Company Update / Tobacco / IJ / Click here for full PDF version

Author(s): Lukito Supriadi ;Andrianto Saputra

- printed 1Q24 net profit of Rp2.2tr (+4.0% yoy), coming below ours/consensus estimate at 27/25% vs. 5yr average of 31%.

- Despite the robust 1Q24 sales growth of 7.9% yoy (+2.3% volume), GPM declined by -167bps yoy as excise hike is not fully passed on.

- SKT continues to be the fastest growing segment, an indication of sustained down trading. Maintain Buy with unchanged TP of Rp1,150.

1Q24 net profit came below estimates

HSMP booked 1Q24 net profit of Rp2.2tr (+4.0% yoy), which came below ours/consensus estimates at 27/25% vs. 5yr average of 31%. Top-line actually delivered 7.9% yoy growth (in-line) to record Rp29.1tr of sales that is driven by SKT's segment sales growing +25.1% yoy while SKM/SPM registered +1.6/-7.6% yoy sales growth. Overall market share in Indonesia declined slightly to 27.5% in 1Q24 vs. 1Q23's 28.6% as industry volume grew +6.4% yoy, likely driven by lower tiered cigarette's volume, in our view. On the other hand, GPM declined -167bps yoy to 16.3% reflecting that excise hike is not fully passed on. Separately, opex discipline is observed as opex declined -3.3% yoy resulting in lower opex/sales ratio of 7.5% (vs. 1Q23's 8.4%). This helped to mitigate the decline in GPM as NPM declined to 7.7% (vs. 1Q23's 8.0%).

Recent ASP adjustments are far more benign vs. last year's

Based on our channel checks, the recent ASP price trend for and industry (Fig 3) are far more benign compared to the same period last year as discussed in our recent tobacco note, where we downgrade the sector outlook to Neutral (link). 4Q23-1Q24 price adjustment for SKM registered only +3.8/0.5/0.5% change for /GGRM/Djarum, compared to +6.4/10.4/8.3% the previous year. remained relatively superior in terms of pricing power and we expect 's GPM to be more resilient, compared to peers.

Maintain Buy with lower TP of Rp1,150

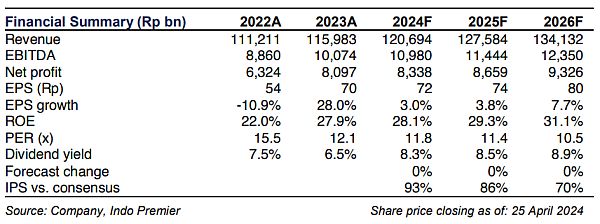

In sum, remains our preferred pick within the tobacco space. Looking forward, we note limited upside for cigarette consumption and the tier-1 players like and may not benefit from the sustained down-trading trend, but may be an attractive dividend play with 8.3% dividend yield expectation in FY24F (based on FY23's earnings). We maintain BUY with unchanged TP of Rp1,150 based on FY24F P/E of 16.0x PE (3yr mean). Key risks are soft purchasing power and inability to fully pass on excise hike for the rest of the year.

Sumber : IPS