Sector Update / Cement / Click link to PDF

Author(s) :Jovent Muliadi,Ryan Dimitry

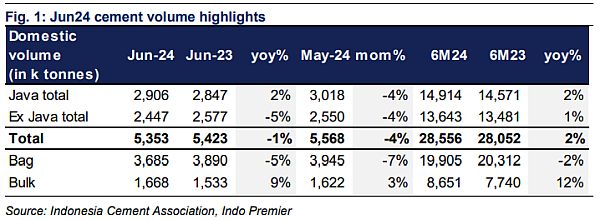

? Overall domestic volume declined -1% yoy/-4% mom in Jun24. Java grew +2% yoy, while ex-Java declined -5%yoy. Bulk remained the driver.

? declined -1% yoy/flat mom while grew by 6% yoy/-6% mom. Non big 2 volume declined by -10% yoy/-9% mom.

? We think weak bag demand was due to restocking activity in May prior to price adjustment in Jun. Maintain Neutral as we expect weak 2Q result.

Tepid Jun volume amidst restocking activity in May

Overall domestic volume declined -1% yoy/-4% mom to 5.4mt in Jun24. Bag declined by -5% yoy/-7% mom to 3.7mt amid restocking activity in May prior to price adjustment, while bulk grew +9% yoy/+3% mom to 1.7mt. Java grew by +2% yoy/-4% mom to 2.9mt while ex-Java declined by -5% yoy/-4% mom to 2.5mt, despite Kalimantan growing by +18% yoy/-1% mom. Cumulatively, 1H24 volumes grew by +2% yoy.

Sulawesi has been the drag for

volume declined by -1% yoy/ flat mom to 2.7mt, as the growth in Java at +4% yoy/+2% mom was unable to offset the decline in ex-Java at -6% yoy/- 3% mom, as a slowdown in smelter project construction in Sulawesi dragged down volumes declining by -25% yoy/-7% mom. Bag declined by -4% yoy/-3% mom, while bulk grew +7% yoy/+7% mom. Cumulatively, 1H24 volumes reached 14.2mt -1% yoy below the FY24F target of +2 to 3% yoy. We observed that 's retail prices rises across the board (both fighting and main brand) by 1.8-1.9% across Java with the highest increase in Central Java.

volume showed growth due to Grobogan inclusion

volume grew by +6% yoy/-6% mom to 1.5mt (note this also includes Grobogan). Java grew by +10% yoy/-6% mom while ex-Java declined by -1% yoy/-6% mom. Bag declined by -4% yoy/-10% mom, while bulk grew +35% yoy/+3% mom. Cumulatively 1H24 volumes grew by +10% yoy reaching 7.5mt. Similarly, we also observed that 's retail prices rises across the board (both fighting and main brand) by 1.6-2.0% across Java with the highest increase in Central Java.

Maintain Neutral as weak 2Q24 results may also drag down share price

We maintain Neutral on the sector despite attractive valuation of 5.2x EV/EBITDA (10Y average of 11.0x) as we are yet to see a clear recovery in the volume trend - note we deem Jun24 volume to be neutral as volume is generally weak following price adjustment. However, Jun-Nov24 is expected to have heavier rainfall due to La Nina. We are also concerned on possibly weak 2Q24 results due to weak volume/ASP and higher costs.

Sumber : IPS