Sector Update / Banks / Click here for full PDF version

Author: Jovent Muliadi ; Anthony

- 1Q25 results shall determine foreign appetite on the overall sector. Current expectation is downwards revision on guidance from management changes especially on and .

- We believe that there will no changes in guidance and as such, no kitchen sinking. We also think 1Q25 shall be the trough for fundamental.

- We maintain our Overweight call with and as our picks.

Foreign positioning has fallen to 2022 level

We observed that overall foreign holding in big 4 banks have fallen to 59.1% from 59.9% at FY23 (peak) with leading the way at -480bp drop from FY23 peak. was the most resilient with -30bp YTD drop from its peak. This was expected given the flurry of overhangs i.e. tariffs, formation of Danantara, management changes, weak Jan25 results.

Current expectation is that some banks will revise down their guidance and some may do kitchen sinking

Our conversation with multiple investors (especially foreign) suggested that current expectation is some SOE banks will do kitchen sinking especially those with the new CEO i.e. and . However, our channel check suggested the otherwise; we don't expect any guidance revision and more importantly any kitchen sinking for all SOE banks due to: 1) new CEO just being appointed in late Mar25 which only left them with one month to assess which we think is way too short, and also US tariff was being announced in Apr; 2) for , we think previous management has done the clean-up and thus far, there is no indication of further worsening in asset quality.

1Q25 shall be in-line but also marks the trough amid elevated CoF

We expect overall banks to report in-line results (including ) with loan growth to remain quite strong (>10%) but we expect weak growth in (<5%). At the same time, we believe that NIM may be under pressure (except ) on yoy/qoq basis amidst elevated CoF given the tight liquidity condition (drop in SRBI issuance was being offset by Govt's bond issuance) and the timing of Eid and dividend was almost coincided (banks need to prepare the cash). Opex will be primarily front-loaded and shall normalize in the coming quarters. Lastly on CoC we expect overall banks to CoC to be in-line, this includes which we expect to book <4% CoC in 1Q25.

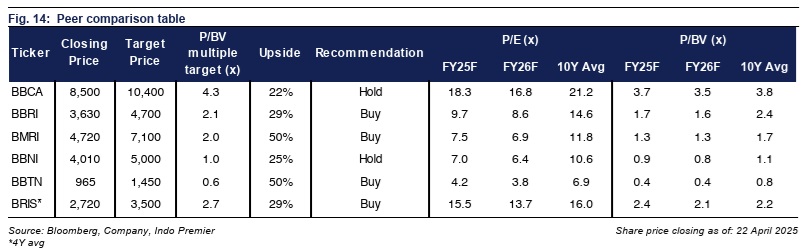

Maintain Overweight with and as our picks

Previously, change in CEO triggered sell-off ('s -7% one month post Sunarso appointment/BBNI's at -14% post Royke's appointment) but +16% for during Darmawan's appointment - figure 11. We believe this time is different given that has done kitchen sinking prior to change in CEO while has done a lot of de-risking in their portfolio by going into private corporate and consumer loans. We also believe that Hery Gunardi may turn around especially in funding and restarting new growth drivers for (consumer and SME to complement micro). We maintain our top picks with and as we expect the former to continue to deliver higher than industry's growth while the latter on the turnaround story. Risks are worsening external factor and government's intervention on PSO.

Sumber : IPS