Sector Update / Bank / Click here for full PDF version

Author(s): Jovent Muliadi , Anthony

- Government just issued PP33 which expand the capability of LPS to prevent a bank's failure during this Covid pandemic.

- This regulation allows LPS to give liquidity injection to troubled bank with maximum of 2.5% of its asset/bank (c.Rp3tr) or 30% for overall (Rp36tr).

- This is positive as LPS previous responsibility only covers failing bank and deposit guarantee. It also shall reduce the risk of dilutive MnA.

PP33: wider capability of LPS to prevent failing bank

To our surprise, government yesterday issued government regulation (PP33) to expand the capability of LPS (Indonesia's Deposit Insurance Agency) by allowing LPS to step-in before a bank is being designated as a failing bank (note that before a fail bank category, OJK i.e. FSA needs to put the bank under intensive supervision and then special supervision). Previously LPS capability only allowed them to step-in after OJK labelled the bank as a fail bank and also deposit guarantee.

What's new? Allowing LPS to inject liquidity to troubled bank

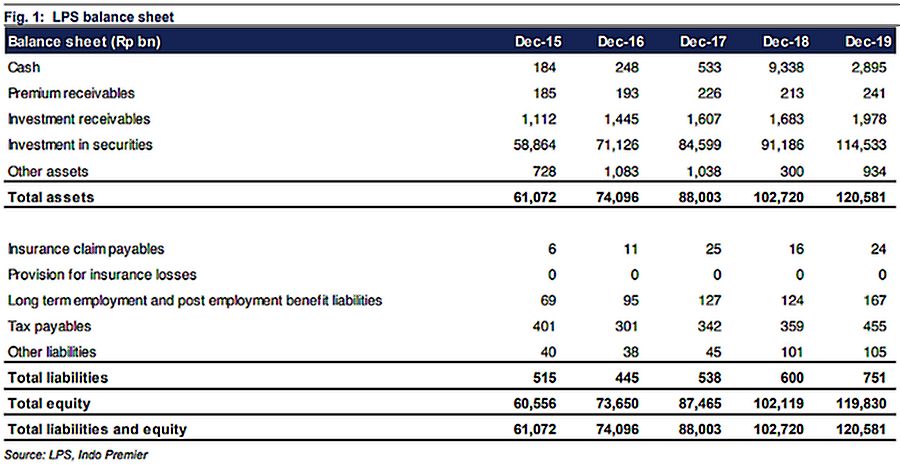

With this regulation, LPS is allowed to give liquidity injection to troubled bank (bank under intensive supervision and/or bank under special supervision) with the amount of 2.5% from LPS asset/bank (or Rp3tr) or 30% for overall (or Rp36tr). The tenor will be one month and can be extended up to 5x (i.e. 6 months). Post the placement, OJK and BI will do a heightened supervision to those banks that received the fund placement as regulated in article 11 point 6. Shall LPS needs more liquidity due to this placement, the regulation also allows them to: 1) do repo with BI, 2) selling its government bond to BI i.e. LPS has Rp115tr worth of government bond currently, 3) issuing bonds, 4) borrowing to other party and/or government. On top of liquidity injection, this regulation also allows LPS to set up a bridge bank to help the troubled bank.

What will be the implication? Lower risk of dilutive MnA

Based on the news flow, there are multiple banks that under OJK intensive supervision but so far only Bukopin that seems urgent and pressing. This was largely due to liquidity issue and was exacerbated by restructuring from Covid pandemic. However with Kookmin commitment to become the majority shareholder, we believe that it may not need LPS support in the medium term. That being said, along with PMK70 (link to our note here ), this PP33 shall greatly reduce the risk of national service/dilutive MnA by SOE banks as previously there is no regulation that allows regulator (i.e. LPS) to step-in to help troubled banks (before designated as fail bank by OJK).

Restructuring and regulation development have been quite encouraging; we maintain our Neutral call for now

Restructuring seems to have peaked in May and all banks under our coverage posted deceleration of restructuring in Jun. Series of positive regulations from the government (i.e. PMK65, 70, 71 along with this PP33) shall give confidence to investors that government is doing all they could to prevent the collapse of banking system without sacrificing the SOEs. Despite the aforementioned factors, we maintain our Neutral call for banks with our preference lies with and (due to MSME exposure). The sector now trades at 1.5x P/BV ex-BCA (vs.10Y average of 1.9x P/BV ex-BCA). Main risk is earnings downgrade for FY21 (our FY21 numbers are 55% below consensus).

Sumber : IPS