Company Update / Consumer Staples / IJ / Click here for full PDF version

Author(s): Lukito Supriadi ;Andrianto Saputra

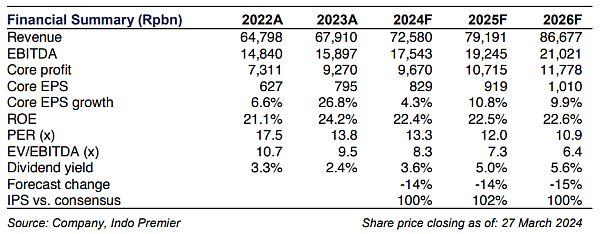

- Following FY24F guidance (sales growth 5-8%, EBIT margin 19-21%), we cut our FY24/25F core profit forecast by -14.1/-14.5%.

- Possible impairment on Egypt business (SAWAZ) seems to be a key overhang for investors, but we think the concern is overblown.

- Maintain our BUY rating with lower TP of Rp12,500 based on FY24F P/E of 15.0x, still attractive vs. other staples' peers average of 18.2x.

FY24/25F earnings cut on more benign growth expectation

In FY24F, management aims to grow revenue by 5-8% yoy with overseas market continuing to be the growth driver over domestic market. EBIT margin is guided to range between 19-21% - lower compared to FY23's realized EBIT margin at 21.2%. We view management's stance to be too conservative and instead we expect slight EBIT margin accretion to 22.0% in FY24 benefitting from the full impact of wheat price cut in FY23 and other key raw material prices conducive outlook. Factoring these, we cut our FY24/25F core profit forecast to Rp9.7/10.7tr (-14.1/-14.5%).

Concerns on future impairment may be overblown

The impairment to Dufil amounting to Rp2.4tr in FY23 is a non-cash item and non-tax deductible. This represents a conservative measure taken by management with currency as the key consideration amid Nigeria's significant currency depreciation (Nigeria Naira: -65.2% in 12M against IDR) - despite the business running normally in the context of Nigeria's Naira. Investors' concern on possible Egypt business (SAWAZ) is based on Egyptian pound currency depreciation (-63% in 12M against IDR). However, we view such concerns may be overblown. A key distinction between SAWAZ and Dufil is that SAWAZ is consolidated under fully-owned subsidiary Pinehill, while Dufil is recognized as 's investment in associate. Noting that Pinehill's majority of profits are derived from Saudi Arabia operations, and as such EGP currency depreciation is unlikely to have a material impact on the financial outlook of Pinehill as an entity.

Maintain Buy with lower TP of Rp12,500

In sum, we maintain our BUY rating for with lower TP of Rp12,500 based on 15.0x FY24F PE (-1sd from its 5yr mean). remains attractively valued at current FY24F P/E of 13.3x, which is relatively lower compared to other consumer staples' FY24F P/E of 18.2x. 's noodles are now more competitively priced in the domestic market given its last price hike dating back to Jun22, especially with the rising rice prices. As such, we expect a slightly improved volume performance for domestic noodles in FY24F. Risk is prolonged softness in domestic buying power.

Sumber : IPS