Company Update / Banks / IJ / Click here for full PDF version

Author(s): Jovent Muliadi ;Axel Azriel

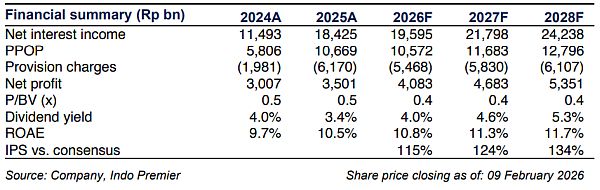

- FY25 net profit of Rp3.5tr (+16% yoy/+101% qoq in 4Q25) was above. PPOP grew +81% yoy/+111% qoq on robust NII (+57% yoy/+66% qoq).

- NIM improved +130bp yoy (+30bp qoq) from both higher asset yield and lower CoF, while loan grew +12% yoy from non-housing at +38% yoy.

- Both NPL/LAR improved to 3.1%/19.4% vs. 3.4%/20.7% in 3Q25. We raise our FY26-27F EPS by 15-20% resulting in higher TP of Rp1,900.

4Q25 results: above from sharp qoq expansion in NII

's FY25 net profit of Rp3.5tr in FY25 (+16% yoy/+101% qoq in 4Q25) was above at 108/109% of ours/consensus FY25F. PPOP grew robust at +81% yoy (+111% qoq) amid strong NII (+57% yoy/+66% qoq), despite weak non-II (-9% yoy) and higher opex (+14% yoy). Provisions rose +201% yoy (+107% qoq) from management's strategy to increase NPL coverage to 120%. This brings CoC higher at 1.6% (+105bp yoy/flat qoq), in-line with guidance of >1.5%. It guides CoC to normalize to 1.0-1.2% for FY26F.

Higher NIM amid improvement in asset yield and CoF

Overall NIM improved +130bp yoy to 4.2% in FY25 (+30bp qoq). This was sourced from higher asset yield at +100bp yoy (-3bp qoq) amid one-off effective interest rate (IER) adjustment and lower CoF at -19bp yoy (-20bp qoq), mostly due to its focus on increasing low-cost base in the middle institution segment. LDR increased to 92% (89%/94% in 3Q25/4Q24). Deposits grew +15% yoy from surging TD at +28% yoy while was modest at +3% yoy - CA at +5% yoy while SA declined -4% yoy.

Robust loan growth with medium-term focus on non-housing

Loan growth of +12% yoy (+5% qoq) was above its guidance of 7-9%. It was led by non-housing at +38% yoy from corporate (+70% yoy). Housing grew +8% yoy, with subsidized mortgages up +10% yoy vs. non-subsidized at +7% yoy. plans to increase the portion of non-housing to 30% in the next five years (vs. 18%/15% in FY25/FY24), primarily from corporate and commercial in private and non-SOE segments. It guides FY26F loan growth at 8-10% yoy.

Improving NPL/LAR from better mortgage collection

NPL improved to 3.1% in 4Q25 (3.4%/3.2% in 3Q25/4Q24), along with lower LAR at 19.4% (20.7%/19.7% in 3Q25/4Q24), driven from better mortgage collection amid its new regional cluster strategy. Both NPL and LAR coverage also increased to 124%/20% vs. 111%/19% in 3Q25.

Maintain Buy with higher TP of Rp1,900

We upgrade ourFY26-27FEPS by 15-20% amid lower CoC and CoF guidance, this results in higher TP of Rp1,900 based on 0.7x P/B. It currently trades at attractive valuation of0.4x FY26F P/B and 4.3x P/E vs. 10Y avg of 0.8x and 6.7x. Risk is slower loan growth & worsening asset quality.

Sumber : IPS