author(s): Luthfi Ridho, Desty Fauziah

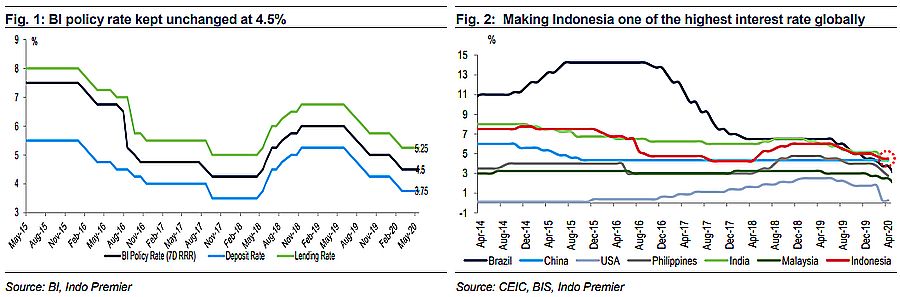

- Policy rate muted at 4.5%, this was in-line with our expectation but against consensus expectation that expects a 25bps cut.

- All macro indicator suggests a steep downturn in the economic activity (less than BI's initial number at 2.3%), but exchange rate will be stable.

- We expect BI to remain accommodative and may cut its policy rate by 50bp to 4.0% in the 2H20 to support more economic activity growth.

Embracing contracting economic activity

Bank Indonesia stated that the economic growth would be below their initial forecast at 2.3% for full year. Accordingly, other macro indicators suggests very weak domestic demand, such as inflation at 2.7% yoy, CAD at below 2% of GDP and PMI at around -22.5%. These weak macro indicators prompted BI to ease more monetary policy to support growth from falling too much. On the other hand, BI sees support from stable Rupiah currently at 14.8k and increasing capital inflows at around US$5.4bn to support the financial sector of the economy.

Rupiah continue to strengthen

Rupiah appreciation to around Rp14.8k from Rp16.4k/US$ last month was due to combination of low domestic demand on US$ following the decline on oil import (US$1.2bn vs c.US$2.0bn in late 2019) and higher capital inflows at around US$5.4bn. In addition, the US Federal Reserve's policy decided to hold its interest rate at 0-0.25%. Cementing the high yield differential in government securities between Indonesia and the UST (700bps vs 500bps in Jan) that will be attractive for foreign investors. These may seal the high inflows for the upcoming months, in our view.

BI's position on the National Economic Recovery program

BI may provide funding for loan restructuring programs (and related) mainly via an open monetary operation (repo channel for government bond). BI sees that the banking sector still has sufficient amount of government bonds that can be traded with the central bank to finance its liquidity needs. According to BI's policy, the banking sector needs to hold government bonds at least 6% of its third party funds to maintain its liquidity. Thus, from Rp886tr of government bonds that is owned by the banking sector, BI can purchase around Rp563.6tr for banking sector additional financing. BI said that this should be more than enough to finance the restructuring process, if any.

More accommodative monetary policy

In the near-term, we believe the policy rate will be kept unchanged as additional cut may trigger unnecessary macro instability such as capital outflow. However, we expect BI to remain accommodative and may cut its policy rate by 50bp to 4.0% in the 2H20 to support the economy as current policy rate remains the highest in both and nominal terms among peer countries.

Sumber : IPS