Company Update / Banks / IJ / Click here for full PDF version

Author(s): Jovent Muliadi ; Anthony

- 1Q25 net profit of Rp5.4tr (+1% yoy), in-line with our/cons at 25/23%, PPOP was tepid at +2% yoy with stable CoC at 0.9%.

- NIM compressed -7bp yoy/-55bp qoq to 3.9% due to pressure on loan yield which we think due to slight deterioration in asset quality.

- New management confirmed no kitchen sinking, in-line with our expectation (link). Maintain Hold due to PPOP /low CoC.

1Q25 results: in-line with ours but lower provision remains a concern

reported net profit growth of +1% yoy to Rp5.4tr in 1Q25, in-line with our/consensus expectations at 25/23% of FY25F forecasts. PPOP was tepid at +2% qoq as NII growth of +5% was offset by opex growth of +4% yoy. Provision increased by +1% yoy, resulting in overall CoC of 0.9% in 1Q25. It maintains its CoC guidance of 1.0% in FY25F.

NIM compression from lower loan yield from competition/asset quality

NIM contracted by -7bp yoy/-55bp qoq to 3.9% in 1Q25, driven by a -10bp yoy/-30bp qoq decline in loan yield amid tighter lending competition and deterioration in asset quality. Meanwhile, CoF remained stable at 2.8% (-4bp yoy/+6bp qoq). LDR stood at 93% (vs. 89/96% in 1Q24/4Q24). It maintains NIM guidance of 4.0-4.2% in FY25F (>4.5% long-term target) and aims to keep LDR below 95%. Deposit grew +5% yoy/+2% qoq, with CA +3% yoy/+5% qoq, SA +10% yoy/flat qoq, and TD +2% yoy/flat qoq.

Expected loan growth from lower risk segment

Loan rose by +10% yoy (-1% qoq) in 1Q25, driven by lower risk segment. The growth was led by corporate segment at +16% yoy/-1% qoq and consumer at +13% yoy/+2% qoq. It retains guidance of 8-10% in FY25F.

Worsening LAR/SML on qoq basis but still improving on yoy basis

Overall asset quality was worsening on qoq basis with LAR at 10.9% in 1Q25 vs. 10.3% in 4Q24 (13.3% in 1Q24); and SML at 4.5% in 1Q25 vs. 3.8% in 4Q24 (5.5% in 1Q24). Notably, NPL formation declined by -22% yoy, leading to a -30% yoy drop in write-off to Rp2.8tr. NPL/LAR coverage stood at 263/47%, compared to vs. 330/50% in 1Q24 and 256/49% in 4Q24.

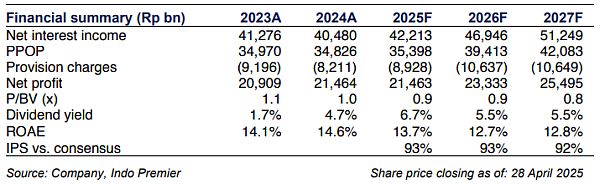

Maintain Hold with lower TP; turnaround in PPOP and stabilizing asset quality are imperatives for us to turn more positive

Despite the new management's assurance that there will be no kitchen sinking or major strategic shifts, we maintain our Hold rating (with lower TP of Rp4,500 based on 13% ROAE vs. 13.4% previously) as we have a concern on level of provisioning vs. asset quality; despite valuation appears attractive at 0.9x FY25F P/B and 7.2x P/E (vs. 10yr avg. of 1.1x P/B and 10.6x P/E). Risk is persistent worsening in asset quality.

Sumber : IPS