Company Update / Coal / IJ / Click here for full PDF version

Author(s): Reggie Parengkuan ;Ryan Winipta

- reported 1Q25 NP of US$87mn (-79% yoy), which came below ours/consensus FY25F estimates at 15%/13%.

- Excluding profit from discontinued operations (), 1Q25 NP declined by 33% yoy, largely due to lower NP (-29% yoy).

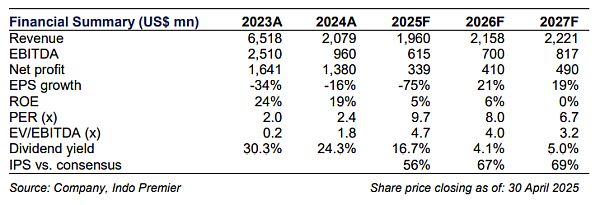

- We cut our FY25-27F NP estimates by 33-34% to mainly reflect 's spin-off; maintain Buy at lower TP of Rp2,300/sh.

Soft 1Q25 NP on yoy basis due to soft coking coal price

reported 1Q25 NP of US$87mn (-79% yoy), which came below ours and consensus FY25F estimates at 15%/13%. We think the NP miss is likely driven by a combination of lower-than-expected NP from in addition to lower SIS volumes (-12% yoy) amid heavy rainfall. Compared with last year's numbers (excl. profits from discontinued operations), NP declined by 33%, largely driven by lower coal mining NP (-29% yoy) while SIS NP declined by 18% yoy. Note that allocated US$48mn for share buyback in 1Q25, reflected in 69% increase in treasury shares.

production was in-line but sales volume lagged behind

production volume remained stable at 1.6Mt (+2% yoy), but sales volume lagged behind production at 1.3Mt (+21% yoy) due to continuous logistical issue at Barito River. ASP declined significantly to US$155/t (-41% yoy), in-line with softer HCC price (-40% yoy), and production cost also declined to US$83/t (-19% yoy) largely driven by lower royalty cost. To add, stripping ratio remained stable at 3.6x (+3% yoy). More details on.

SIS volumes declined on seasonality, but margins expanded

SIS coal transport and OB volume declined to 16Mt/37mbcm respectively in 1Q25 (-5/-14% yoy), likely driven by heavy rainfall in Mar25. All-in mining fee rose to US$3.2/t (+13% yoy), but production cost also increased to US$2.2/t (+5% yoy). As a result, cash margin still rose by 38% yoy to US$1/t.

Maintain our Buy rating at lower SOTP -based TP of Rp2,300/sh

We adjust our FY25/26/27F estimates by 33/33/34% to mainly reflect 's spin-off. We think 's green business is not reflected at current share price (IPS TP excl. green business: Rp1,800/sh) and thus we maintain Buy rating at a lower SOTP -based TP of Rp2,300/sh (from Rp3,900 previously). To add, given 's stellar track record, we are confident with the group's execution. Key downside risk is lower than expected coking coal price attributed to softer China economic growth and delays in future project execution as well as capex overrun.

Sumber : IPS