Company Update / IJ / Click here for full PDF version

Author(s): Jovent Muliadi; Anthony

- FY19 net profit of Rp27.5tr (+10% yoy) was in-line. Headline PPOP grew 1% yoy (+9% yoy ex one-offs), while provision improved (-15% yoy).

- Lower provisioning was attributed to improvement on its overall asset quality. NPL/LAR improved to 2.3/9.6% in 4Q19 vs. 2.5/11% in 3Q19.

- Ample provision adjustment (post IFRS 9) shall further alleviate investors' concern on its asset quality. Maintain Buy and upgrade TP to Rp9,000.

Stellar PPOP growth excluding one-offs

FY19 net profit of Rp27.5tr (+10% yoy/+8% qoq) was in-line at 101%/100% of our/consensus estimates. Headline PPOP was mild (1% yoy/-9% qoq) due to one-off gain/tax income in FY18 (Rp2.5tr) and one-off tax provision in 4Q19 (Rp625bn). Excluding all the one-offs, PPOP grew 8% yoy (-4% qoq). Concurrently, provision also improved (-15% yoy/-56% qoq) which result in lower credit costs (CoC) at 1.4% in FY19 vs. 1.8% in FY18 (0.8% in 4Q19 vs. 2% in 3Q19). It guides for lower CoC of 1.2-1.4% in FY20 (ours: 1.3%).

Robust NIM in FY19, though FY20 guidance remains conservative

NIM stood at 5.6% in FY19 relatively stable on a qoq basis (5.7% in FY18) this was largely due to higher LDR (97% in 4Q19 vs. 94%/97% in 3Q19/4Q18). Deposits grew at 11% yoy (+5% qoq) driven by CASA (+13% yoy/+7% qoq), while TD was weaker (+7% yoy/flat) - this also helps CoF. It guides for NIM of 5.4-5.6% in 2020 (our estimate: 5.5%).

Loan growth driven by micro and corporate

Loan grew 11% yoy (+8% qoq) driven by micro (20% yoy/+6% qoq) and corporate (+11% yoy/+11% qoq). Commercial (+6% yoy/+10% qoq) and small (+3% yoy/+2% qoq) were weakest. It guides for 8-10% growth in 2020.

Gradual improvement in asset quality is the much needed catalyst

NPL improved to 2.3% in 4Q19 vs. 2.5% in 3Q19 (2.8% in 4Q18) driven by commercial and small segments. Loan-at-risk (LAR) also improved to 9.6% in 4Q19 vs. 11% in 3Q19 (9.7% in 4Q18) amid lower restructured loans (7.3% in 4Q19 vs. 8.3%/7.1% in 3Q19/4Q18). Post IFRS 9 (Rp21-25tr with 220-250bp impact to CAR), NPL/LAR coverage is expected to increase to 255%/61% from 144%/35% previously.

Maintain Buy with higher TP, Mandiri is one of our top pick

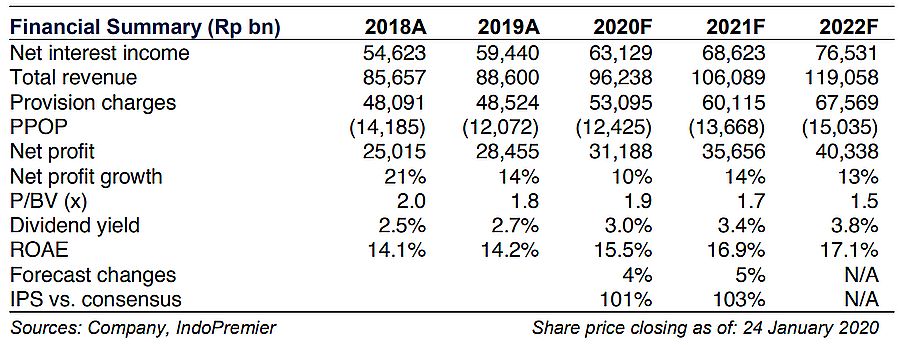

Continuous improvement in asset quality and ample provision post IFRS 9 shall alleviate investors' concern towards its loan quality. We raise our EPS by 4-5% for FY20-21. Maintain Buy with higher TP of Rp9,000 (based on 1.9x P/BV). It trades at 1.9x FY20F P/BV (10-year avg: 2.1x). Risk is asset quality.

Sumber : IPS