Company Update / Automotive / IJ / Click here for full PDF version

Author(s) : Timothy Handerson, Anthony

- Mar21 wholesale 4W volume of 85k (+11% yoy/+73% mom) already at par with pre-Covid run-rate; overall non- volume still lagging 's.

- Retail 4W volume of 78k (+28% yoy/+65% mom) formed 92% of preCovid; saw stronger traction from higher exposure to <1500 cc cars.

- Despite tightening supply (2-3 months waiting time), we still believe that Kemenperin's FY21F target of 830-850k is achievable. Maintain Buy.

A steep mom increase in Mar21 wholesale 4W volume

National wholesale 4W volume reached 85k (+11% yoy/+73% mom) in Mar21, which formed 99% of pre-Covid run-rate (based on average monthly volume in FY19) as producers raised volume in response to the PPnBM relaxation introduced back in Mar21. Both (-1% yoy/-72% mom) and non- (+27% yoy/+73% mom) saw similar mom volume pick-up in Mar21, though non- wholesale volume (96% of pre-Covid) still lagged 's (101% of pre-Covid). Cumulatively, national 4W wholesale volume was -21% yoy (+17% qoq) in 1Q21 with market share of 53% (vs. 55% in 1Q20). indicated that it plans to maintain flat mom production in Apr, before expecting lower volume in May due to Lebaran holiday.

retail sales volume outpacing non- volume

National retail 4W volume stood at 78k (+28% yoy/+65% mom) in Mar21, forming 89% of pre-Covid run-rate. (+35% yoy/+79% mom - 92% of preCovid) saw stronger yoy/mom pick-up in retail demand vs. non- (+21% yoy/+52% mom - 87% of pre-Covid), which was due to better brand equity and higher exposure to < 1500cc cars eligible for PPnBM relaxation (55-58% of total volume). Cumulatively, national 1Q21 retail sales volume was still down by 19% yoy (+4% qoq). We expect the strong retail volume sales to continue in Apr, still supported by the on-going PPnBM relaxation.

Stretched supply

Despite higher wholesale volume in Mar, our checks as of early Apr revealed that inventory for most dealers have declined, with buyers having to wait 2-3 months for delivery of popular models (Avanza/Rush/Fortuner). We expect demand to normalize starting in Jun amid smaller magnitude of relaxation (50% PPnBM discount in Jun-Aug vs. 100% in Mar-May), which shall ease pressure on supply. However, we still think that Kemenperin's FY21F 4W volume target of 830-850k (+57-60% yoy) remains achievable, which presents 15%/3% upside to our FY21F auto/consolidated net profit forecast.

Maintain Buy

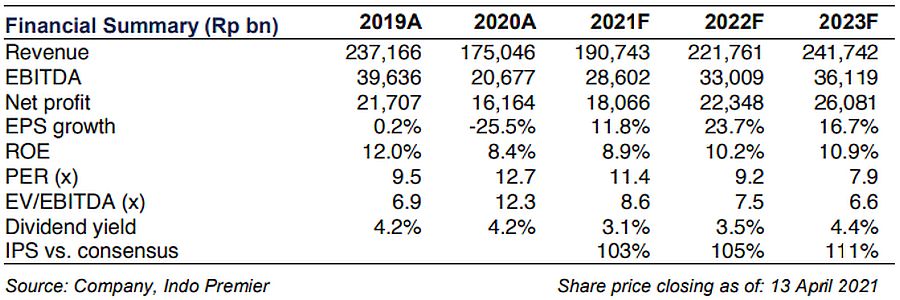

Maintain Buy amid the positive volume trend. is now trades at 11x FY21F P/E vs. 10Y avg of 15x P/E. Risk is worsening macro.

Sumber : IPS