Company Update / Banks / IJ / Click here for full PDF version

Author(s): Anthony ; Jovent Muliadi

- 1Q25 net profit of Rp904bn (+5% yoy), beating expectations on strong NII and PPOP growth (+17% yoy) with manageable opex (+11% yoy).

- NIM rose to 3.6% (+30bp yoy) due to lower CoF and a change in interest income accounting for non-subsidized mortgages.

- Loan growth was soft at +5% yoy, while LAR stayed at 20% with plans to boost LAR coverage to 19% with 1.0-1.1% CoC. Maintain Buy

1Q25 results: strong rebound from weak Feb25 performance

reported a net profit of Rp904bn in 1Q25 (+5% yoy), a sharp rebound from the weak -55% yoy result in 2M25 and came above our/consensus estimates at 28%/29% of FY25F. This was driven by strong NII and PPOP growth (both +17% yoy), while opex rose at +11% yoy. Provisions increased by +49% yoy, resulting in CoC of 1.1%, in-line with guidance.

NIM improved on accounting changes and lower CoF

Overall NIM improved by +30bp yoy (+70bp qoq) to 3.6%, above the bank's guidance of 3.2-3.4%. This was largely driven by change in accounting treatment for interest income recognition for non-subsidized mortgage (to effective interest rate) which added of Rp600-700bn in 1Q25 (Rp2-3tr in FY25); and also lower CoF which fell by -15bp yoy/-4bp qoq as reduce reliance on institutional deposit, shifting towards mid-size or retail deposit. LDR remained stable at 94% in 1Q25 (vs. 96/94% in 1Q24/4Q24). Deposit grew by +8% yoy (+1% qoq), primarily supported by growth in - CA (+12% yoy/-6% qoq), SA (+5% yoy/-1% qoq) while TD grew at +5% yoy/+7% qoq. maintains its NIM guidance for FY25F.

Slower than expected loan growth

Loan growth came in at +5% yoy (+1% qoq), below the FY25F target of 7-8%. The growth was supported by mortgage at +8% yoy/+2% qoq and corporate at +7% yoy/+8% qoq but offset with construction and commercial loan, which fell by -14% yoy/-5% qoq and -14% yoy /17% qoq, respectively.

Stable LAR with coverage expected to improve

NPL/SML slightly increased qoq to 3.3/10.4% in 1Q25 from 3.2/9.5% in 4Q24 respectively; while overall LAR stable at 20% in 1Q25 vs. 22/20% in 1Q24/4Q24 with LAR coverage of 17% in 1Q25 vs. 21/19% in 1Q24/4Q24. It aims to increase NPL/LAR coverage to c.135/19% by year end with another Rp1.0-1.1tr bulk asset sale.

Maintain Buy as valuation remains attractive

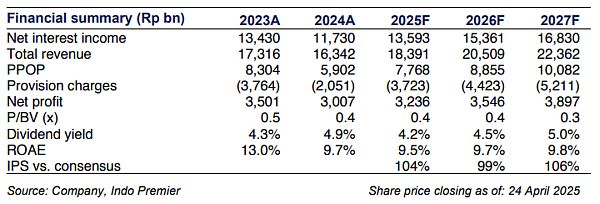

We maintain our Buy rating with unchanged EPS/TP amid strong set of results. as it trades at 0.4x FY25F P/B and 4.4x P/E (vs. 10Y avg. of 0.8x and 6.9x). Risk is slower than expected loan growth.

Sumber : IPS