Sector Update / Coal & Metals / Click here for full PDF version

Author(s): Reggie Parengkuan ;Ryan Winipta

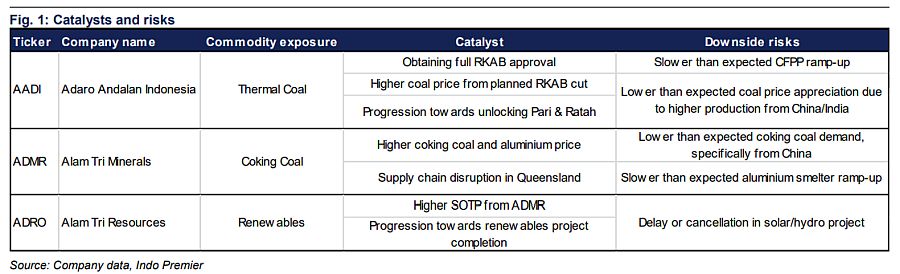

- We think Adaro Group's (i.e. , , ) still provide further upside as a commodity-play with manageable downside risks.

- remains a laggard in comparison to other listed miners in Indonesia with undemanding valuation of 4x FY26F P/E.

- We remain tactically +ve on on coking-coal supply tightness and as a laggard to . Maintain Overweight on the sector.

: RKAB risks remain manageable; coal ASP is the upside

We think downside risk to at current share price is relatively limited, as RKAB quota cut appears largely priced-in and coal price is more likely to trend upwards due to the planned cut in RKAB to 600Mt (FY25F: ~800Mt). Based on our estimate, a 25% production cut to 51Mt would yield US$673mn FY26F NP (assuming US$67/t ASP), implying a fair valuation of 5x FY26F P/E and 8% yield (vs. peers' 7-8x P/E and 9% yield). However, it is worth noting that a majority of 's sales guidance is already on a long-term contract basis, and thus we think RKAB risk is relatively more manageable compared to peers. If there is no cut in RKAB (71Mt sales), FY26F NP could potentially reach US$889mn (4x P/E and 12% yield), with NP sensitivity of 3% to coal price. To add, 's KPI is expected to commission in 1Q26F and contribute US$34mn to FY26F NP (4-5%)

: tactically +ve on near-term supply tightness

In the near-term, we expect tightness in coking-coal supply to boost prices further. Due to cyclone Koji hitting Australia's Queensland - where coking-coal mining area is primarily located (c.50% seaborne supply), SGX Australia's coking-coal currently stood at US$240/t (+9% YTD). While the cyclone has ended, we think supply-chain disruption shall persists, limiting the supply. One of the downside risks is the soft coking-coal demand in China, with Dalian Coking Coal price were flattish YTD, indicating that the supply-tightness have only affected the seaborne market.

: higher SOTP ; progression in renewables project is a tailwind

We think upside in is mostly derived from higher sum-of-the-parts ( SOTP ) value from . However, there is potential tailwind should there be any progression towards completing its hydro and solar PV project, but as of latest, progression is only up to pre-construction. Meanwhile, growth from SIS appears limited as stricter RKAB approval suggests that aggressive volume growth is unlikely.

Maintain Overweight stance with as a laggard to the group

Overall, among Adaro/Alamtri Group, we prefer >ADMR> as we believe that could provide further upside at current price vs. the other two. Note that were only up by +14% YTD while and has performed by +39%/+30% YTD, respectively. We remain tactically positive on due to potential near-term supply tightness. However, outside of the near-term tightness, we think shall provide higher upside, with having similar downside risks to (i.e. RKAB cut), but at undemanding valuation of 4x FY26F P/E. As a result, we remain tactically +ve on , but prefer on the medium to longer-run. Downside risks include potential RKAB cut, slower than expected ramp-up in aluminium project, and delay in renewables project (i.e. solar/hydro).

Sumber : IPS