Sector Update / Banks / Click here for full PDF version

Author: Jovent Muliadi ;Anthony

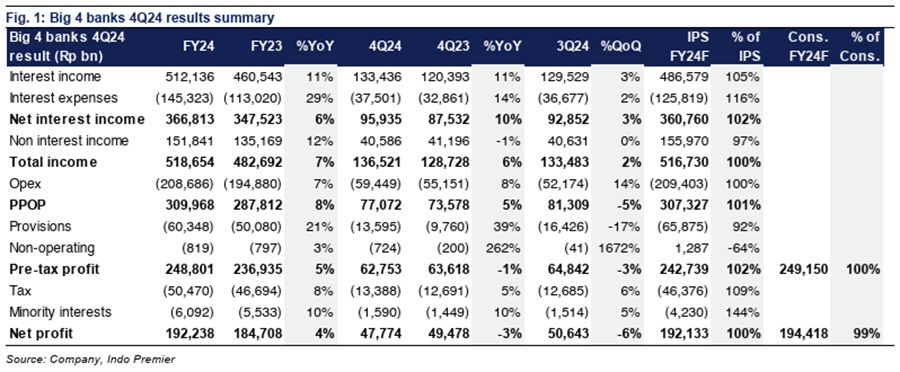

- Big 4 banks net profit of Rp192tr (+4% yoy) in FY24 was in-line. outperformed the rests in terms of earnings growth at +13% yoy.

- All banks are anticipating for slower loan growth in FY25F amid tight liquidity environment as LDR has risen by 500bp to 1,000bp yoy in FY24.

- Post our earnings downgrade (c.6%), FY25F EPS growth will be only at +1% yoy which underpin our downgrade to Neutral. is our pick.

Broadly in-line results; outperformed the rests

Aggregate net profit of the big 4 banks rose by +4% yoy to Rp192tr in FY24 and in-line with both our and consensus' FY24F estimates. Among them, only recorded double digit earnings growth by +13% yoy, while SOE banks' earnings grew by only 0-3% yoy. This resulted in ROE expansion for by +70bp yoy, while the others contracted by -50bp to -200bp yoy.

Inevitable slowdown in growth amidst tight liquidity

Aggregate loan growth was robust at +13% yoy, led by (+19% yoy) and (+14% yoy), both surpassing their guidance. On the other hand, deposit growth was sluggish at +3% yoy; this translated to pick-up in LDR for all banks by +500bp to 1,000bp yoy. Consequently, all banks are anticipating slower loan growth in FY25F with being the most conservative at 6-8%, followed by at 7-9%, at 8-10% and at 10-12%. Despite aiming for the highest target, it stated that loan growth will follow deposit growth and aiming to achieve 90-95% LDR (vs. 98% in 4Q24).

was ahead of its peers in terms of growth

On the funding front, overall grew by +5% yoy driven by savings at 8% yoy (CA at +1% yoy), while TD declined by -1% yoy. Notably, led the growth at +8% yoy particularly in savings account which grew by +13% yoy. This was much faster compared to , , and which grew by +11%, +5%, and +3% yoy, respectively.

Improving asset quality across the banks

All banks saw an improvement in the asset quality with posted the strongest LAR improvement on yoy basis (-260bp yoy/-150bp qoq) but this was driven by massive write-off by Rp19tr (2.5% of loan vs. 's 0.8% of loan). For , management believes that 2023's Kupedes problem will be fully resolved this year while 2024's Kupedes vintage has showed tangible improvement. All banks are guiding for relatively similar CoC in FY25F.

Downgrade to Neutral; we only like at this point

We downgraded our rating to Neutral on the sector as we lowered our aggregate big 4 banks FY25/26F EPS by -6% YTD, which results in FY25/26F earnings growth of +1/+10% amid weaker loan growth outlook and margin risk.We only like at this point as we think that the current valuation clearly has priced-in the liquidity/earnings risk. For , we think that consensus estimate is lagging (our estimate for FY25-26F are 10-11% lower than consensus). We continue to have same concern on 's asset quality given the sizable gross NPL formation. The sector is currently trading at an undemanding valuation of 2.2x FY25F P/B and 12.5x P/E, below its 10Y average of 2.3x P/B and 14.8x P/E. Imminent risk shall be the AGM at end of March which may lead to kitchen sinking.

Sumber : IPS