Index Analysis / MSCI Index / Click here for full PDF version

Author(s): Ryan Winipta ; Reggie Parengkuan

- During yesterday's press conference, IDX is planning to release high shareholding concentration, based on the discussion with MSCI .

- HK's HSC list is set to be used as benchmark; with certain number of shareholders owning >50%+ free-float considered to be concentrated.

- Note that MSCI will delete constituents inside HK's HSC list; and similar treatment in Indonesia shall help MSCI to resolve index replicability.

High-shareholder concentration list 101

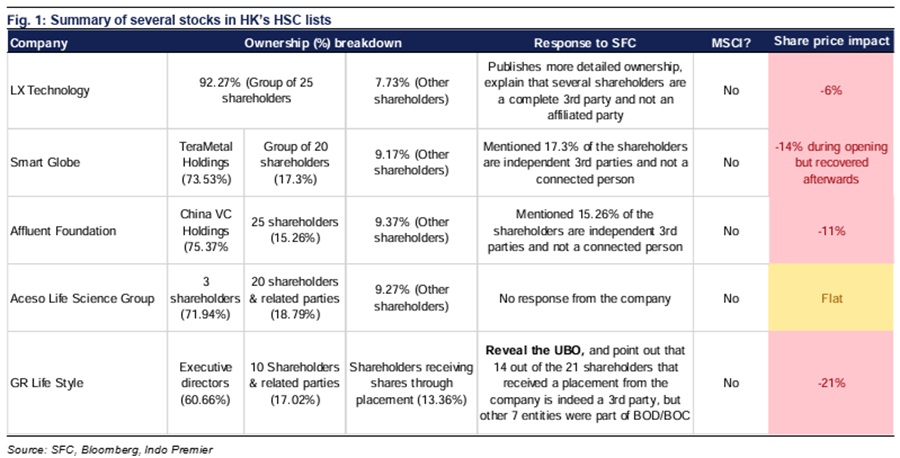

As IDX and Indonesian regulators have yet specified further details on the potential release of high share-holding concentration (HSC) list, we observed HK's HSC list as an alternative that can be used as a benchmark for Indonesian stocks. As there are no official rulebook nor metrics that is used by HK regulators, we observes stock that has 50% plus additional free float controlled by certain number or a group of shareholders (i.e. either affiliated and not affiliated) is typically included in the list. Nevertheless, the list is not equivalent to a trading suspension nor an accusation that the stock is being cornered by market-maker or group of shareholders, but rather would act as a notice to investors that there are risks of shareholding concentration, and hence, investors shall take a careful approach in investing in such stock. The stocks that were subject to HSC list in the past is in Fig. 1.

Step-by-step approach in determining stock in HSC lists

While it is not entirely clear how a particular stock ended up in HSC lists, we think HK regulators are observing the shareholding structure on case-by-case basis, especially with price movement & corporate actions - i.e. shares placement, being the primary highlight. This was the case with GR Life Style (0108.HK) which later, had to reveal ultimate beneficial owners (UBO) - refer to Fig. 3. In other cases, HK regulators just came-up with an announcement that certain number of shareholders own certain % of free-float and/or issued shares. Note that company can also issue a response to regulators to clarify their shareholding structures, but this won't always remove them from HSC list.

MSCI treatment on HK HSC list and what we can expect for Indonesia

When MSCI started planning to incorporate HK's HSC list to methodology, consultation was being held to market participants. Thus, we expect MSCI to also open consultation sessions once IDX revealed the list to the public. The consultations include whether market participants agreed to delete existing MSCI constituent included in HSC lists, timeline for MSCI re-inclusion, among others (Fig. 2). If MSCI set to apply similar treatment, existing constituents of MSCI Indonesia that got included into HSC lists would be at risks of being deleted and won't be eligible for re-inclusion in the next 12-months after the stock is included in the HSC lists. Stocks in HSC list also won't be eligible for inclusion until further disclosure confirming an increase in FF equal to 15% or larger is made.

Positive step towards solving the index replicability

In our previous report, we mentioned that MSCI remains concerned on index replicability, and we think HK's HSC lists is a potential solution/alternative to MSCI 's concern.

Sumber : admin