MacroInsight / Click here for full PDF version

Author(s): Luthfi Ridho, Desty Fauziah

- State revenue grow slower at 3.5% yoy in Apr (7.7% yoy in Mar) due to further income tax contraction at 5.3% yoy (-6.0% yoy in Mar).

- State spending in total contracted by 1.2% yoy (+0.1% in Mar) due to lower material and subsidy spending at -18.5% and -13.6% yoy.

- State deficit narrowed to 0.3% of GDP (0.6% last year), though financing realization already grew by 54% yoy (Rp222tr) from last year (Rp144tr).

All revenue streams recorded contraction

State revenue remained sluggish at 3.5% yoy, mostly due to contraction on revenue from income tax at 5.3% yoy (vs +4.2% yoy last year). The lesser income tax realization was led by the drop in the oil & gas income tax at - 32.3% yoy (vs +5.1% yoy last year) amid weak oil price. If the global oil price remains low, the fiscal deficit may have some downside risk as the income tax from oil & gas made-up around 45% of total revenue in the budget ( please see our report here ). In the meantime, excise tax was pretty robust at 25% yoy due to higher receipt from tobacco products.

Spending is lower than last year

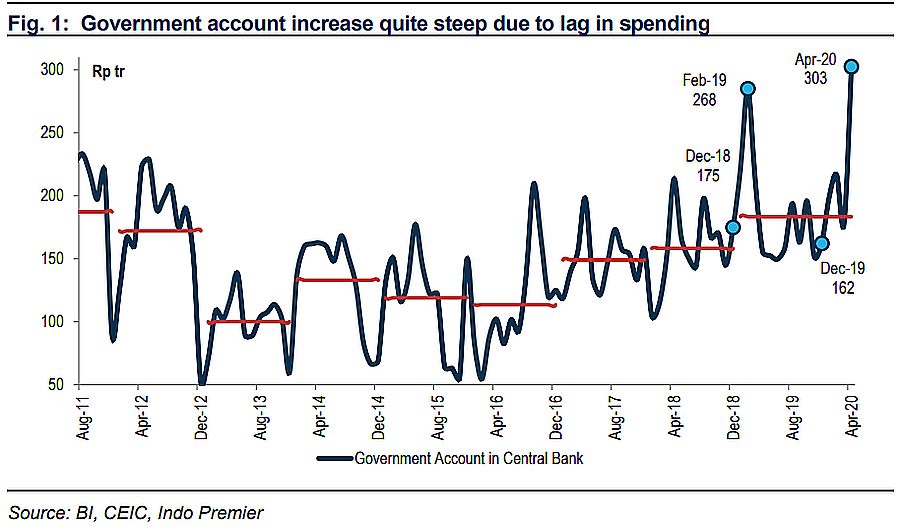

Government spending contracted by 1.2% yoy (vs +8.4% yoy last year), due to contraction in both material (goods) and subsidy spending each at 18.5% and 13.6% yoy (vs +9.8% and -6.8% yoy last year). In the meantime, as expected the spending for social aid continued to rise by 13.7% yoy despite a high base last year amidst political year (+75.9% yoy). The contraction in spending will likely widen as financing realization already went up by 54.2% yoy in Apr (vs -23.8% yoy in Apr19).

Finding the optimal equilibrium

The government absorbed the liquidity from the financial sector by roughly Rp148tr in Apr, and may only spend it in the subsequent months, in our view. With high budget financing realization but low spending realization, the government account in the central bank jump to Rp303tr in Apr, from Rp178tr in Mar. We are on the view that the optimal equilibrium between the pace of government spending and the financing realization may emerge soon (i.e. disbursement of economic recovery funds) which shall be the catalyst for the overall economy, in our view.

Sumber : IPS

powered by: IPOTNEWS.COM