Company Update / Banks / IJ / Click here for full PDF version

Author(s): Jovent Muliadi ;Anthony

- posted net profit of Rp14.1tr in 1Q25 (+10% yoy), in-line with ours/consensus and supported by solid NII/PPOP growth of +7/10% yoy.

- Loan growth reached 13% yoy, exceeding its 6-8% FY25F guidance. NIM expanded +20bp yoy to 5.8% driven by higher LDR and asset yield.

- LAR rose to 6.0% (+70bp qoq) due to one-off restructured debtor, but expected to normalize by Jun25. Upgrade to Buy with unchanged TP.

1Q25 results: in-line supported by strong NII and PPOP

reported net profit of Rp14.1tr in 1Q25 (+10% yoy), in-line with expectations at 25/24% of our and consensus' FY25F. PPOP rose +10% yoy, supported by solid NII growth of +7% yoy and non-II at +8% yoy while opex remained manageable at +2% yoy. Provisions rose by +16% yoy, bringing CoC to 0.5% in 1Q25 (vs. 0.4/0.3% in 1Q24/FY24) slightly above management's FY25F guidance of c.0.3%.

NIM supported by higher LDR and asset yield

NIM improved by +20bp yoy to 5.8% (-20bp qoq) driven by a +10bp increase in asset yield - from better asset mix - and rising LDR which reached 79% in 1Q25 (vs. 75% in 1Q24). It maintained its FY25F NIM guidance of 5.7-5.8%. Deposits grew +7% yoy/+5% qoq, led by strong growth of +8% yoy/+6% qoq, while TD declined -1% yoy but rose +2% qoq.

Higher than expected loan growth, though slower outlook maintained

Loan growth remained robust at +13% yoy/+2% qoq, exceeding guidance of 6-8%. Corporate led the growth at +14% yoy/+3% qoq (mainly from power plant, infrastructure, and mineral sectors). SME and consumer followed with +13% yoy/+1% qoq and +11% yoy/+1% qoq, respectively. It also maintains FY25F loan growth target unchanged given the high base effect in 2H24.

One-off restructured account drove qoq increase in LAR

NPL rose slightly by +10bp yoy/+20bp qoq to 2.0% (vs. 1.9/1.8% in 1Q24/4Q24). While LAR declined -60bp yoy to 6.0% (vs. 6.6% in 1Q24), though up +70bp qoq due to one-off restructured debtor (nickel), which is expected to normalize by Jun25. Excluding this, LAR would stand at 5.4%. LAR coverage stood at 67% (74% excluding one-off in 1Q25 vs. 72/77% in 1Q24/4Q24).

Upgrade to Buy as slower growth outlook has been priced-in

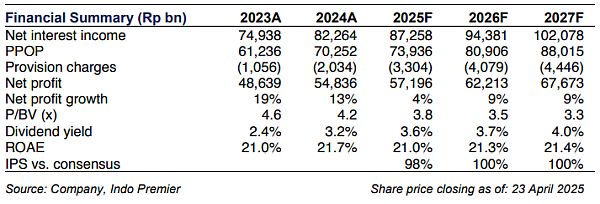

We upgrade to Buy but maintaining our EPS estimates as slower growth has clearly been priced-in (-10% YTD). Currently trades at 3.8x P/B and 18.8x P/E vs. 10Y average of 3.8x and 21.2x. Upside risk is better than expected liquidity condition.

Sumber : IPS