Company Update / Consumer Discretionary / IJ / Click here for full PDF version

Author(s): Lukito Supriadi ;Andrianto Saputra

- We expect a stellar 3Q23 earnings rebound of c.50% yoy on a low base effect and robust 3Q23 SSSG expectation of 13% (2Q23 of 8.9%).

- We upgrade our FY23/24F earnings by 11/10% on the back of higher-than-expected 8M23 SSSG (7%) and monthly sales run-rate.

- Despite the earnings upgrade, we maintain HOLD with higher TP of Rp740 as current valuation of 18.5x FY23F P/E has partly reflected the upside.

Assessing 's Sep23 sales outlook and 3Q23F preview

In light of 's 8M23's stellar SSSG of +7% yoy (vs. FY23F guidance of +5%), we assess 's sales outlook for the remainder of the year (Fig 1). We found that Sep22 in particular was a low base, netting only Rp509bn in sales - the lowest September's sales in the past 5Y (average Sep's sales at Rp594bn between FY18-21). Assuming historical mom seasonality, we expect to potentially book a SSSG of c.13% SSSG in 3Q23 with c.15% SSSG in Sep23 alone. This would likely translate to a significant net earnings rebound of +49.7% yoy in 3Q23 through positive operating leverage, in our view. Separately, air purifier which tripled in sales mom in Aug has minimal contribution to consolidated sales (<1%).

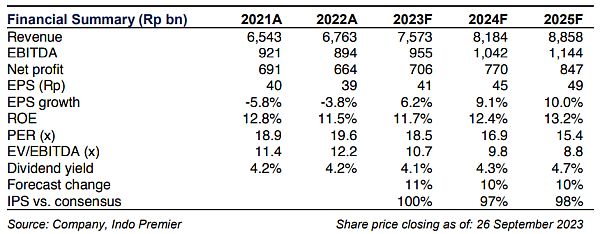

Earnings upgrade of +11/10% in FY23/24F

Further assessing the outlook for 4Q23F, we found that would be on-track to achieve a higher sales growth based on historical seasonality pattern, partly due to 4Q22's low base effect. As such, we upgrade our FY23F SSSG assumptions to 8% (from 6% previously) to reflect 8M23's current run-rate (ex-Boom sales, the run-rate for monthly sales at c.Rp600bn) which paints a more realistic outlook for , in our view. Given the positive operating leverage, this translates to a higher profit growth of +11.1/10.3% in FY23/24F, this also brings our FY23F earnings estimate in-line with consensus despite lower EBIT margin (IPS: 10.5% vs cons: 11.4%) as we assume a higher opex/sales ratio of 38.4% (vs. consensus of 36.8%/1H23's stood at 39.8%).

Maintain HOLD with higher TP of Rp740

Despite the positive development of SSSG , recent share price appreciation of +1/12% in the past 1M/3M may have partly priced-in the upside, in our view. We maintain our HOLD call for with TP of Rp740 based on 18.0x FY23F PE (-1.0SD from its 5Y mean). 's re-rating to its historical mean (5Y mean: 27.2x) may not be justified by its current growth profile, especially given the competition and pricing transparency arising from online marketplaces.

Sumber : IPS