Sector Update / Banks / Click here for full PDF version

Author: Jovent Muliadi ; Axel Azrie l

- We expect banks' loan growth to recover to high single digit to low double digit amid rebound in M2 growth and Government program i.e. KDMP .

- At the same time, falling benchmark rate (SoFR/IndoNIA) and sticky CoF may adversely impact margin. CoC is expected to be relatively flattish.

- As such, we expect big 4 topost around 5-6% earnings growth for FY26F, an inflection point post -ve earnings growth in FY25F. Maintain OW.

Loan recovery in 2026 to be supported by public sector

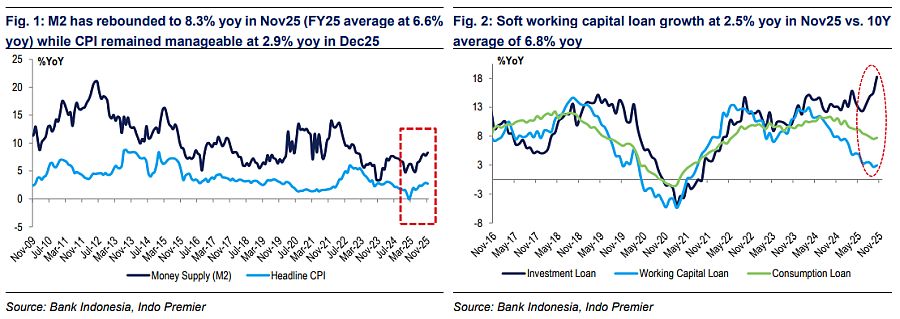

We expect big banks under our coverage to book c.9-11% loan growth in FY26F. This was due to rebound in M2 growth (8.3% in Nov25 and average of 6.6% in FY25), strong demand from government program i.e. village cooperative ( KDMP ) -that will require Rp240tr or additional 6/3% of loan from big 3 SOE banks/industry total loan.However, this may be offset by tepid CPI growth (2.9% in Dec25/2.8% in FY26F), resulting in minimal working capital loan growth (2.5% in Nov25); and drop in capex (lower investment loan) as companies under our coverage may allocate Rp226.5tr in capex in FY26F (vs. 274.3tr/231.7tr in FY25F/24; strong capex in 2025 has reflected in robust investment loan at +18% yoy in Nov25).

Margin outlook may be challenging from falling benchmark rate

BI/Fed has cut its benchmark rate by 125/75bp in FY25, and Fed is projected to deliver another 50bp cut in FY26F; however we expect BI to maintain the benchmark rate amid weakening Rupiah. We expect both IndoNIA and SoFR to continue to trend down - IndoNIA/SoFR have dropped by -205/-62bp in FY25 (+30/-89bp in FY24). This shall adversely impact banks margin especially those with low fixed rate loan proportion i.e. /BBNI at c.31/25%; however, we also remain cautious on 's fixed rate loan portfolio especially on micro segment shall there any adverse changes on KUR subsidy/insurance rate. At the same time, weforesee CoF to remain elevated from tighter liquidity condition. In sum, we project NIM to contract by 10-20bp in FY26F across big banks.

CoC is expected to remain flattish; corporate asset quality is more resilient than consumer/MSME

We expect CoC to be relatively flattish in FY26F except for Mandiri i.e. consol CoC stood at 60bp in 11M25 (vs. its FY25F target of 80-100bp). We are more confident with corporate asset quality, given that as of 3Q25 /BMRI/BBCA % corporate NPL stood much lower at 1.2/0.3/1.5% vs. small/micro of 3.6%/2.3%/2.7% and consumer of 2.6/2.6/2.2%. However, we remain concerned on low-end loan segment amid slow recovery in purchasing power i.e. Kupedes's 2024 vintage hasn't showed meaningful recovery vs. 2023 despite all the improvement in underwriting and monitoring since 2024 (fig. 16).

Inflection point on earnings; maintain OW with /BMRI as our picks

In sum, we project big banks under our coverage to book c.5-6% earnings growth for FY26F, tad lower vs. consensus of 7-10%, suggesting minimal earnings revision. At the same time, the sector currently trades at 1.9x P/B and 10.9x P/E or at -1 S.D. from its 10Y mean of 2.2x P/B and 14.5x P/E. Our top picks are and . Main risk is Rupiah depreciation which may result in higher benchmark rate/bond yield.

Sumber : IPS