Key takeaways from BI Board meeting:

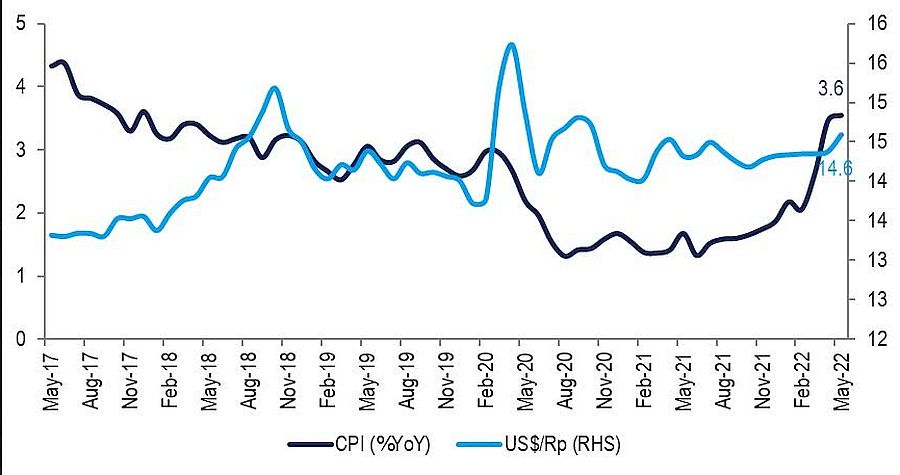

1. Bank Indonesia sees global economic to grew slower than expected. In the meantime, BI said current account will be on a surplus in 2Q22, whilst for full year the current account deficit will be at 0.5% - 1.3% of GDP. Furthermore, BI sees recent Rupiah depreciation to be aligned with peer countries and caused mainly by the monetary policy normalization in developed market. Nevertheless, BI said that onshore US$ supply is ample and BI will watch closely the development of US$ supply. BI said it will stand ready to make necessary action but still on market mechanism corridor.

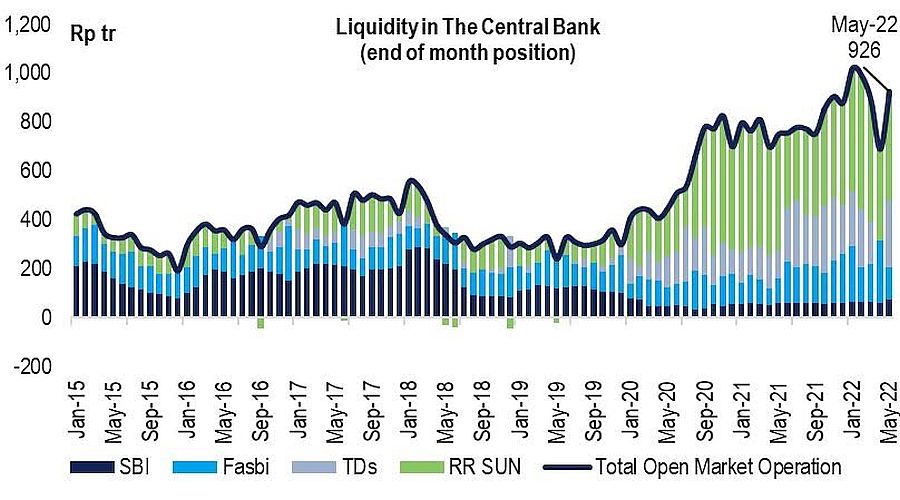

2. On domestic economy, BI keep its economic growth expectation at 4.5% - 5.3% in FY22.Meanwhile, BI said inflation FY22 will still on target range at 2.0% - 4.0%. In addition, Bank Indonesia stated its commitment to finance the state budget that comply with the law. As of 20 June 2022, BI had bought Rp32 - 54tr worth of SUN.

3. Bank Indonesia sees the banking liquidity situation to be very ample, with very high LCR indicator at roughly 30.8% mtd (previously at 29%, 23% in the pre-pandemic level). On the other hand, private loan grew quite stable at 9.0% yoy in May22 (+9.1% yoy in Apr22).While deposit growth at +9.9% in May22 (+10.1% in Apr22). Target for private loan growth still unchanged at 6% - 8% and similarly deposit growth at 7% - 9% in FY22.

Our take:

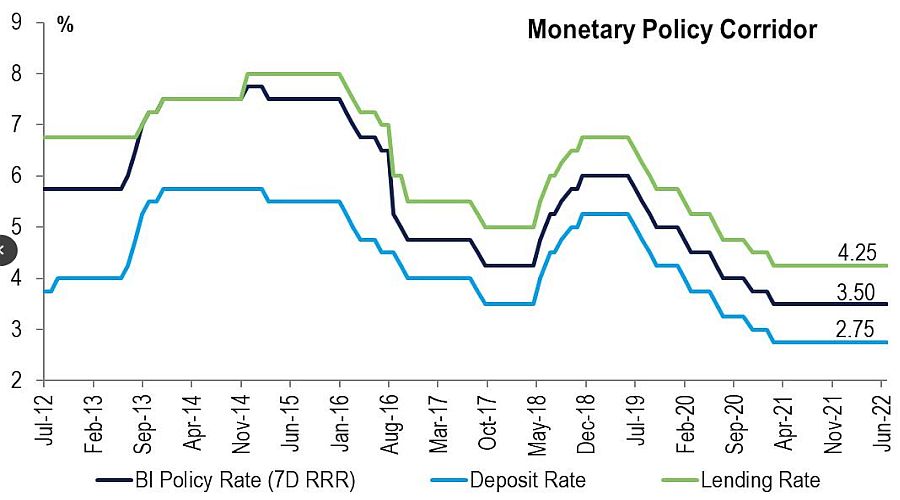

With the Fed's FFR trajectory and recent pressure in Rupiah, we believe BI rate adjustment to be inevitable. We expect BI rate to be at *4.5% (100bp increase) by year-endand we consider the magnitude to be a balance between guarding interest parity and actively promoting economic recovery. (Indo Premier Research)

Sumber : IPS