Company Update / IJ / Click here for full PDF version

Author(s): Ryan Winipta ; ReggieParengkuan

- reported 9M25 NP of US$238mn (-10% yoy), which came in-line with ours/consensus forecasts (76%/73%).

- 3Q25 NP stood at US$93mn (+13% qoq) due to higher dist. spread of US$2.2/mmbtu (+10% qoq), supported by surcharge fee during 3Q25.

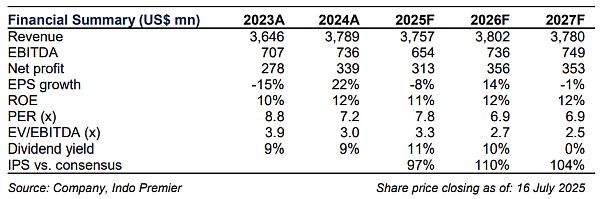

- We maintain our NP estimates for now, as the result was in-line with expectations; D/G to Hold with an unchanged TP of Rp1,800/share.

3Q25 review: NP boosted by higher gross spread

reported 9M25 NP of US$238mn (-10% yoy), came in-line with ours/consensus forecasts (76%/73%). 3Q25 NP rose +13% qoq to US$93mn, mainly driven by a higher gas distribution spread (+10% qoq) to US$2.2/mmbtu, which offset the lower ASP in the upstream business (-12% qoq). As a result, 's 3Q25 GP only improved by +2% qoq to US$183mn, while operating expenses declined by -4% qoq, leading to +4% qoq increase in EBIT . Below operating line, lower effective tax rate of 23% (vs. 25% in 2Q25) and minority interest (-24% qoq) helps offset the decline in interest income (-29% qoq).

Operations: positives in distribution was partly offset by Saka

Gas distribution volume improved by +4% qoq to 835bbtud in 3Q25, despite unscheduled maintenance in several of oil & gas fields in Aug25, as successfully sourced additional gas from other blocks (i.e. West Natuna, among others). This also resulted in higher gas distribution spread of US$2.2/mmbtu (+10% qoq) during the quarter. However, the improvement in gas distribution was partly offset weaker performance at Saka Energi, where ASP decline -12% qoq to US$41.2/boe, in-line with softer crude oil price in 3Q25. Gas transmission volume and toll-fee were flattish qoq at 1.6k mmscfd and US$0.45/mmscf, respectively (Fig. 2).

Downgrade to Hold rating with unchanged TP of Rp1,800/share

We maintain our FY25-27F NP estimates the results was in-line with ours and consensus expectations. However, we downgrade our rating to Hold (from Buy) as upside appears limited. Our TP remains at Rp1,800/share.Going forward, we think gas spread is likely to narrow in 4Q25F due to the absence of the surcharge fee recorded in 3Q25. Meanwhile, with an even softer oil price environment in 4Q25F, we think Saka Energi ASP is likely to remain under pressure, supporting our cautious stance. Upside risks: better-than-expected gas spreads, higher distribution volume, and firmer crude oil prices.

Sumber : IPS