Company Update / IJ / Click here for full PDF version

Author (s) : Jovent Muliadi, Anthony

- 1Q20 profit of Rp4.2tr (+4% yoy) was in-line with consensus (28%) but above ours (49%) as restructuring impact hasn't been reflected yet.

- It guides for lower loan growth (to 2-4%), NIM (by 100-130bp vs. our estimate of 40bp) and higher credit costs of 3-3.5% vs. ours of 2.8%.

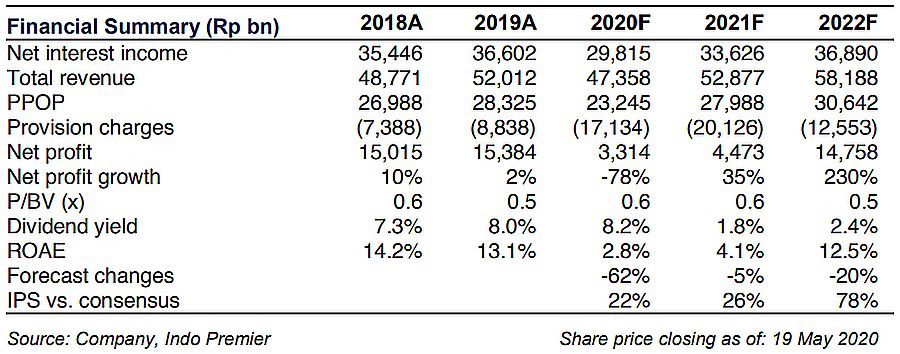

- Due to worse than expected NIM and CoC, we revise down again our FY20-22F estimates by 5-62%. Maintain Hold.

Robust PPOP offset by additional provision for restructured loans

posted 1Q20 net profit of Rp4.3tr (+4% yoy), forming 49%/28% of our/consensus FY20F net profit estimates. PPOP grew 11% yoy, while provisions rose by 31% yoy, credit costs (CoC) rose to 1.7% in 1Q20 vs. 1.4% in 1Q19 (1.7% in FY19).

Lower NIM guidance

1Q20 NIM of 4.9% was relatively flat both yoy and qoq basis. Nonetheless it guides its NIM to be around 3.7-4% for FY20F, a 100-130bp drop vs. 4.9-5% initial guidance. Lower NIM is inevitable due to: 85% of the new restructuring (10% of loan as of Apr) was being granted interest deferral and/or lower interest rate; also from lower policy rate (BI rate has dropped by 50bp yoy). We adjust our NIM assumption by another 70bp to 3.9% from 4.6% initially.

Slow loan growth in FY20F

Loan still grew by 11% yoy (+4% qoq), however it expects loan growth to slow down to mere 2-4% yoy vs. our estimates of 10%. It remains cautious in disbursing new loan amidst current uncertainty despite decent loan demand.

Asset quality is our biggest concern

NPL ratio rose to 2.4% in 1Q20 from 1.9% in 1Q19 while LAR also rose to 10.9% in 1Q20 from 8.3% in 1Q19. However, it also restructured additional Rp70tr of loan (12% of loan) due to Covid-19 with total pipeline of Rp147tr (27% of loan), not far from our forecast of Rp130tr (22% of loan - link to our previous report). With rising restructured loan, surge in CoC is inevitable and it expects CoC to increase to 3-3.5% from 1.2-1.4%, higher than our FY20F estimates of 2.8% but we actually expect its FY21F CoC to be 3.7% and thus with the new guidance, we shifted some of FY21F provision to FY20F translating to 3% and 3.3% CoC for FY20F and FY21F, respectively.

Maintain Hold

We cut our EPS by another 5-62% FY20-22F and now 22-78% below consensus estimates. We maintain our Hold call despite attractive valuation (now trading at 0.6x 2020F P/BV vs. -2 s.d. of its 10Y mean of 1.4x). Upside risks to our call are better than expected margin and provision while downside risk is potential national service.

Sumber : IPS