Strategy Update / Click here for full PDF version

Author(s): Jovent Muliadi ; Anthony

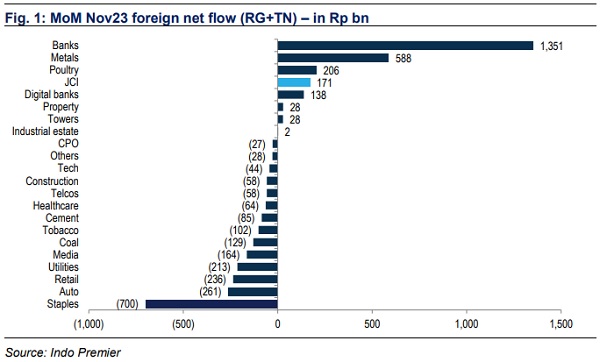

- JCI recorded a small inflow of Rp171bn in Nov23 after recording massive outflow of -Rp6.3tr in Oct23. The flow only went to banks and .

- Consumer (staples and retail) booked massive outflow of -Rp936bn in Nov23 followed by auto, media and coal.

- Tech (/ARTO) outperformed (+62/103% mom). We maintain our OW stance on banks, telco, metals and tech (shift from consumer).

Reversal of flow in Nov although still relatively minimal

After recording a massive foreign outflow of -Rp6.3tr in Oct23, foreign flow reversed at +Rp171bn in Nov23 (JCI +4.9% mom in Nov23, +3.3% mom ex. and ) - recall in our previous note (link) we expect that the reversal is bound to happen after aggressive sell-off. However most of the flows were concentrated to banks at Rp1.35tr and metals at Rp590bn, which mainly from at Rp940bn. Digital bank booked small inflow of Rp140bn in Nov23 and poultry at Rp200bn. Consumer (staples, retail and tobacco) recorded an outflow of total -Rp1tr led by staples at -Rp700bn, we suspect this due to weak consumption pattern observed in Nov post Oct +ve surprise.

Tech and digital banks outperformed in Nov23

Tech and digital banks outperformed by 32% and 55% mom despite relatively minimal foreign inflow of Rp69bn and Rp178bn for and (/ARTO up by +62/103% mom). We think the rally was fuelled by the bet of peaking interest rate and rumour the collaboration between TTS and (link to our previous note). Auto, coal and poultry led the underperformance in Nov23 at -6/-7/-10% mom. Telco and banks are all up by 7/5% mom.

On the stock level, we see massive inflow to , ,

recorded top inflow of Rp940bn which we suspect due to anticipation of MSCI /FTSE inclusion, followed by /BMRI at Rp700/620bn which was expected amidst peaking interest rate view; while the latter was more on the result outperformance. also recorded inflow of Rp330bn - the only consumer names that recorded foreign inflow in Nov. inflow subsided to Rp180bn in Nov vs. Rp840bn in Oct which we have expected as YTD inflow of stood at 2nd (at Rp3.4tr) among all stocks in JCI after (Rp4.1tr YTD) - as such, we think the upside from this point seems to be limited.

We prefer tech over consumer along with banks/telco/metals

Recall in our previous note we added 3 names: (+62% mom), (+20% mom) and (+13% mom), we remain confident on these 3 names to continue to outperform for the rest of the year. We shift our sector preference from consumer to tech as we think that consumption story has yet to materialize in meaningful way whereas we think that the tech rally may be quite early considering very minimal positioning ( local/foreign fund is -2/-3% underweight against JCI/MSCI weight whereas barely any local fund owned ; on the other hand, both locals and foreign continued to be heavy overweight in consumer sector (especially staple at +3.5% against JCI weight). Risk obviously sudden spike in inflation and thus interest rate.

Sumber : IPS